Stocks gained yesterday as traders struggled to figure out what potential Pres candidate Harris could do for Wall Street. The bulls decided dip a horn into the water to see if it was time to buy the dip on recently soft mega caps.

The contenders eye the ring. It looks like a head-to-head battle for America’s top spot is shaping up to be Trump vs. Harris, at least according to the bookmakers… and prominent Dems who have lined up behind the Veep. I can’t say that it was a surprise, but it did catch most of Wall Street with a lack of answers on what a would-be President Harris would mean for the economy, business, and really, Wall Street. With little in the way of policy position to go on, one can only speculate. Harris is known as a former tough Attorney General, leaving one to wonder if that toughness will be channeled against business, should she be elected. She does, after all, hail from California which is known for its progressive policies.

Regarding her voting record as a Senator, Harris had a relatively consistent voting record which aligned with the more progressive, Democratic agenda. She has supported legislation on environmental protection, consumer protection, and financial regulation. She has voted against measures that favor deregulation and corporate tax relief. Therefore, it is safe to say that, historically at least, that Harris is less pro-business than Trump.

So, what does that mean for the economy and your portfolio? Well, I suppose, it depends. It depends on what is in your portfolio. Clearly there are sectors that would benefit from less regulation which should be at a disadvantage under Harris. Increased environmental protection regulations would certainly impact energy and smokestack-oriented industries. Enhanced consumer protection would have broad impact but is perceived as being negative for companies in banking, healthcare, utilities, and insurance. Remember the rules of my writing, I am focusing on policy, not politics, and more importantly, their impact on your portfolio.

Ok, so where are we? Trump is clearly anti-regulation, pro-tariff, looking to lower corporate taxes, in favor of lower taxes across the board, and looking to bolster domestic energy. Harris, on the other hand, has historically voted against tax breaks for corporations, has been in favor of regulations (consumer, environmental, etc.), and has voted in favor of tax-related measures focused at benefiting disadvantaged groups, which can be viewed as lower taxes. That leaves just one big talking point… tariffs. While Trump is clearly in favor of tariffs, Harris has historically come down on the side against unilateral tariffs, recognizing their potential burden on consumers. Be patient, I am going somewhere with this 😉.

So, which industries would be impacted by Trump’s vs. Harris’s historical support of trade restrictions and tariffs? It’s clear, autos, agriculture, retail, core manufacturing, and… technology. Uh-oh, “did he just say tech, Martha?” Yes, he did. We all know that technology, as we know it today, is highly reliant on foreign trade for assembly, components, and parts. Parts, as in, SEMICONDUCTORS. If you don’t believe me, just think back to the beginning of the pandemic in which the supply chain imploded leaving the US without those things. Now, it is important to recognize that some restrictions are, indeed, necessary to remain competitive and to protect national security interests, but for the most part, they are a huge burden on companies, consumers, and the economy in general.

Now back to tech. Since the start of 2020, the S&P 500 has risen by +72%! During that same period, the technology sector has risen by… +172%!! And semiconductors, a sub-industry of tech, has jumped by +349%!!! It would seem that any policy that would have a negative impact on tech or semiconductors may have an… er, unwanted, negative impact on those growth engines.

There are certainly whispers amongst traders that Harris may be more pro-tech than Trump, based on trade. However, it is important to remember that we are still in the early days. Politicians are saying what electors want to hear. Policy is completely another thing. For example, it is hard to believe that a would-be President Trump 2.0 would put policies in place that would cause the tech sector to suffer a significant setback. Similarly, as a Senator, Harris was charged with serving her progressive constituency, while a President must represent ALL the people, including those who live in Texas and rely so heavily on the energy sector. One would hope that a would-be President Harris would not want to have domestic energy, also a crown jewel, to suffer setbacks.

Folks, this base case analysis is going to continue to grow and evolve leading up to the election in November. As the race tightens up, so will the proposed policies. A match-up between Harris and Trump has not yet been thoroughly polled, though, at the moment, the odds appear to be in favor of Trump. Those may change as well as we get closer to election day, which too, will affect how the market reacts. Will it continue to be close, or will we see a clear front runner emerge. All these will allow traders to handicap the likelihood of the winner’s policies. Stay tuned and keep your calculator handy… you are going to need it.

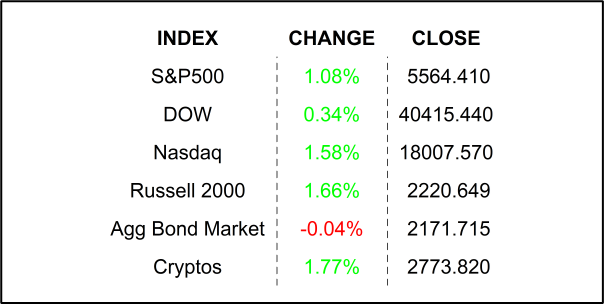

YESTERDAY’S MARKETS

NEXT UP

- Richmond Fed Manufacturing Index (July) is expected to have improved to -7 from -10.

- Existing Home Sales (June) may have slipped by -3.2% after slipping by -0.7% in the prior month.

- This morning Danaher, GM, PulteGroup, Quest Diagnostics, Coca-Cola, Philip Morris, Lockheed Martin, and HCA Healthcare all beat on EPS and Revenues while UPS, Polaris, GE, Kimberly-Clark, Sherwin-Williams, and Comcast came up short. After the closing bell, we will hear from Capital One, Tesla, Visa, Manhattan Associates, Texas Instruments, CoStar Group, Alphabet, Seagate, and Enphase Energy.

.png)