Stocks were punished after a far-weaker-than-expected employment figure raised fears of recession. Just a few days after the Fed chose to press-pause on rates cuts, one important part of its dual mandate unraveled.

A series of unfortunate events. We didn’t just wake up and find ourselves in this situation. It’s true that the occasional black swan lands in our walled garden, but this time, it simply was not the case. I can remember a Bugs Bunny episode where the silly rabbit is wooed into a hot cauldron by his would-be chef. The rabbit is led to believe that the pot is a bathtub, and as the rabbit sings and frolics, the chef stokes the flames, turning up the heat, and then begins to chop carrots and mirepoix into the tub… er, soup. Or was it stew? Whatever it was, the rabbit was all-the-wiser and managed to get out before things got too hot.

Just last Wednesday, the Fed voted to maintain its current, restrictive monetary policy. Policy makers did declare that job growth had “moderated,” and pledged to focus on both parts of its dual mandate which includes keeping inflation in check and maintaining full employment. This newfound focus on the labor market is a signal that central bank policy makers are concerned that a weakening of the labor market could portend the possibility of an economic contraction.

In his post-release comments, Fed Chair Jerome Powell underscored the FOMC’s focus on the softening of the labor market and hinted strongly toward a rate cut at the Fed’s September meeting. The Chair relayed that the body decided to take the conservative route so as to mitigate the risk of an inflation resurgence and was willing to risk further declines in the labor market.

The markets initial response to the Chair’s comments was positive, allowing recently oversold sectors to regain lost ground. However, on the following day, a closely followed gauge of US manufacturing posted a larger-than-expected decline increasing traders’ concern that the Fed may be too late to avoid a so-called “hard landing.” Compounding that fear was a weekly Initial Jobless Claims number that came in above expectations. Finally, while earnings in the past few weeks have come in largely as expected, there have been signs that earnings growth in the next few quarters may be muted compared to the growth experienced over the past few. Those fears fomented a selloff in stocks with a flight to quality starting on Thursday.

After the close, some high-profile earnings only supported the “slowdown” case and the admission by Intel that it would cut 15,000 jobs further supported the weaker labor market narrative. In the wake of the Chairman’s and the FOMC’s messaging, weaker economic numbers, and lackluster earnings announcements, all eyes were on Friday morning’s monthly employment situation from the Bureau of Labor Statistics. Unemployment had risen markedly over the past 12 months and Friday morning’s release was expected to remain at 4.1% but came in at 4.3%. This monthly increase is significant in that many economists fear that it would trigger the Sahm Rule, which is a signal that has historically predated a recession. While the Sahm Rule has been historically accurate, it does not in and of itself cause a recession, but rather, adds to a growing list of warning signs. I actually wrote about the Sahm rule on that very morning warning that a hot print could trigger it, and my basic accounting of the numbers would put very little doubt on the fact that the rule has been triggered.

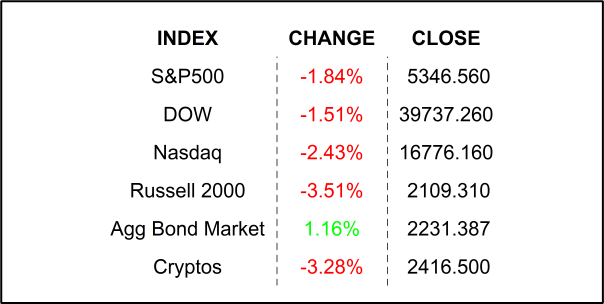

Stock markets responded with a sharp and broad selloff. Cyclical sectors were initially harder hit and ultimately, high-growth, tech shares were affected as well. At the close, the tech-heavy Nasdaq 100 Index has fallen into what is considered a correction, down more than -10% from its recent high. Treasury yields have declined as traders have driven prices higher in a flight to quality. Shorter maturity treasuries, which are more closely tied to Fed policy have also given up yield, reflecting traders’ views that interest rates may come down sooner and greater than expected prior. At the close, Overnight Interest Rate Swaps as well as Fed Funds futures were factoring in a full percentage point of rate cuts by yearend in response to the prior 2-days’ events; earlier in the week, the markets were pricing in just half of that.

For most of the week, all eyes were on the Fed and earnings. A slightly stronger-worded policy statement followed by comforting words from the Chair left traders on the fence. Was it a good or bad Fed day for stocks? Well, if traders were looking for a tiebreaker, a less-than-stellar earnings season for hotly oversold tech certainly didn’t help the bulls. Friday’s market action was painful, but not surprising, given the circumstances, AND the fact that it was a summertime Friday which could easily find senior traders enroute to the Hamptons, leaving things in the hands of retail traders.

THEN came the weekend. Berkshire Hathaway, which is, surprisingly, an indicator in and of itself, announced that it had been selling equities. Specifically, it announced that it cut its famously huge position in Apple by some -50%. To be clear, it had done so far in advance of Friday’s numbers. That admission was sure to be taken in by traders who spent most of the rainy Hamptons weekend trying to digest last week’s events. Oh, and maybe they missed the fact that Japan RAISED its key lending rate last week, which was sure to impact Asian stock markets. Those same Asian markets started trading just as your Sunday scaries were kicking in last night in the US. With all signals red, well… not surprisingly sellers lined up to… um, sell, sending futures sharply lower.

By this morning Nasdaq 100 futures were quite a bit lower. By 07:30 Wall Street time, they were down by around -4.5%, off its lows from the middle of the night. The VIX Volatility Index, also known as the fear gauge, spiked above 50! If you do some fancy math, you will find a 50 on the VIX means that investors anticipate +/- 3.1% daily swings in the S&P500. In case you are wondering, the VIX closed at 23.39 on Friday, its first close over 20 since October of last year.

What this all means is that this series of events will lead to a challenging open this morning. It is the start of a week with a very limited economic number release schedule, leaving traders to… well, speculate on what might happen next. Now, all eyes are back on the Fed. Many are wondering if the Fed, ONCE AGAIN, missed its mark. It was too slow to start raising rates in the face of already rising inflation. Was it too slow to lower them in the face of what now looks like a stumbling economy? Looking at Fed Funds Futures this morning, the market is now looking for a -50 basis-point rate cut by its September meeting, when the markets were expecting only a -25 basis-point cut at Friday’s close. It is important to note that the Fed does not have to wait until its September meeting to take action. Additionally, Fed speakers will surely line up in coming days and weeks knowing that traders will be watching closely. An emergency rate cut may appear to be welcomed on the surface; however, it would more likely give the appearance of panic and cause markets more angst. Therefore, if Fed members are feeling remorseful about last week’s decision, their only recourse may be to simply… talk nicely.

Today’s session will be a tough one. The easiest route through is to stay vigilant and remind yourself of your long-term focus. While a bigger than expected rise in unemployment is not good by any means, it also does not guarantee that the US will head into a recession.

FRIDAY’S MARKETS

NEXT UP

- S&P Global US Services PMI (July) is expected to come in at 56.0 in line with earlier flash estimates.

- ISM Services Index (July) may have climbed to 51.0 from 48.8.

- Fed speakers today: Goolsbee and Daly.

- Later this week we still have lots of earnings along with weekly Initial Jobless Claims, and you know traders will be looking at that one closely. Download the attached economic and earnings calendars for times and details.

.png)