Stocks rallied on Friday to close out a tough week after a benign inflation figure injected some much-needed optimism on Fed rate cuts. The Presidential race heats up as new polls show Harris picking up some momentum.

Shaken, but not stirred… too much. The past week or so of trading has been a bit challenging from a digestive standpoint as traders were treated to the unthinkable, a softening of megacap, tech momentum. Not to mention a marked pickup in volatility. As measured by the VIX volatility index, you can see by the following chart how May, June, and most of July offered relatively subdued volatility. Actually, but for a spike in April, volatility has been rather quiet for the entire year. This, considering the macro backdrop. A heating up Presidential election, tech stocks trading at all-time highs (at least until a little more than a week ago), a muted start to earnings season, and an uncommitted Fed. In fact, if you know how the VIX trades, you would probably be not surprised to see this last spike. Check it out and keep reading.

You can see on the chart above how the VIX popped over 18 for a hot second last week. A bad print by Tesla and a poorly received earnings call from Google shook the pillars that have held up the Nasdaq and S&P500 over the past 18 months. Then there has been a lot of talk about a “great rotation,” where investors sold their tech stocks and piled the proceeds into oversold small cap stocks. Tech seemed overdone and small caps have had a somewhat lackluster recovery from the pandemic-era pullbacks, giving the appearance of value. Additionally, small caps are perceived to be rate sensitive so any data that comes along appearing to support rate cuts will have a positive effect on the small cap index. The net result of this has left the S&P and tech-heavy Nasdaq up by +14.45% and +15.63% year to date, while the small-cap Russell 2000 has turned in a +35.43% gain!

So, where might we go next? Well, this week’s releases are likely to help answer that question. This week’s earnings calendar is heavy on technology (too many to name here, just trust me), an FOMC meeting, and the monthly employment numbers for July. As far as earnings go, investors have super-high expectations that go beyond what is published by the blue-chip analysts where there is a nagging fear that AI may underdeliver. Regarding the Fed, there is a growing expectation that while it is not going to cut rates this month, it is expected to strongly signal a cut in September, which would be consistent with market indicators. Those rising expectations are tied to what appears to be a decay in the employment situation, so with maintaining a healthy labor market being one of its two mandates, the Fed is likely to be more inclined to cut rates sooner than later. That said, on Friday, when we get the monthly employment report, all eyes, especially the Fed’s, will be on the tape. Don’t discount the JOLTS Job Openings release, or the Consumer Confidence Index print, as either of those could certainly shake the market.

Now that we are talking about shaking the market, I feel that I should remind you of something that I do often. Volatility works in both directions. It is your friend on the upside, and your nemesis on the downside. To win, you have to accept both conditions. With a possibly softer Fed coming our way, volatility might become your friend once again. Just be patient and diligent. Maybe, start by downloading the attached, weekly calendars.

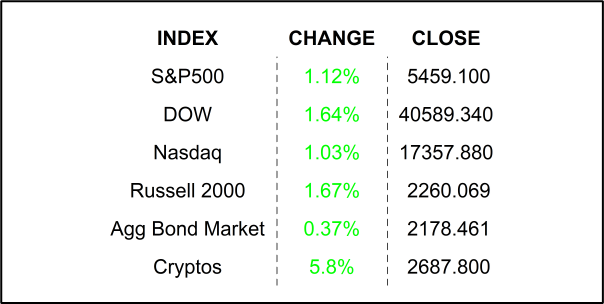

FRIDAY’S MARKETS

NEXT UP

- Dallas Fed Manufacturing Index (July) is expected to have declined slightly to -15.5 from -15.1.

- Later in the week, we will get some more housing numbers, Consumer Confidence, JOLTS Job Openings, FOMC Meeting, and June’s Unemployment Situation. Additionally, some 173 S&P500 companies will take to the tape with their Q2 earnings reports. Please download the attached economic and earnings calendars so you can be ahead of the curve.

.png)