Stocks ended yesterday’s session with moderate gains as Treasury yields continued their decline. The labor market may be easing up according to the latest data.

A little gain from all this pain. It is no secret that the Fed is trying to exact pain on us. It does it with the hopes that we will stop spending money… that is, refuse to pay those insanely high prices now being charged by landlords, beauticians, car repair mechanics, meat producers, hospitals, etc. My childhood hero, Popeye the Sailor would say “that’s all I can stands, ‘cause I can’t stands no more!” But alas, it seems that we, as consumers, have very little choice in certain matters, despite the pain. We, after all, need shelter, so we have very little practical choice but to pay what is being asked.

Ok, so let’s say that we actually can cut out certain things when things get tight. We can, we do, and we have. Indeed, inflation has receded from its 2022 highs. We all know that it’s not quite where the Fed would like it to be… that’s old news. But beyond the actual inflation numbers, are there signs that we can look for that let us know if we are on the right track? Yes! The Fed has been heavily focused on the labor market. The theory, rooted in the work by economist Bill Phillips (drawer of the notorious Phillips Curve – adored by the Fed), implies that a tight labor market leads to inflation. Tight labor market means that producers are forced to pay higher wages in a tight labor market which eats into profits, and the only solution is to pass the higher costs on to the consumers by raising prices… er, inflation.

You with me? Good. How can we describe a tight labor market? Let’s start simply with supply and demand. High demand and limited supply causes prices to go up. In this case, there is high demand for laborers which causes wages to go higher. It costs money to incent workers to abandon their La-Z-Boys and get back behind the plough. Joking aside, remember my story a few weeks ago about the Mediterranean food importer who had to triple his truck driver’s wage to keep him from going to a competitor? That happens when there are too few workers to fill too many positions. So, it seems that if we could somehow track labor demand, we might be able to assess just how tight the labor market is. It just so happens that the Bureau of Labor Statistics does just that in its JOLTS Job Openings series. This indicator literally tracks vacancies that arise from openings from old jobs and from newly created ones. Have a look at the chart and then follow me to the close.

What I want you to notice on this chart of JOLTS is just how rapidly demand increased through early 2022, topping 12 million job openings. The peak interestingly coincides with when the Fed began to hike interest rates. If indeed the Fed was looking to strangle the labor market with its hikes, you can see that it was effective just by following the white line to the right-hand side of the chart. There, you will see, encircled in yellow, that there were 8.059 million job openings in yesterday’s reported number for April. That may seem like a lot to you, but if you go back to 2019 just before the lockdown layoffs, you will see that there were 7.171 million vacancies, so we are currently not that far off from where we were.

This means that the Fed’s efforts are paying off, and that my friend the food importer may catch a break on the salaries he needs to pay his workers. That may allow him more room on the pricing of his products. Ultimately, at least according to the Fed, unhealthy inflation will be defeated. Happy? Unfortunately, there is a cost to a looser labor market. That cost will be borne by you, because lower demand means lower wages paid to you. If you want to be strong to finish, you had better “eats” your spinach.

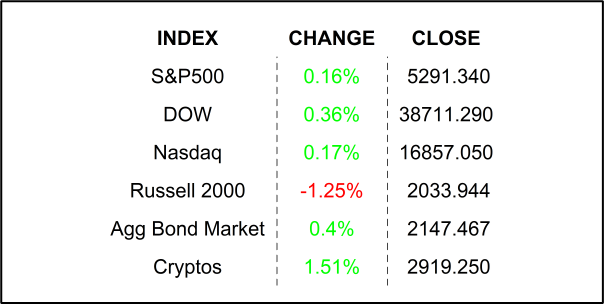

YESTERDAY’S MARKETS

NEXT UP

- ADP Employment Change (May) is expected to show that +175k new jobs were added, less than the month earlier.

- ISM Services Index (May) may have risen to 51.0 from 49.4.

- S&P Global US Services PMI (May) is expected to be unrevised from its 51.0 flash estimate.

.png)