Stocks rose yesterday because Powell signaled that he was ready for a well-earned vacation. Traders look to today’s CPI release for confirmation that the edge of the woods is near.

Labor of love, love of labor. Day 2 on The Hill featured anything but fireworks, but the Chairman’s soothing tone was enough to drive stocks to YET ANOTHER HIGH. “This can get boring”… said NO ONE ever, because who doesn’t like to make money in their stock portfolios. But it isn’t difficult to notice that the market seems to have settled in on a September/November rate cut, and the futures numbers support it. Based on Fed Funds futures. there is now a 74.5% chance of a rate cut in September, and that probability goes over 100% in November. Well, now that we are on that page, those same futures are expecting a 100% of 2 rate cuts by year-end. I am sure that this is not news to you, but if you watched the probabilities closely, daily (I do so you don’t have to), you would see that the probabilities are climbing. However, their rate of ascent is not as sharp as they were a few weeks ago.

Now I know that this sounds silly, but the past few days of Powell testimony seems like he was taking cues from investors, and sort of setting up to do exactly what the markets are expecting. To be clear there is nothing wrong with that as long as it is consistent with the Fed’s strategy. In fact, in a perfect world, the Fed would guide investors to do its dirty work with words alone, and any hard policy moves (hikes or cuts) would simply serve to back up the market-based moves. Let’s take a step back and have a look at what was said during Powell’s testimony.

There were lots of “it’s not there yet,” and “more proof is necessary,” and “we are making progress” admissions. No one was expecting anything different, nor was anyone expecting the Chairman to hint at or give clues on any rate-cut timeframes. It was supposed to be 2 days of just that. Senators and representatives pining to look like they are standing up for everyday citizens struggling to make ends meet, whose lives have been devastated by inflation and high interest rates. Through all that, Powell, simply a prop, was supposed to find 250 ways to say the same thing, which would equate to nothing new. BUT, he did say a few new things worth noting. Here is an excerpt worth noting.

The job is not done on inflation. We have more work to do there, but at the same time, we need to be mindful of where the labor market is, and we have seen considerable softening in the labor market.

Now, I don’t know if you remember, but as the Fed was chambering its first round of rate HIKES, the labor market was also at the center of discussion. At the time, the labor market was considered to be tight. Too many jobs and too few willing workers to fill them causing wages to rise. That pressure is a key source of cost-push inflation, one of the three forms of inflation. If you want to know more about the three forms of inflation, check out my Malek Market Minute video about that on Instagram (https://www.instagram.com/stories/highlights/17921816126822214/). Now that I got that shameless plug out of the way 😉, let’s get back to it.

Remember that the Fed has only 2 jobs! Job 1: keep inflation in check, and Job 2: keep unemployment in check. Seems simple, but if you have been following me, you know that those 2 are kind-of in opposition of each other. Strong employment typically leads to inflation with lots of wage dollars to be spent. So, if the Fed is happy with Job 2, Job 1 may be challenging. If the economy heats up and the Fed tightens monetary policy, unemployment typically rises. When that happens, there are less wage dollars to consume with, a slower economy, and reduced consumer confidence, which can help ease inflation at the cost of unemployment. In this case the Fed may be happy with Job 1, but nervous about Job 2. That quote up above is all about the Fed’s concern about Job 2.

How do you think that the Fed deals with problems in Job 2 (weak employment)? Yep, by easing monetary conditions, AKA rate CUTS. Bear with me, I am almost done. If you look back at the body language and signaling used at all the Fed pivots in recent years, and there have been a few since The Global Financial Crisis, this is typically how they start, with very similar wording around the labor market, job 2. This morning, we will get Consumer Price Index / CPI for June which is expected to show headline inflation declining to +3.1% from +3.3%. It is not the Fed’s favorite gauge of inflation, but it is certainly a data point, and confirmation of a further decline in inflation will be well received by the Fed and those who would like to see rate cuts soon. But, based on what I just laid out for you, it would seem that we should, rather, focus on the weekly Initial Jobless Claims number (also out this morning). Lest we forget about the JOLTS Job Openings number out later this month, and the monthly employment situation numbers, which will be released on the first Friday of next month. The opposite of a tight labor market is a slack labor market, and many economists suggest that the market is slackening with more workers available vying for fewer jobs. That means lower labor cost pressure, which means… lower inflation. That’s it. Thanks for your patience 😊.

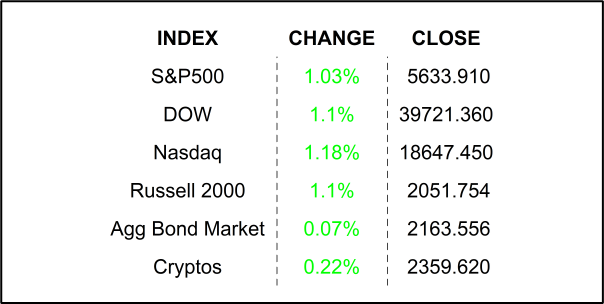

YESTERDAY’S MARKETS

NEXT UP

- Consumer Price Index / CPI (June) is expected to come in at +3.1% after registering +3.3% in May.

- Initial Jobless Claims (July 6) is expected to come in at 235k, slightly lower than last week’s 238k claims. Here, we are looking for the weekly numbers to stay around here, get higher, or stay above 200k at the very least to support the Fed’s fear of a weakening labor market.

- Fed speakers today include Bostic and Musalem.

.png)