Stocks traded higher yesterday as cooler heads prevailed and investors went shopping for sales. Monday’s doom and gloom cooled as investors did their homework.

Yenning for carry. Have you been paying attention to the financial news lately? Sure, you have, AND YOU ARE READING THIS REPORT RIGHT NOW to boot, so I would say that you are pretty well-informed. There has been so much chaos to address in the past few days that I haven’t had a chance to address this one key topic yet, so finally, today is the day.

On the other side of the world from New York’s icon Stock Exchange sits the Bank Of Japan. Known as the BOJ in most circles, it is Japan’s equivalent to the Federal Reserve, responsible for many things, least of which is the country’s key lending rate, similar to the US’s Fed Funds Rate. You may have noticed that Japan has had negative policy rates since 2016. In fact, it has been a rocky road for the lending rate since BOJ adopted what is now commonly known as ZIRP, or Zero Interest Rate Policy. But for a quick spike to 0.5% in 2007/2008, the rate has been near zero or below since BOK implemented ZIRP. BOJ has kept rates low to stimulate the nations sluggish economy. Because lending rates are so low in Japan and interest rates abroad have been high, an investment opportunity of sorts had emerged. That investment is known as a carry trade.

A carry trade is when an investor borrows money cheaply in a low interest rate country and uses it to invest in instruments with higher interest rates in another country. An example would be as follows. Borrow Yen in Japan at an interest rate of 0.1%, convert to US Dollars, and invest in US T-bills with a yield of 5%. That would net you 4.9% return without lifting a finger… other than the mouse clicks required to put the trade on. Seems easy, but the devil is in the details and there are many risks, least of which are currency risk and market risk.

Let’s start with currency risk. If one borrows money in Japan, proceeds must be converted into another foreign currency to invest in the target country investments. Because interest rates were so low in Japan, it was common for investors to borrow and convert to currencies in higher yielding country currencies such as the Indian Rupee, the Euro, and the US Dollar. In order to pay back the loan and unwind the trade, the investor must convert back to Yen. If the Yen appreciates in value, or the target currency declines in value, the investors profit is diminished. That is known as currency risk, and it affects not only carry traders but also companies doing business in foreign markets wishing to repatriate profits.

Now, on to market risk. In case you haven’t noticed, policy interest rates can change, as we have witnessed in the past few years in the US. Earlier this year, the BOJ raised its key lending rate to just above 0%, and on July 31st BOJ raised its key lending rate once again to 0.25%, which is the highest it has been since 2008. Now even though that increase only represents a +0.15% increase, it was enough to cause traders to panic and begin unwinding the massive amounts of carry trades that were open. This caused the Yen itself to spike in value as unwinding requires conversion back to Yen, which further ate into profits, causing further panic selling. So, an increase in market risk caused a spike in currency risk. Check out the chart that follows to see how the Yen spiked against the US Dollar in the past week.

Many folks have attributed Monday’s steep losses to an unwinding of this popular Yen carry trade. But what does that have to do with NVIDIA, Proctor & Gamble, Walmart, or any US Stock for that matter? A traditional carry trade is conducted using fixed income instruments. That is correct, but here is how it indirectly affected US markets. As trading began on Monday in Japan, it was still Sunday in the US. Friday’s selloff in the US spilled over to the Japanese stock market on Sunday causing selling. The unwinding of the currency trade intensified causing liquidity issues and Japanese investors in all global markets looking to sell investments and convert back to Yen found their losses growing as the Yen spiked. This led to further carry trade unwinding pressure. By the time Japan’s stock market closed finding the Nikkei Index down by some -12% the damage had been done! All of that selling spilled over into US index futures causing significant losses and the VIX index to spike prior to the opening bell in the US.

In the end, the US experienced a broad market selloff on Monday. Sure, the usual suspects, mag-7, were hit hard, but most stocks suffered painful losses as panic selling ensued. So, was it really the big carry trade unwind? Well, not directly, but it certainly had a hand in the disarray that led to Monday’s market action… er, re-action. Remember, nothing is without risk in the markets. You can only count on one thing, that markets will inevitably do what is inconvenient for you at the moment. Continue to stay focused and diligent. Volatility is lower, but it is still very much with us… and you know, YOU KNOW, that it works in both directions 😉.

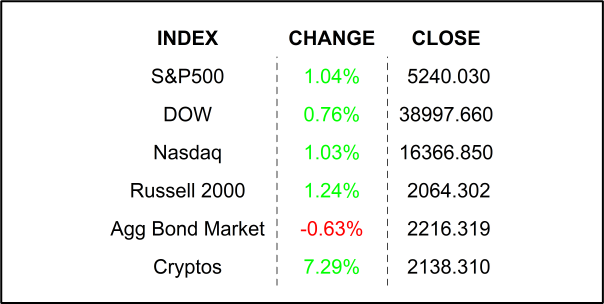

YESTERDAY’S MARKETS

NEXT UP

- Boston Fed President Susan Collins will speak today.

- This morning’s earnings: Lyft, Hilton Worldwide, Disney, Rockwell Automation, Charles River, and Ralph Lauren all beat on EPS and Revenues while CVS Health, Emerson Electric, and Warner Music Group came up short.

- After the closing bell earnings: Robinhood, Occidental Petroleum, AppLovin, McKesson, Energy Transfer LP, Equinix, Bumble, Zillow, Warner Bros Discovery, Hub Spot, Dutch Bros, Guardant Health, and Monster Beverage Corp.

.png)