Traders look past inflation to the labor market and a possible hard landing

Stocks sold off yesterday after traders were spooked by a weak manufacturing activity print. Traders fear that the Fed is risking recession by waiting until September for a cut, prompting the selloff.

Sahm like it hot. Stocks have been pushed around quite a bit in the past few weeks… ya think? Tech stocks have enjoyed a rather meteoric rise for a little over a year, dragging the broader indexes higher with it. To be clear, the rise was warranted in most cases with superior earnings growth. Companies were printing +50% year-over-year EPS growth stats which is truly amazing, no matter how you look at it. But having a bar that high only sets you up for disappointment. We are seeing a bit of that in this current earnings season where big gainers are beating estimates, but investors are expecting more, and their disappointment results in selling pressure. Ok, so there is that working against the bulls. Next, we have a wishy-washy Fed keeping its designs close to the vest only adding further stress to equities. Earlier this week the Chairman Powell… implied strongly that a rate cut would be on the table for the FOMC’s September meeting. When asked why the Fed wouldn’t just cut now and get it out of the way, the canned answer was that policymakers did not want to make a mistake and risk a resurgence in inflation. The risk, of course, of that conservative approach is… um… er, recession. But the economy is doing OK, says the Fed. Employment may be softening, but it is still not terrible, says the Fed in not so many words. Stock traders bought it… for the moment, sending indexes higher after the release.

Yesterday’s economic figures included a higher-than-expected weekly unemployment figure, and an ISM Manufacturing PMI which showed a steep drop. To make matters worse, the ISM Price Paid Index (part of the release series) unexpectedly jumped… you know, a driver of inflation. Those releases re-opened healing wounds from recent selling, causing traders, fearful of a recession, to sell their favorite tech shares and buy treasuries. There is some old-school stuff we haven’t witnessed in a while, so it caught many weak-handed traders by surprise, causing yet more volatility.

This morning, a “hard landing” is back on the breakfast menu, stoked by yesterday’s numbers, the selling, and some weaker-than-hoped-for earnings from some big techs. By the way, in case you have forgotten, a hard landing is a recession. A recession, that many are whispering, will come as a result of the Fed having acted too slowly in lowering rates. The most recent poll of blue-chip economists still only shows a 30% probability of recession in the next 12 months. So why all the fuss? I have written a lot about the Fed’s recent shift in focus to the labor market from inflation. That was a sure sign that the Fed is ready to ease policy. The Fed acknowledged in its policy statement that the labor market was softening. So how much is too much? And what is a bad unemployment rate?

Well, you may have heard some of the talking heads on your favorite financial channel throw around the Sahm Rule. Now, I know you are smart BECAUSE YOU READ MY NOTE EVERYDAY, but you probably have not come across the Sahm rule before. Brookings Institute researcher Claudia Sahm noticed that certain conditions in the labor market typically indicate an oncoming recession. We know that high unemployment leads to recession, but what is the signal that a recession is imminent? The Sahm Rule looks at a 3-month simple moving average of the unemployment rate in order to smooth it. If the average rises by ½ percentage point or more above the trailing 12-month low, a recession is likely to be in the offing. Check out the following chart, then follow me to the close. Go on, it’s worth a look.

If you look at this chart, it will appear that the Sahm rule has been triggered with June’s release, however according to Sahm herself the indicator came in just shy of the 0.5 needed, more like 0.43. The point is, it was darn close and if this morning’s figure comes in higher than the expected 4.1%, experts expect the rule to be triggered… even with the rounding error 😉. Claudia Sahm is a former Fed economist and Chairman Powell did mention the rule, which means the Fed is watching it. Now I have to disclaim all this and say, just because this indicator worked in the past, it does not mean that a trigger will predict a recession in the future. It is purely a statistical observation. The rule itself does not cause a recession, but math aside, a rapidly rising unemployment rate can indeed cause a recession… and you don’t need a calculator… or a PhD in Economics to know that.

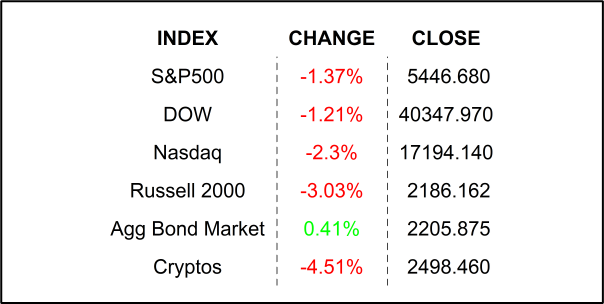

YESTERDAY’S MARKETS

NEXT UP

- Chang in Nonfarm Payrolls (July) is expected to come in at 175k, lower than June’s +206k new hires.

- Unemployment Rate (July) may remain unchanged at 4.1%.

- Fed speakers today: Goolsbee and Barkin.

- Next week: More earnings and services PMIs. Check back in on Monday to download your weekly economic and earnings calendars.

.png)