Stocks posted somewhat of a rebound yesterday with a mixed close as traders thought better of the prior day’s tech selling. Home prices continue to climb according to the latest raft of data, but the growth may be slowing.

Just a reminder. I am not sure about the exact date and, having only had 1 caffeine infusion so far this morning (espresso No. 1), I do not have the drive to get exact on this one, but it had to be some time in the mid to late 1990s… probably late. I was at a large family gathering. I remember clearly, and with great joy, many of the folks in attendance who have sailed to the great beyond since. My daughter was a toddler and my son had not yet found his way into existence, though he was on the way. Those were happy days, but not just for my large extended family, but for the stock market. In case you don’t remember, it was BOOMING! Now these family gatherings were quite frequent in those days as my daughter was the first of her generation which meant that most of us in my generation had… tidy homes, less bills to pay, and time… to focus on the stock market. Now I come from a family of bright people. There are scientists, lawyers, accountants, professors… and 1 finance person. Yep, the finance person was the one bouncing that beautiful little toddler on his lap… yep, that was me. The scene is set.

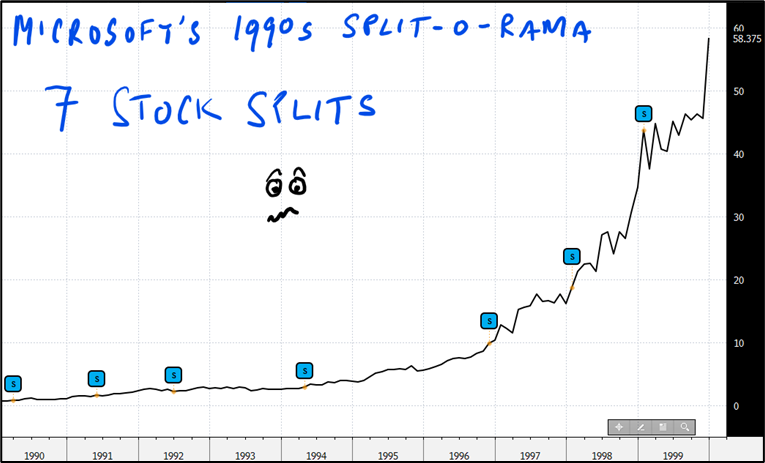

Conversations around the table were loud and quite animated. One of the more focused members of my generation announced that either Microsoft or AOL (not sure which) had announced a stock split. He then proceeded to say something like, “I am going to buy it and ride it to the next split.” I was THE finance guy, so I had to make a snap decision. Should I challenge him and explain the mechanics of a stock split, or just let him feel like a savvy captain of finance? In truth, he probably was going to make money anyway as we were in the midst of a tech boom and all ships were climbing with rising tide (see my note AND INSTAGRAM VIDEO 😉 from a few days ago). You see, stock splits were quite frequent in those days, especially amongst climbing technology-related stocks. You could hear many casual elevator conversations sounding something like “if you liked bla-bla-bla at $36, you are going love it at $12, after the 3 for 1 split!” I mean, really, who would not want to buy a $36 stock for $12? Check out this chart of Microsoft’s split history in the 1990s for context, then follow me to the close THAT YOU PROBABLY KNOW IS COMING.

Pretty impressive chart, eh? I only ran it through 2000, because… well you know. Wait, you don’t remember? Ok, if I extended this chart only 1 more year, you see that big surge on the right-hand side of the chart (after my son was finally born) evaporate as Microsoft lost some -62%. Don’t jump to conclusions; it had nothing to do with the stock splits… or my son’s birth. The tech bubble had burst, and it took all companies, even the good ones like Microsoft with it.

Stock splits are not very common today, but they do occur. Most recently NVIDIA had a 10 for 1 stock split earlier this month. Prior to the announcement, the stock was trading just under $1000 a share. Doesn’t that seem like it is expensive? After all, $1000 is a lot of money. If you had $1000 to invest, would you rather had bought 1 share of NVIDIA or, say 5 shares of Alphabet/Google. Alphabet is a good company and also involved in AI. Think about it, wouldn’t it look better on your statement to have 5 shares of something instead of 1. Who wants 1 share of something… that is Bush League (a completely American colloquial term for amateurish), right? Can you see that there is a bit of psychology at play here? After the split, you would be able to buy almost 10 shares of NVIDIA. Here is the thing. Financially, the split means absolutely nothing! Prior to the split, your 1 share of NVIDIA would have represented $6.33 (2025 EPS estimate) of earnings, while after the split each of your 10 shares now represent just $0.63. That’s 63 cents per share! What about value, like Enterprise Value? The same math applies. Before the split, each share represented $870, while now, after the split, each share represents just $87. Now this calls for one of my favorite lines: it’s just math, stupid. Now, I have to say, there is a case where someone who had less than $1000 to invest but wished to buy NVIDIA prior to the split. If that person could only invest in whole shares, an investment in even 1 share would have been impossible. So, indeed, even though many firms allow investors to purchase fractional shares, there are theoretically more investors who are now able to purchase the stock. NVIDIA hit a high of $135 last week, and without the split that stock would have been at $1350! Doesn’t NVIDIA seem like a bargain relative to where it would have been without the split? MIND GAMES are at play. If you avoided the stock because it was $1000 prior to the split, you left a +33% return on the table. Don’t be fooled.

Meanwhile, should I tell you how much return my family member would have made if he held Microsoft from that split in 1998? That’s right, he would have earned +2691%! But he didn’t, because he lost interest in the stock by 2003, WHICH WAS THE LAST TIME MICROSOFT HAD A STOCK SPLIT. Microsoft is trading around $450, which means you could only buy 2 shares if you had $1000. Doesn’t it seem amateurish to only own 2 shares of something?

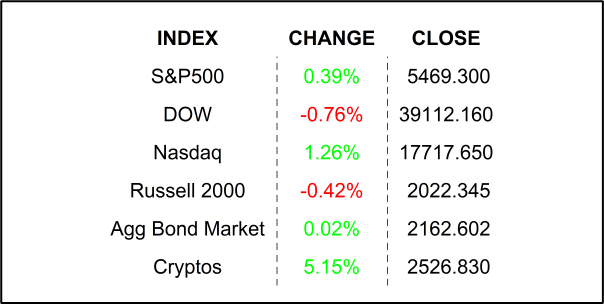

YESTERDAY’S MARKETS

NEXT UP

- New Home Sales (May) may have slipped by -0.2% after falling by -4.7% in the month prior.

- The Treasury will auction $70 billion 5-year Notes today.

- Earnings after the closing bell: Levi Strauss, Micron Technology, and Jefferies.

.png)