Stocks bathed in red on Friday as tech stocks led the way down. The CrowdStrike-borne outage shined a light on the vulnerability of technology, not only in the network, but also in the markets.

Disrupted. Yes, a faulty software patch from security high-flyer CrowdStrike brought industry titans to their knees on Friday, grounding flights, locking out bankers, and even preventing me from getting the weather from my local TV station. I know that I can get that on my smartphone, but I use the local TV weather forecast as my cue to finish up my espresso and get down to business WRITING THIS REPORT. This is a tradition that predates the existence of those things that we are all far too reliant on 📱😉. It didn’t take a rocket scientist (and I actually know a few of them) to figure out how the market was going to react. With no weather report to guide me, I decided on a second expresso, and headed to my office to find that the obvious had already occurred. Recently bloodied tech was dragged through the dirt, and it dragged everyone with it. Will there be financial implications for the outage? Certainly, for some companies, but not for most of the shares that were beaten down in a guilty-by-association trade. So, don’t panic, be patient, and do a little research to make sure your portfolio companies were down for the wrong reasons. It shouldn’t take rocket science.

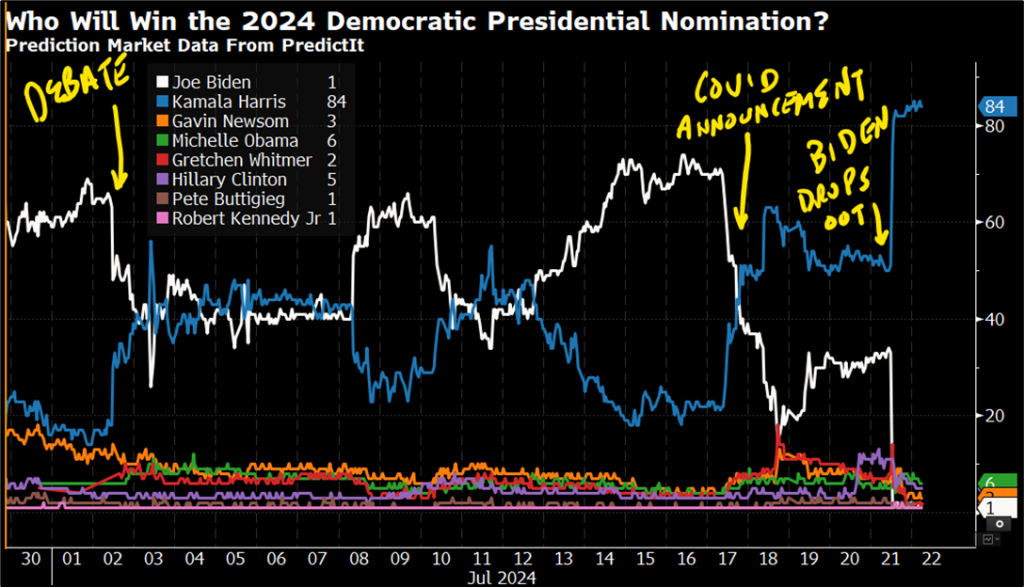

But what will probably take some rocket science is how to interpret the latest bit of news on the presidential election front, after Joe Biden announced that he was bowing out of the election race. The news was not completely unexpected, but it was far from a safe bet. Yesterday, I was sitting on the beach next to my son who offered me the news headline. That caused the rest of my family to grab for their smartphones to confirm the news. Suddenly, the guy in the blue bucket hat who was sitting near us offered the news to his lady-friend, gesturing to his smartphone. One member of the gaggle of perfectly tanned folks sitting behind us made a quite loud announcement about the news. At that point, whether the news was official or not I knew that my son was onto something. The two couples to our right spent the rest of the afternoon discussing the news… amidst a healthy discussion about local restaurants. It seemed official and before long, President Biden endorsed Veep Kamala Harris to be his successor in the Oval Office. That too was not entirely surprising given that Harris, at one point in the wake of Biden’s weak showing in the recent debate, actually surpassed her boss in probability of getting the top job, according to the PredictIt market. Check out the following chart to get a look how the predictions led up to this weekend in this 20-minute chart (go on, it’s worth a look).

