Stocks sold off yesterday despite good news on inflation as weak hands holding high-flying tech shares decided to take profits and head to the beach. Inflation is cooling according to June’s CPI figure that was released yesterday morning.

Clear-cut cuts. It’s summer, can’t we just get a break? All these super-sized gains and drops are just not good for one’s… um, digestive health. Sorry, but market behavior in the past several days appears to be settling in as the norm through the end of the year. There are two world events going on just as we speak, and I toiled with which one I was going to highlight for you this morning. It was, indeed, a challenge, and it is Friday, so I decided to end the toil and just go with both of them.

Have you heard of Manhattanhenge? Well, if you live in New York, you may have. For those of you who haven’t heard, Manhattanhenge is when the sunset aligns perfectly with some of New York City’s major east-west streets. Imagine that you can stand at the corner of 34th Street and Park Avenue and watch the sun sink between the buildings and fade into the western horizon. It probably sounds silly if you haven’t seen it, but I can assure you that it is visually stunning and tends to give one goosebumps… even in the sweltering heat. That alignment is rare and only happens 4 or 5 days in each year… really twice if you are a purist. Tonight is THE night if you want to witness that perfect alignment between nature and… er, not-nature. Yesterday’s release of the Consumer Price Index / CPI came in lower than economists were expecting AND lower than the prior print. Ready for this? AND just a day after the Fed Chair finished his 2-day testimony to lawmakers during which he struck a slightly less-than-expected dovish pose. AND just under a week after we got a weaker-than-expected monthly employment figure. If that is not perfect alignment, then what is 🌇?

Well, it is technically almost perfect. Inflation, while lower and getting slower is still not exactly at the Fed’s +2% target, and the economy, while cooling down, is still pumping out growth. With that, the Fed, while likely pleased, still has enough room to dawdle and tempt fate, waiting for THE perfect alignment to start cutting rates. Just steady as it goes while heading straight for the rocks, it seems that the Fed’s new strategy is to attempt to do a full 180 degree turn just before wrecking the ship. Let’s have a quick look at yesterday’s numbers so you have a better idea.

Once again, core goods (aka stuff) dis-inflated; we are demanding less stuff and companies are slowing price gains. Check! Energy has normalized and continues to stay within an acceptable range since early last year. Check! Food inflation is right in its sweet spot and nowhere near where it was when I was writing too much about it in late 2021 through early 2023. I guess you know where that leaves us, eh? That’s right services, the bane of the Fed’s restful sleep. That is still the key driver of what remains of this recent spate of high inflation. Drilling down further, it is still shelter / rents that is confounding that aggregate. HOWEVER, it did slow last month in a continuation of a declining trend. In English, that means it was slightly better. Check out these 2 charts and follow me to Pamplona, Spain.

The first chart shows the major categories of CPI and serves as strong visual representation of the numbers I shared above. You can see how services (gold bars) dominate inflation, but you should also notice that it is trending downward, albeit slowly. You should also note the cyan and white lines which represent Core CPI and just plain, old CPI, respectively. You can see those clearly in a downward trend. The second chart shows the biggest culprit for what remains of high inflation, Shelter. I plotted this separately so that you can appreciate just how bad it got by 2023, BUT just how far we have come in getting it back to “normal,” which is just around +3.5%.

I hope that you have gleaned from these charts, and my rantings, that there is very little doubt that we are heading in the right direction. The big question that remains is just how close to the rocks we have to get before the Fed yells “full rudder port” to initiate an aggressive turn in order to avoid what is sure to be pain. Speaking of pain, let’s finally get to global event number two, the Running of the Bulls festival in Spain. Yesterday’s unexpectedly lower inflation figure was sure to please stock investors. I mean, after all, normalizing inflation would get us closer to rate-cuts right? Perhaps, but stocks sold off on the news. Why did the bulls run? Well, it is likely that markets were already on that page, and the number only confirmed what was already built into the market. That said, the biggest selling pressure came from highly overbought tech stocks which pulled indexes to several recent, fresh highs. It could be that traders were hoping for an even softer inflation print, though not likely. It could also be that STOCKS CAN’T ONLY JUST GO UP. They, the bulls, need their rest as they have been running hard lately. Earnings season starts this very morning and expectations for those high-flyers is high. Perhaps traders were playing it safe, now that the path to rate cuts appears to be… well, more clear-cut. Futures put the probability of a September decrease at 100%. The bulls ran, but they didn’t run far.

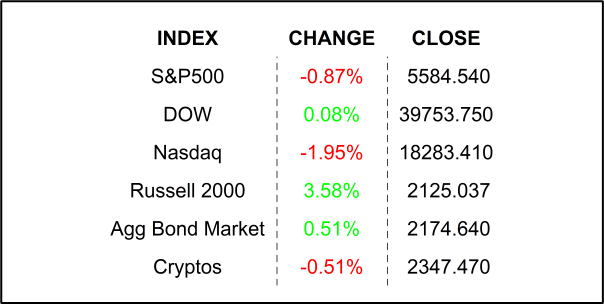

YESTERDAY’S MARKETS

NEXT UP

- Producer Price Index / PPI (June) is expected to tick slightly higher to +2.3% from +2.2%.

- University of Michigan Sentiment (July) may have climbed to 68.5 from 68.2.

Next week it’s earnings, earnings, earnings, AND Retail Sales, housing numbers, regional Fed reports, Industrial Productions, Leading Economic Index, and Fed Beige Book. Check back in on Monday to download calendars for the

.png)