Stocks had a mixed close in another bumpy session as investors await the wave of numbers that will begin today. The Fed convenes for a 2-day debate on what to do next.

Stick to the script, guys. They roll in one at a time. It is probably not as buttoned up in pinstripes as in the years past. No, the Fed bankers are more likely to show up in breathable, stretch fabrics donning sensible shoes. After all, they will have to endure nearly 2 full days of what are most likely the most boring presentations on the planet. These numbers are growing, those are slowing, marginally increasing, peaking, bottoming out, obviously, clearly, please refer to the chart on page 48, precisely, as you can see, where all these curves intersect, Taylor Rule… blah, blah, blah… seems like we need a break. Ya think?

Now I know that you don’t want to believe this, but could you imagine one of the most powerful policymakers in the world checking her or his smart phone to check the news and markets in between meetings which will determine policy that will affect pretty much anyone with an investment… worldwide? Well, you would be kidding yourself if you believed that FOMC members make decisions based purely on those boring presentations. Of course, the presentations inform, to some extent, but the Fed is keenly aware of what the markets are expecting.

Last time I checked, we are not all robots… yet 😉. No, we are still humans, subject to emotions which inform our purchase decisions, not only at Costco, but in the stock markets as well. I am sure that you have heard of the Fed Funds Rate. Have you ever borrowed money at the Fed Funds Rate? Have you ever called up the Fed’s Discount Window for an on-demand loan? Have you ever borrowed money overnight From JPMorgan so that there is enough money in your checking account to clear a check you wrote? OF COURSE NOT! No, you work hard, you save as much as possible, YOU INVEST WISELY, and you hope for smooth sailing in the economy. And then you read my daily market note and learn that the Fed Funds rate is going up (they are not this is just hypothetical). You stop and think about it. You may simply cock you head sideways and utter a “hmm,” then move on. You might get nervous, and think, “maybe I should keep this old Jeep for another year until things settle down.” You may get really nervous and call your broker and scream “sell Mortimer, sell!” You may do all or some of these things without even knowing what the darn Fed Funds Rate is, or if it even moved up.

We all know by now that the Fed raised that Fed Funds Rate 80s-style, aggressively in 2022 to fight inflation. Your stock portfolio lost lots of value. That made you nervous and you cut back on your spending. Non-negotiables like manicures were suddenly stretched to every five weeks, then six. You started to pay attention to your grocery bills. You decided against that trip to Ibiza to see Tiesto ☹. Wait, but what did the Fed Funds Rate have to do with any of that? And why did your stock portfolio value go down? Could it be because the present value formula used by analysts to come up with a theoretical value in a stock has interest rates in its denominator? 🤣🤣 No, man, you have been psychologically manipulated, sorry. BUT it was for a good reason. By spending less, you have helped inflation come down! Of course there were other factors, but lowering demand certainly had a big impact on it.

So, now inflation is getting closer and closer to the Fed’s target. The economy is hanging on for now, but it appears that the labor market is getting a bit shaky. What do you do now? Thankfully, your stock portfolio has recovered a bit, but now you are worried about layoffs, so you think “maybe Tiesto will have to wait another year,” or “my nails are holding up nicely, I can wait another week.” This ultimately causes the economy to slow and possibly enter a recession. If that happens… well, let’s not even go there.

You are probably thinking, “wait, I heard interest rates were coming down and that inflation is getting better.” You even opened the Zillow app on your iPhone to fantasize for the first time since 2021! By the way, you heard correctly that inflation is getting better, and you kind of heard that interest rates are coming down. The Fed has implied it, and the market IS DEMANDING IT. We can see that by observing the Fed Funds Futures, Overnight Swap Rates, SOFR futures, etc. Those markets are telling the Fed that it’s OK not to cut rates tomorrow afternoon, but it better not dash-our hopes for a cut in September, because if it does… IF IT DOES, you are going to give up manicures altogether… which will not cause a recession directly, but it may have a hand in it 💅. The Fed does not want that to happen, so, indeed, FOMC members will be looking at their phones today and tomorrow, not just to book manicure appointments, but to check the markets and the news. Stick to the script Fed members, and all will be good.

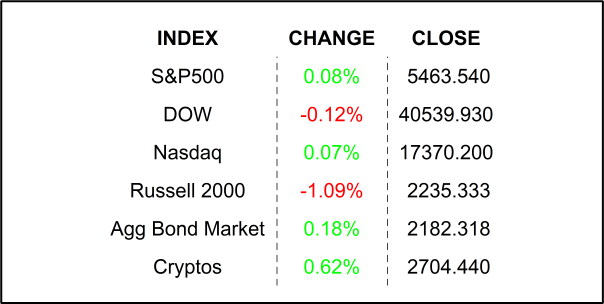

YESTERDAY’S MARKETS

NEXT UP

- FHFA House Price Index (May) is expected to have increased by +0.2%, same as April’s read.

- JOLTS Job Openings (June) may have slipped to 8.0 million from 8.14 million vacancies.

- Conference Board Consumer Confidence (July) probably ebbed to 99.7 from 100.4.

- This morning’s earnings: JetBlue, Stanley Black & Decker, Merck, Pfizer, American Tower, Phillips 66, and PayPal all beat on EPS and Revenues while P&G, American Electric Power, Archer-Daniels-Midland, Corning, Watsco, and AGCO missed the mark.

- Earnings after the closing bell: Stryker, Caesars Entertainment, Arista Networks, First Solar, Match Group, Skyworks, Starbucks, Live Nation Entertainment, AMD, Pinterest, and Microsoft.

.png)