Markets gained on Friday as the first of the bank earnings came in with positive surprises. The latest sentiment survey from University of Michigan showed a decline in confidence which can portend weaker growth.

Spending equals inflation. This morning was reserved for a discussion around how the latest University of Michigan Sentiment survey showed that consumers were less optimistic about the future than economists were expecting and how consumers were lowering their expectations for inflation. Both of those support easier Fed policy, which should support recent strength in the stock and bond markets. HOWEVER, that will have to be put aside in the wake of the horrible, attempted assassination of Former President Trump over the weekend. I will stick to my regularly amplified “policy not politics” guidelines this morning.

I have contended that, up until really last week, markets were completely ignoring the general election that will come to head later this year. Up until a few weeks ago the next occupant of the Oval Office was anyone’s guess as polls had Biden and Trump neck-and-neck within the confidence interval. With that, traders were likely awaiting more specific policy information from both camps, which will be forthcoming as we draw closer to the election. Biden’s recent poorly perceived performance in the first Presidential debate with Trump amped up the betting lines in favor of Trump and the market took notice. More specifically the bond market.

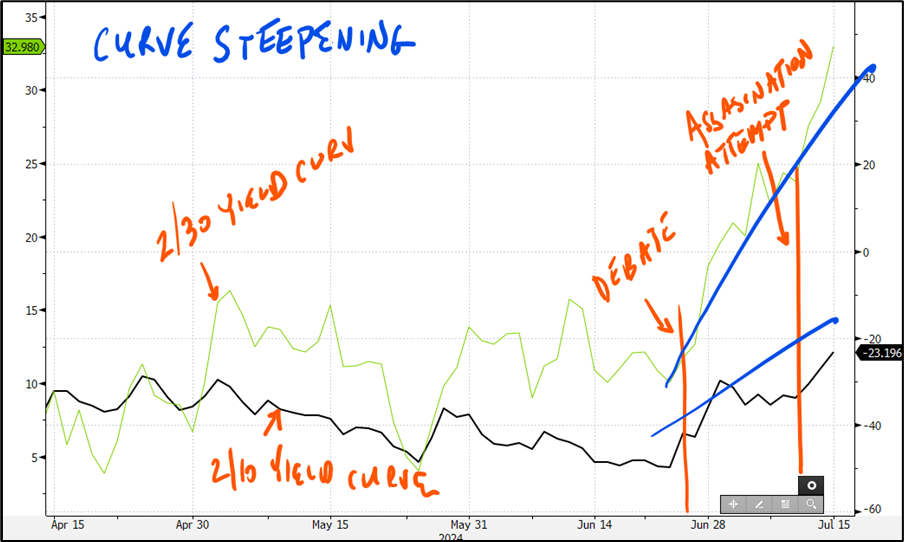

Saturday’s assassination attempt on Trump, according to some, will give him a further leg up on Biden, causing traders to have a fresh look on the Trump 2024 trade. In the absence of any real policy proclamations from Trump (other than no taxes on tips), traders are finding themselves having to speculate, and this is what they think. A second Trump presidency would mean expansionary economic stimulus in general, lower income taxes, less regulation, and increased tariffs. With that assumption, what does that mean for the economy? Well, all except for tariffs are stimulative to the economy, so let’s go with increased growth. Prior to 2021, increased growth would be perceived as just plain awesome, as inflation had not been a threat since the days of neon clothes and big hair (the 1980s 😉). Now, with painful inflation still high but possibly on its way out, the economy is in a tender state in which too much growth too fast could lead to the re-igniting of 2022-like price growth spikes. Actually, even prior to the recent spate of bad inflation, longer dated Treasury Note and Bond yields were highly sensitive to economic data, rising on strong releases and declining on soft ones. So, naturally, if we expect a second Trump term to be expansionary, we expect longer-maturity yields to pop, and they have. SIMILARLY, if we expect those expansionary policies to keep inflationary pressure on, we would expect shorter maturity yields to stay put as the Fed will only delay steeper rate cuts to keep inflation in check. What does that ultimately mean? Well, you can see in the chart that follows, a yield curve steepening. Check it out and then keep reading.

Now, I know that this is a busy chart, but here are the quick takeaways. This chart shows both the 2-year / 10-year yield curve (black) and the 2-year / 30-year yield curve (green). You can see how both steepened noticeably since the June 27th debate and yet further since this past weekend’s events.

Getting into slightly more detail, tariffs are also inflationary, and higher expected inflation would also lead to higher yields as investors require more yield to make up for inflation, which supports a steepening yield curve. Finally, though it has not been very pronounced heretofore, decreased regulation would be viewed as positive for industries in which regulation is limiting such as banking, energy, and healthcare. Those industries would be expected to benefit from lessened regulatory scrutiny.

With the Republican National Convention kicking off in Milwaukee today, we will witness a ratification of the published Republican platform, which does, indeed reflect some of these expansionary details. The speeches in coming days are likely to underscore and, perhaps even, expand on them giving traders further details to trade on. The Democratic National Convention is a month away and we are likely to get more detail on its platform as we get closer, but for now, markets are viewing a Trump 2024 win as being expansionary and inflationary for the US economy, while a Biden win would mean status quo. Stay tuned closely, this is likely going to be a bumpy summer.

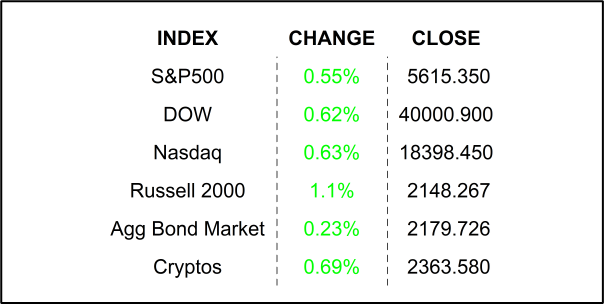

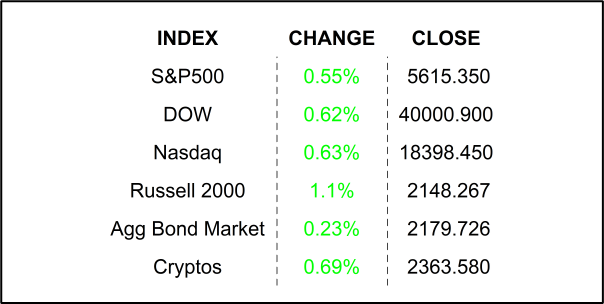

FRIDAY’S MARKETS

NEXT UP

- Empire Manufacturing (July) is expected to have declined to -7.6 from -6.0.

- Fed speakers: Chairman Powell will give an interview at 12:30 Wall Street Time, also San Francisco Fed President Mary Daly will speak later in the day.

- The week ahead: Lots of earnings, additionally, Retail Sales, housing numbers, Industrial Production, Fed Beige Book, and Leading Economic Index. Download the attached earnings and economic calendars for details.

.png)