Stocks hit new highs yesterday on the hint of a hint of a friendlier Fed from Chair Powell. Job Openings gained in May according to the latest JOLTS release.

Trucking. When it comes to the economy, it’s usually the long game that wins. The US economy is not something that can turn on a dime, like a highly tuned sports car. No, it is more like a fully loaded tractor trailer speeding along on a superhighway. Truck drivers must anticipate brakes and turns far in advance in order to avoid disaster 🚛🚛.

The Fed has been dealing with a rash of inflation not seen for many decades… in the wake of an economic lockdown not seen in… like, ever. At the start of the pandemic, the Fed mashed down on the gas pedal, throwing its full weight into accelerating the economy, which had almost ground to a complete halt. It took a bit, but eventually the economy picked up speed and began to accelerate. Before too long the economy was at top speed. The Fed kept the pedal to metal, hoping for yet further growth. But storm clouds were brewing on the horizon. Slick roads are not a friendly environment for a speeding tractor trailer. Making matters more challenging was that they were roads that were not familiar to the Central Bank. The Fed forecast for the darkening clouds was “transitory,” as it expected things to clear up.

Alas the clouds got darker and closer. A light drizzle turned quickly into a driving rain with no clear skies in sight. It was at that point that the Fed decided to let its foot off the accelerator… still no brakes. The highway gave way to curvy, downward sloping roads with the rain coming down at full force. The Fed slammed both feet on the brake pedal. The truck lost traction and continued to accelerate. A jackknife or even worse seemed inevitable. However, as luck would have it, the truck began to slow, and the rain let up in intensity. The clouds on the horizon, still there, were lighter. The truck continued to slow as a hill appeared on the horizon.

In order to make it up that hill, the truck would have to pick up momentum in order to avoid stalling and rolling backward into the cars and trucks behind. The incline is getting closer and closer. Though it starts out shallow, it clearly steepens rapidly beyond. The rain has stopped but the roads are still slick.

The Fed’s choices are a) keep both feet on the brake pedal, b) let up on the brake pedal slowly, or c) continue to stand on the brakes and hope that it can mash back down on the gas pedal once the incline starts and possibly avoid a catastrophic stall. The Fed thinks about its track record in delivering that maneuver successfully. It can only remember back to the mid-1970s, but it recalls that it encountered these conditions 7 times over the decades, and in each of those occurrences, its late accelerating had ended up unsuccessful, in a stall.

Now I am not a professional statistician, but I know a thing or two about statistics 😉🤓. If one has a 50-year track record with 0 out of 7 successes, the expected outcome of the next event is… um, highly unlikely. Knowing this, perhaps choice “b” from above might be a more conservative approach than the one that the Fed is currently choosing. Remember that even 2 rate cuts are not the equivalent to pushing on the gas, and it may not even be the equivalent of removing its foot from the brake and coasting.

Overnight Interest Rate swaps show that the market is expecting 2 cuts before yearend. The Fed’s last forecast shows that it is expecting only 1 cut. Unarguably, 1 rate cut is the equivalent of keeping the brakes depressed. We are all passengers in that speeding truck – make sure seatbelts are fastened tightly ⚠️.

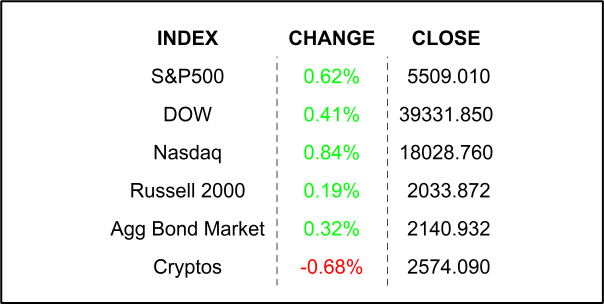

YESTERDAY’S MARKETS

NEXT UP

- ADP Employment Change (June) is expected to show 165k new jobs, slightly above last month’s 152k additions.

- Initial Jobless Claims (June 29) is expected to come in at 235k, slightly higher than last week’s 233k claims.

- Factory Orders (May) may have climbed by +0.2% after climbing by +0.7% in April.

- ISM Services Index (June) probably slipped to 52.6 from 53.8.

- FOMC Meeting Minutes from its June 12 meeting will be released at 14:00 Wall Street Time. Though it’s sure to be a showstopper, equity markets will close early at 13:00 ahead of tomorrow’s Independence Day Holiday.

- Markets are closed tomorrow in observance of Independence Day.

.png)