Stocks clawed their way into a mixed close yesterday, spurred by artificially intelligent Apple. Bond yields eased in response to strong demand for the Treasury’s 10-year Note auction.

Stereo. That’s right, we will have economic forces hitting us from 2 directions today, though it may not be as enjoyable as the tagline implies. Do you remember back when stereo sound was a luxury? Do you remember when there was a switch or button which allowed you to switch between stereo and mono? Why would someone want to switch to mono, I wonder? Well, folks, that is one of those mystical questions that may never be answered in this world, but we will get a pair of answers today.

The FOMC will conclude its 2-day meeting today and announce the resulting policy this afternoon at 14:00 Wall Street Time. Guess what, it’s no secret that the bankers will probably keep rates unchanged, so that will not be big news. The officially prepared statement may say things like “…lack of progress toward the Committee’s 2 percent objective,” “…economy continues to expand,” and finally “…has progressed but remains elevated.” That all means NO RATE CUT FOR YOU! But fret not, “…the committee will continue to monitor progress!” Well, we certainly hope so 🤣. Any drastic changes will certainly be met with some market volatility.

Along with its official statement, the Fed will release the FOMC’s quarterly projections which will be the real star of the show. In that release we can see what each policy maker is expecting by the end of this year… AND YEARS TO COME… though we really only care about what will happen through the end of this year 😉. You can find those rate projections displayed nicely in the now-infamous Dotplot, which… um, plots dots representing where each FOMC member is expecting Fed Funds to be going forward. By taking a median of those expectations we can get a good handle on where interest rates may end up. After all, it is those beige and buttoned-up folks that make rate decisions. The last Dotplot showed that, on median, the bankers were expecting three -25 basis-point cuts by yearend. That was three months ago, and it is likely that members have revised those projections since, given that economic figures have been coming in on the “stronger” side and disinflation has slowed.

We only get that Dotplot quarterly, but the markets adjust their projections every microsecond… or is it millisecond. There is a big difference, but the CME Group commits to “several times a second,” which is pretty OK for me. Those futures (as you can see from the chart below) have been adjusting to reflect where traders, AKA the markets, expect Fed Funds to be by the end of the year. According to those, there is a 100% probability that we will get a -25 basis-point cut and a 59% chance of getting a second -25 basis-point cut. That is moderately high odds of 2 cuts, because there is a better-than-even chance of getting a second cut.

This morning, before all the real chaos, we will be treated to the release of the Consumer Price Index / CPI, which is, kind-of, the reason for the season. That release is expected to show that core inflation moderated by a bit to +3.5%… still higher than “the committee’s 2 percent target.” It is important to note that the release reflects May’s inflation while we are nearly halfway through June already. In case you have forgotten, year-over-year inflation ticked in February and March, while it moderated slightly in April. That early-year uptick, as you will also note in the chart below, caused the markets to adjust its end of year forecast for Fed Funds.

Though this morning’s CPI release will likely impact those estimates further, it will probably not have an impact of the Fed’s projections. Those are largely expected to show a good chance of 2 rate cuts by yearend. Of course, any deviation from those expectations will, unsurprisingly, be met with increased volatility. Actually, as we have learned in meetings past, we can expect volatility no matter what is released today. Unless we see any new areas of inflation pop up in this morning’s CPI release, we shouldn’t expect any material changes. In other words, keep calm, carry on, and switch to mono, because why not 📻.

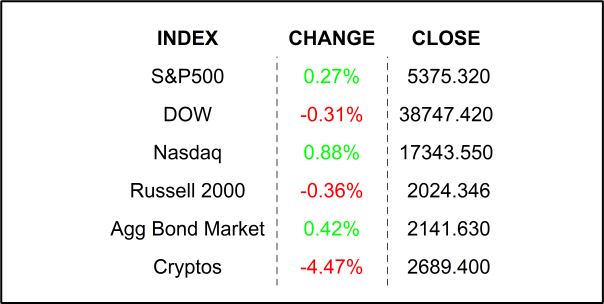

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI MoM (May) is expected to have moderated to +0.1% from +0.3%.

- Consumer Price Index Ex Food and Energy / CPI YoY (May) may have declined to +3.5% from +3.6%.

- FOMC Meeting results will be released at 14:00 Wall Street Time. At 14:30 the Chairman will hold a press conference.

.png)