Stocks rose on Tuesday as slower-than-expected Retails Sales increased hopes for sooner rate cuts. Without a strong showing from Autos, Retail Sales came in with an anemic print which included a downward revision of the prior month.

DotAI. I know that you have heard about NVIDIA, the AI phenom. You may own it and feel pretty accomplished… whether by plan or happenstance — don’t worry, nobody cares if it was happenstance on Wall Street, because it’s the profit that counts. If you don’t own, you wish you did but are scared to get in now. You may have owned but sold too early and you are brooding. If you fit into none of these categories and you are super late to the party, perhaps you woke up this morning and read a headline that looked something like “NVIDIA – most valuable company – Tops Apple and Microsoft.” And there it is, perched on top of the S&P500, similar to the Dragon which is currently perched on top of New York’s Empire State Building (trust me, or you can just Google it). You probably remember NVIDIA as a maker of video cards and chips fancied by gamers. For a hot second, crypto miners discovered that the company’s processor chips excelled at solving the complex equations required to mine cryptocurrency. That craze didn’t last long, but it educated Wall Street that parallel processing, which differentiates NVIDIA’s chips from the serial processing of the more well-known Intel and AMD, is something to be reconned with. Those chips are optimized to execute complex instructions while NVIDIAs multiple cores allow its chips to process many simple calculations simultaneously. Ok, that’s your science lecture for today, and that is where the chapter would have ended, but for the birth… um re-birth… er, re-re-birth of Artificial Intelligence in 2023.

You see, AI has been around for a long time; far longer than you think. It was really born in the 1950s with the famous mathematician Alan Turing’s devising of the Turing Test which measured machine intelligence. There were lots of developments and promises that followed, but perhaps, as with many things, the world was not ready for AI, so it languished. We have been using various forms of AI on Wall Street for many years with little fanfare. More recently generative AI advancements led to a new age of more consumer-focused applications. Now, front and center in everyone’s face, its time has come. Ok, cut the ominous music and let’s get down to it. To make generative AI work effectively, you need lots and lots of computers learning everything they can and making connections between all those bits of data. To do that effectively, those lots and lots of computers (servers) need to be optimized to run lots of simple processes… IN PARALLEL. [cue light bulb] And what company just happens to have been in the parallel processing business for the better part of its commercial life? Wait for it… NVIDIA! Here is what that meant to NVIDIA and its shareholders.

That’s right, a +497% increase in the stock since March of 2023. Why? Because AI is real, it is game changing… and NVIDIA is the leading manufacturer of the chips required to make it happen. That, my friends, is how we got to here from there so fast. That is also how the company usurped usual suspects Apple and Microsoft from the top spots of the S&P500. BUT THAT IS NOT WHERE THIS STORY ENDS.

There are also plenty of headlines that read like this: “AI stock gains similar to Dotcom bubble.” Now those headlines really upset me. Did AI arrive and excel fast? Yes, it did, but we have to dig deeper before adopting sweeping generalizations. Let’s start here. Artificial Intelligence is very real, it is here right now, having a major positive impact on productivity, and commercially viable. That means it is generating revenue that didn’t exist just 2 years ago. WAIT, but wasn’t that the same promise of the Dotcom era? Pets.com remains the posterchild of the Dotcom bubble because it came at a time when many other companies were simply adding the “.com” notation to their names just to enjoy quick gains in their stock prices. Unfortunately for Pets.com, it IPOed just as the fever for internet retailing broke. It took only 11 months for the company to cease operations. There were plenty of others that simply disappeared as the newly-informed investment community caught on to the ploy. HOWEVER, that time did witness the birth of modern, online retail which represented a sea change in how all of us operate in our daily lives. We have that era to thank for Uber, DoorDash, Etsy, Wayfair, Netflix,… wait, wait, also Amazon… technically Amazon… “.com”. Amazon.com has quite literally set the standard for all the online retailing that we use today. If you bought Amazon.com at the start of the Dotcom era and held it through the bubble burst, you would have earned +4,975%. The year that followed was a tough one, but you would have only lost some -27%. Are you ready for the bomb blast? If you held the stock through thick and thin until today, you would have earned +243,647%!

What is the moral of this story? Sure, there were plenty of Dotcom stocks that were a joke with little or no prospect for financial greatness. Simply adding the “.com” notation to the end of your name was good for a moment, but creating a lasting, very real, and a productivity changing business model was what it took to make an investment of a generation. Do you believe that AI is a flash in the pan, or is it lasting, very real, and productivity changing? If you do, just make sure you look closely at the companies that claim to use AI and decide if it is a) in fact, true, and most importantly b) that it has a positive commercial impact on the company. If you answered “no” to both questions, throw them out with the bathwater, but hold on to all the babies that you answered “yes” to question “b.” Should I drive the point home? Of course, I should. Would you invest in a company named pets.ai? Sorry pundits, you got this one wrong.

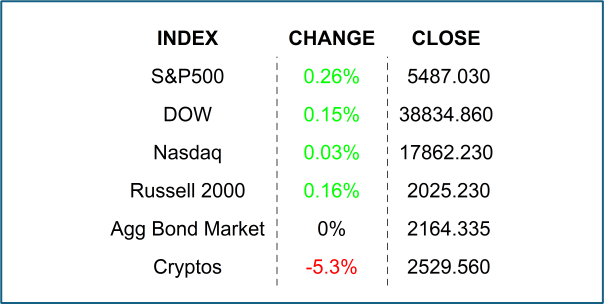

TUESDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (June 15) is expected to come in at 235k, slightly lower than last week’s 242k claims.

- Housing Starts (May) are expected to have grown by +0.7% after increasing by +5.7% in April.

- Building Permits (May) may have gained by +0.7% after declining by -3.0% in the prior period.

- Today’s Fed speakers include Kashkari, Barkin, and Daly.

.png)