You can see that by following this chart, you would have known that Harris, while no shoe-in, was certainly not a surprise entrant. Oh, and by the way, that green line on the bottom is Michelle Obama with a 6% chance of earning the nomination. Ok, so the really important question that had me glued to my smartphone after witnessing the news spread like wildfire across the beach, was WHAT DOES THIS MEAN FOR THE MARKETS?

Well, you have been following me, so you know that up until Friday, markets were putting the odds in favor of Mr. Trump and his only known policy agenda was no taxes on tips, lower corporate taxes, tougher tariffs, more Jerome Powell, cheaper energy, and implied looser fiscal policy. Oh, he likes crypto and prefers a weaker currency. That trade played out over the last 10 days. Longer-maturity treasury yields rose, the yield curve steepened, the dollar weakened, and bitcoin gained. In fairness, though there is lots of talk about a so-called “Trump Trade,” other than the yield curve, there has not really been much. Don’t get me wrong, things are happening, but nothing trend-worthy… yet. If we expand our look beyond Trump’s Bloomberg interview in which he articulated some of his policy objectives, we might look into the “Project 2025” initiative. In addition to overlapping Trump’s already revealed ideas, the treatise proposes some more aggressive moves regarding the FTC, the Fed, and cuts to Medicare and Medicaid. All would aim to promote economic growth and would be stimulative. The initiative was organized by the Heritage Foundation and not officially adopted by Trump, but it is reasonable to assume that his policies will be consistent with the spirit of the project.

The news of Biden’s exit has not yet been sufficiently polled to make any solid predictions as yet, though those will be surely forthcoming in the days ahead. Without better data, or without any solid policy from the Dems yet, we must assume that a Harris win will mean more of the same policies going forward. Many believe that Harris would champion wage gains for lower income classes (possible tax policy), which could be viewed as being stimulative. All in all, it is too early to tell how this latest news will impact markets in the future. In this temporary vacuum, we must assume a base case of the prevailing “Trump trade” versus 4 more years of current policy. Basically, everything is fluid, so pay close attention to the polls and the official announcements.

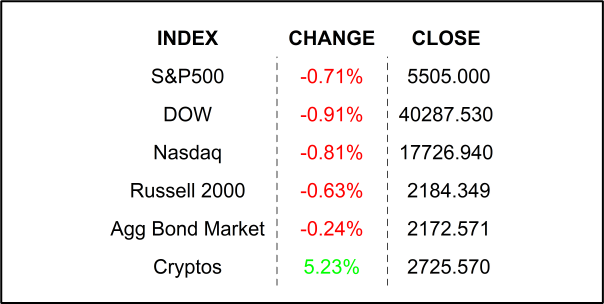

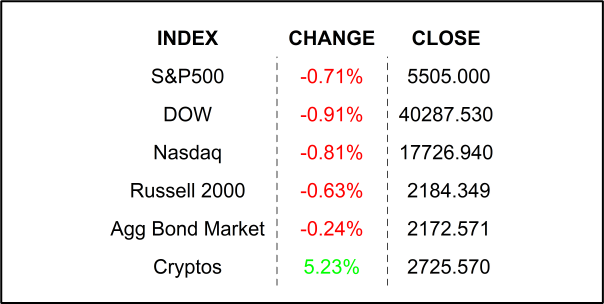

FRIDAY’S MARKETS

NEXT UP

- No economic data today but looking forward we will get lots of earnings along with more housing numbers, regional Fed reports, GDP, Personal Income, Personal Spending, Durable Goods Orders, PCE Deflator, and University of Michigan Sentiment. Check out the attached economic and earnings calendars for times and details.

- This morning, Truist beat, Verizon missed, and we will hear from Nucor, Crown Holdings, Alexandria Real Estate, Cleveland-Cliffs, and Cadence Design Systems after the closing bell.

.png)