Stocks rallied to fresh highs yesterday as investors prepared for 2 days of Jay Powell talk on The Hill. Investors are hoping to see a softer side of the Fed Chair as he answers to lawmakers.

So, what if… It is early days for election talk. I know it seems like just around the corner, but there is still plenty of room for political jockeying. However, more and more conversations are beginning to happen on Wall Street wondering what a Trump or a Biden… or a someone-else investment thesis would look like. I have contended on record with CNBC 😉(Trump’s better election odds after debate are already moving markets (cnbc.com)) that there have been no clear policy admissions yet, so it’s still anyone’s guess on what a thematic election portfolio should look like. I have laid out for you that high-level themes have not worked out in the past. Notable is how energy stocks performed far better under Biden than Trump, which would not be expected given their respective feelings about the sector. At a high level, the best approach at this point is to determine what each party’s election platform would mean for the economy and invest based on what your economic projections are. Sure, both parties will tell you that their policies are going to have the economy BOOMING, but we know better, because we do the research. With Trump expected to reveal some of his strategic policy initiatives in the coming days, I thought it might be interesting to provide an example of what we should think about based on those policies.

As I have said, it is early days, but at this point, polls are giving Trump the edge over Biden (47.5% to 44.1%) in November (Real Clear Polls). The betting averages show Trump with a 56% chance of a win versus Biden’s 20.8% chance. Again, to be clear, these numbers will fluctuate a lot in the coming months and days, and a big part of it will have to do with policy, the economy, and markets. So, let’s say, these current numbers play out and Trump is elected. What would that mean to a specific stock? Let’s use a simple theme: trade with China. Trump has been a clear advocate for tough regulation against China. Biden, for the most part kept most of the Trump-era tariffs in place, so we can consider these past few years a baseline. A reasonable thesis, therefore, would be that Trump 2.0 would toughen sanctions further with China. Let’s see what that might mean for a few select companies.

Most of the trade haggling has been around technology, so we will focus on that for now. Let’s start with top consumer tech superstar Apple. If we look at Apple’s top suppliers, they are Hon Hai, Luxshare, Pegatron, TSMC, Quanta, and Samsung. Of that group, Luxshare is the only Chinese company representing 11.94% of Apples COGS, with Hon Hai, a Taiwanese company and Apple’s biggest supplier coming in at 50.4%. Could Apple’s earnings be affected by increased tariffs on Luxshare imports? Yes, indeed. What about the other side of the equation, revenues. In 2023, 18.9% of Apple’s revenue came from Greater China. Could China retaliate and limit Apple sales if a fresh trade war erupted. Sure, it can, and who better to target than American crown jewel Apple. So tough trade with China will definitely have an impact on Apple’s financial health.

Let’s apply the same type of analysis to Tesla. Tesla’s number 2 supplier, Contemporary Amperex Technology Co, a Chinese company, makes up 10% of Tesla’s cost of goods sold. Can trade interruption with China cause pain for Tesla? Yes, indeed, but if we look more closely, Contemporary produces batteries, obviously a key component to Tesla’s products. It turns out the Tesla’s 3rd and 4th largest suppliers LG and Panasonic (South Korea and Japan) are also battery suppliers, so Tesla can shift away from Contemporary in a squeeze. Looking to revenues, 22.5% of Tesla’s sales were from Chinese customers in 2023. With plenty of competition from local producers, China could easily retaliate in a trade war by placing sanctions on domestic Tesla sales. So, would tougher foreign trade policy affect Tesla? Yes, and on a similar level to Apple.

Finally, let’s take a quick look at everyone’s favorite AI chip company NVIDIA. Using a similar analysis, we note that the company has no high-level supplier exposure to China, but it did derive 21.4% of its Revenues from China in 2023. That could pose a challenge to the company’s forward revenues. What about the company’s competition? Advanced Micro Devices, Intel, Qualcomm, and Broadcom all derived 15.1%, 27.4%, 62.5%, and 35.8% from China, respectively. So, while NVIDIA has revenue exposure to China which can indeed be impacted by strained trade relations, it is positioned well amongst its peers.

This level is quite high-level, but I wanted to give you an example of how we might look at proposed Presidential policies and how they may impact stocks that you own. What should be clear is that we cannot just make sweeping generalizations when formulating an investment thesis. Investment theses like “energy will thrive under Trump,” may prove riskier than you might think. Finally, though the polling and betting numbers portend a Trump win today, they are sure to fluctuate. And lest we forget, Congress also has a say in policy, and that race is neck and neck as well. Finally, we have not gotten any real policy promises from either side, but don’t worry, those will be forthcoming. Just stay sharp and do your homework.

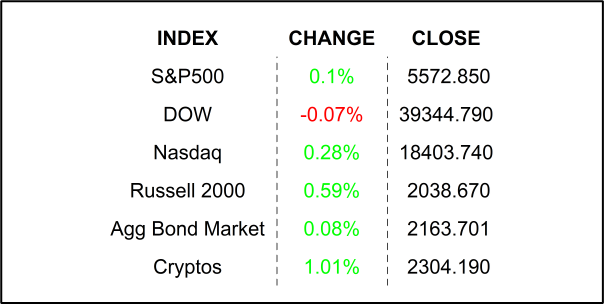

YESTERDAY’S MARKETS

NEXT UP

- No economic releases today, but the big market driver will come from the Senate where Chair Jerome Powell will testify for the Senate Banking Committee at 10:00 Wall Street Time. He is likely to defend the Fed’s higher for longer strategy, but analysts are expecting him to strike a more dovish tone in light of recent weaker employment figures.

.png)