Stocks sold off yesterday after Friday’s selloff bled into the weekend and worried Asian markets, leading to a messy, dog days Monday. Warren Buffet decided to sell Apple and the world got nervous without even knowing when or why he even sold it.

What do you know? I wish I could get a statistic from Google for how many searches for “another sensational term for ‘traded down’” were conducted by reporters yesterday. Ok, let’s get something straight. Stocks certainly traded lower yesterday, and it wasn’t pretty. I am not even going to give you examples of some of the eye-catching headlines that flew over my transom yesterday and overnight. I even saw some headline this morning that read something like, “this super-bear analyst has been predicting this decline for 2 years, this is what he is worried about next!” Really, my brothers and sisters of the press? Let me ask you something, my friends. If there is some random guy that has been saying that the market is going to pull back for the past 24 months and it finally did yesterday, do you really want to know what he thinks about anything else… especially the market? Of course not. Why? Because you are rational, YOU READ MY NOTE REGULARLY, and you know that markets can’t only just go up. So, predicting that the market will pull back at some point is like predicting that there will be lots of traffic during Wednesday’s commute.

Yesterday’s selloff looked really bad on the surface, but it was not as bad as it could have been. Was there some panic selling? Yes. Was there a spike in volatility? Yep. Were some folks forced to sell to satisfy margin calls? Indeed. Does a loss in the Dow Jones Industrial average over 1,000 points seem scary? Actually, it only makes for a good attention-grabbing headline; it was only a -2.6% decline. Since hitting a low point last October, the Dow climbed some +26% in less than a year through the end of July. Isn’t 2.6% a reasonable price to pay for that kind of growth?

What about NVIDIA? Did you hear that it fell by -25.5% in the past month or so? That sounds horrific, doesn’t it. What if I reminded you that the stock returned +235% from last October through mid-July? What do you think now? I know that if you bought at $120, and the stock is now trading $100 you are very upset. But why did you buy the stock? Because you believe that the company has great prospects, given its clear first-mover advantage in the AI software and semiconductor space. You also know that the stock can gift investors some great returns. Do you still believe that NVIDIA has great prospects and that it will continue to dominate the growth of AI? If you do, that’s great, but what about those huge declines the stock has recently been experiencing? Well, my friends that is simply the cost OF THE HUGE GAINS YOU HAVE GOTTEN AND WILL GET IN THE FUTURE.

If you have heard me say it once, you have heard me say it hundreds, perhaps thousands of times. Volatility works in both directions; it is your friend on up-days and your foe on down-days. You have to think of volatility as a cost. If you want to get big returns you must accept big volatility. Indeed, you can’t get one without the other. There it is, now you remember, it’s the old risk/reward scenario. You may not like risk, or more importantly, you may not be able to afford high risk because you need near-term access to your funds. That is OK, but you must choose investments with lower risk, or volatility. But there is a catch. You cannot expect headline-worthy returns with lower risk investments. Ok, I can’t take it anymore. I am simply going to have to show you a chart to demonstrate. Look at it carefully, then follow me to the finish.

There you go. This is a plot straight out of my R Programming Language IDE. In other words, I didn’t just make this up. It is a plot of the historical volatility and return of three stocks: Proctor & Gamble, Microsoft, and NVIDIA. On the x-axis (bottom/horizontal) we have volatility; the farther right, the more volatility. On the y-axis (left/vertical), we have return; the higher up, the more return. So, if we observe the three stocks on volatility, we see that P&G is the least volatile, followed by Microsoft, then NVIDIA. Here comes the punchline. If we look at the returns, we see that P&G has the least historical return, followed by Microsoft, and then NVIDIA. Returns are commensurate with risk! Wouldn’t it be great if we could have an investment that comes with P&G volatility, but comes with Microsoft-like returns? It would, but YOU KNOW, that does not exist.

Where do your portfolio stocks fit into this chart? If you don’t know, you should have, at least, a loose idea of where they would be plotted. If you cannot afford to take those types of risk, YOU MUST be satisfied with lower potential returns. If you are good with all that and you are still concerned about how your stocks have been behaving over the past few weeks, re-check your investment thesis on each stock you own. Has anything changed? Has there been any news or company admissions that violate your thesis. If not, then please just recognize that this volatility you are experiencing is simply the price of the great returns you are expecting to make in the future. Be diligent, stay frosty, but most importantly, be patient, because you know that volatility is the price of great returns… and that volatility works in both directions.

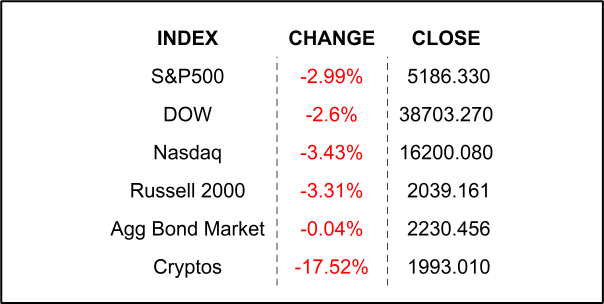

YESTERDAY’S MARKETS

NEXT UP

- No economic releases today.

- This morning: Duke Energy, Planet Fitness, Kenvue Financial, Uber, Zoetis, Baxter International, and Surgery Partners all beat on EPS and Revenues while Caterpillar, Tempur Sealy, Hyatt Hotels, Jacobs Solutions, Constellation Brands, and Vulcan Materials all missed.

- After the closing bell earnings: Devon Energy, Illumina, Lumen, Fortinet, Rivian, Flywire, Sunrun, Reddit, Coupang, Airbnb, Wynn Resorts, Amgen, and Super Micro.

.png)