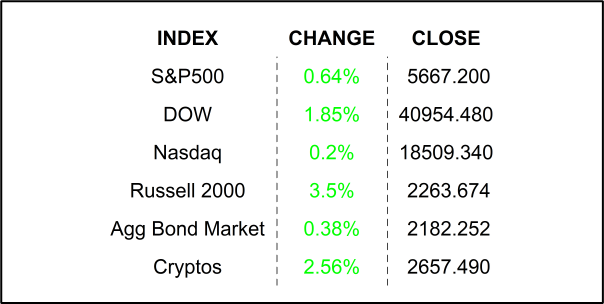

Stocks gained and the Dow stunned once again on strong-ish economic data suggesting that a soft landing is still on the table. Small Caps have achieved “meme” status in recent sessions as tired tech bulls rest their horns.

Meteoric. Do you think I like New York? Well, friends, I, in fact, love New York. To be fair, I love other places too, but New York is where I derive most of my inspiration. And in a city like New York, there is always something to be inspired by. One day it might be the stock exchange, another it might be the cobblestones that still peak out through a century’s worth of asphalt, perhaps it is the random steam hissing out of makeshift orange chimneys, or the rumble of the subways beneath your feet. I can keep going on, but if you don’t know it, come for a visit with an open mind and you too will be enamored. Yesterday, Manhattan was treated to something altogether different and unique. Would you believe a meteor shot straight across the backdrop of skyscrapers and Lady Liberty herself? Yep, New York just keeps on giving.

Similarly, so does the American consumer. You’re thinking, “there he goes with his obsession with consumption again.” Sorry for being infatuated with the thing that is responsible for more than 2/3 of US economic growth. Yesterday, the US Census Bureau released its Retail Sales number, which beat estimates (economists were expecting a slight decline) by breaking even for the month and got an upward revision for the prior month. The economy has demonstrated rather healthy growth in the past several quarters, but analysts and the Fed expect that growth to wane in the next few only to recover in Q4 of next year. The slowdown is expected to be caused by a slowdown in consumption and private investment. Blah, blah, blah, you have heard this before, but do you remember how many times economists pulled the fire alarm only to be rescued by consumption? It’s true, consumption has this way of pushing the economy forward when things have looked dire in recent years, forcing economists to re-label the business cycle stage over and over. It’s peaking, it’s peaking… and still peaking… or is it expanding… forget it, let’s just say we are in the “not-contracting” stage. That was a little economist humor 🤣. Settle down, let’s see what this is all about.

The two biggest influencers on yesterday’s number are Motor Vehicle and Parts Dealers and Nonstore Retailers. Auto dealers make up a big part of the overall number, and it declined significantly. Economists have explained that the decline was likely due to a cyber-attack which crippled sales for several days in June. That may have been a factor, but sales for the group have been in a cyclical decline. Nonstore Retailers, on the other hand, gave the core, or control, group the much talked about monthly gain. Nonstore Retailers really means ONLINE SHOPPING. If you don’t know about it… well, good for you, but I am sure that you do. My front stoop is certainly not wanting for more boxes, which litter it on the daily.

Yesterday’s strong print can be viewed in two ways. From the inflation / Fed alarmist perspective, the stronger month could dash hopes of rate cuts as strong retail can lead to inflation. Another view would be that inflation is on its way out, the Fed is cutting in September, and retail sales is keeping the economy from stalling. In other words, a so-called SOFT LANDING. Investors seemed to go with the latter interpretation yesterday as can be witnessed by the rare +3.5% increase in small-cap stocks which are perceived to thrive in a low-interest rate, healthy growth environment. This, as traders have been increasing their bets on more aggressive rate cuts in recent days in response to not only numbers like these, but also to the Fed’s subtly softer tone of recent. Right now, futures are predicting a 100% chance of 2 rate-cuts and 54% chance of a 3rd rate cut by year end, with a sure bet on the first cut coming in September.

Next week we will get another big inflation number and the Fed will meet in the following week. We are sure to get some answers, if not interpretable rhetoric in those alone, not to mention EARNINGS which will hit full torrent in the coming days, along with all those other numbers. Sprinkle in election season promises which are now also in full swing, and you get an interesting market. Still, at a high level, investors are looking for that very, very rare occurrence of a soft landing. Can it happen? Can a meteor fly over New York City in broad daylight?

NOTABLE IN THE PREMARKET

Already volatile semiconductor stocks are pretty-much down across the board in response to Biden suggesting to allies that he will ramp up restrictions on Chinese imports using American made tech… AKA semiconductors. Hardest hit are AMD, Lam, Applied Materials, QUALCOMM, and NVDIA which are down by -4.82%, -4.74%, -4.72%, -4.64%, -4.05% respectively.

YESTERDAY’S MARKETS

NEXT UP

- Building Permits (June) are expected to have increased by +0.1% after declining by -2.8% in May.

- Housing Starts (June) may have increased by +1.8% after falling by -5.5% in the prior month.

- Industrial Production (June) probably climbed by +0.3% after gaining +0.7% in the prior period.

- Fed speakers today include Barkin and Waller.

- This morning Synchrony, Elevance, J&J, US Bancorp, and Ally Financial all beat on EPS and Revenues while First Horizon came up short. After the closing bell, we will hear from Steel Dynamics, SL Green, United Airlines, Discover Financial, Alcoa, and Kinder Morgan.

- Follow us on Instagram (https://www.instagram.com/siebertfinancial/) I am there daily with hot market takes along with all sorts of other cool stuff. Go on, just click the link, and hit the follow button 😉.

.png)