Stocks clawed back some gains yesterday closing solidly in the green as traders rejoiced that weekly jobless claims weren’t “too” bad. Investors have lots to think about but little in the way of real tangible election-related information to determine the future path of their portfolios.

Highly rated. Sure, we have been pondering bonds and rates, but all eyes have been on the stormy stock market lately. To be clear, the storm is far from gone with the VIX Index still hanging around 23, however 23 is certainly better than 60 (Monday morning), or 28 (Wednesday). Still, 12 would be better; that was Independence Day, if you can even remember that far back.

Ok, that discussion is out of the way, so let’s cross over into rates land for a moment. The markets, according to Fed Funds Futures, are expecting a single -25 basis point rate cut in September with a 60% chance of an additional -25 cut. For the record, a 60% chance is pretty high for Wall Street, so it is safe to say that a -50 basis-point cut in September is not out of the question. Futures are now placing a 100% chance that Fed Funds will end the year a full percentage point lower than today’s effective rate. Can I take a moment to remind everyone that, though nobody you or I know borrows money at the Fed Funds Rate (it is an interbank rate), it sets the tone for the entire rates market. When Fed Funds is on the move, most other rate-related securities are on the move as well, though the intensities vary based on collateral and maturity.

That said, the front end of the yield curve (shorter maturities) is likely to go down over the next 4 months as yields adjust to policy. If nothing else happens, the yield curve will steepen. At the moment the 2-year/10-year yield curve is slightly inverted. It has been pretty much pegged there for some time and is typically a harbinger for a recession. The inversion, therefore, may be erased, and the curve returned to normal… assuming nothing crazy happens. “Wait, what,” you exclaim, “did he just say crazy, Martha?” Indeed, I did. Here are 2 potential crazy things. 1) A recession. No, we are not in a recession, however you may have noticed that more and more folks are talking about it lately. The median of blue-chip economists gives a 30% probability of a recession occurring within the next year. It hasn’t been this low since early 2022 and it has been at 30% since April of this year. Let me just say, that is just a number and that economists are notoriously bad at forecasting.

The market on the other hand weighed in on that last Friday and this past Monday. Last week’s larger-than-expected Unemployment Rate scared the market into believing that the Fed was too late on pulling back on its monetary tightening and that the decaying labor market was a sign of an economic contraction… aka a recession. That was the initial cause of the selloff… IN STOCKS. Bonds, on the other hand rallied. When traders expect tough times, they flee to safe, US Treasuries pushing yields lower. This would serve to flatten the yield curve and is typically why a flatter or inverted yield curve is a telltale sign that a recession may be in the offing. Once bond traders start pushing longer-maturity yields lower expecting tough times, only the Fed can steepen the yield curve by cutting rates. That is crazy thing 1.

Now onto crazy thing 2. In the weeks leading up to this recent pullback, the yield curve was flattening, but for another reason altogether. The Presidential elections. Trump was first out of the gate promising corporate tax cuts and tariffs. The former causes the deficit and debt to increase, and the latter causes inflation. Both of those serve to drive longer maturity yields higher. Assuming the Fed continued to move at its glacial pace in rate-cutting, the yield curve would steepen. And it did.

Finally, let’s get to the 10-year Treasury yield itself. At the end of 2021, just as Fed Chairman Jerome Powell first hinted toward rate hikes, 10-year yields were around 1.5%. That would change in 2022 as the Fed began to raise interest rates and inflation spiked as high as +9.1% in June of that year. The 10-year rounded out 2022 with a yield of around 3.8%. In 2023, though inflation began to ebb, expectations of inflation did not. The Fed continued to raise rates through July of ’23, and it continued its quantitative tightening (selling bonds, causing yields to climb). By the end of 2023, 10-year yields had fallen below 4% after spiking to just under 5% in October. Strong economic numbers earlier this year caused yields to climb above 4% once again, proving that the markets were not convinced that inflation was licked. Remember: stronger economy means inflation, and inflation causes longer maturity yields to climb.

Lastly, let’s have a look at yields and rates’ impact on consumers. Mortgage rates are closely tied to 10-year treasury yields. You may recall that 30-year fixed rate mortgages were at historical lows in 2021, bouncing around 3%. As 10-year yields climbed in the two years that followed, so did mortgage rates. They peaked over 8% last fall. While it certainly squelched activity in the housing market, it did not have the intended effect, as low supply caused house prices to continue to climb. With wishy-washy Fed policy and stronger economic numbers, mortgage rates actually climbed this year, peaking in April. They have since receded, and last week’s activity brought them back to around 7%. Where they go next will have everything to do with 10-year yields. And now you know what 2 crazy things can affect those. So, if you are waiting to refinance your existing mortgage or may be thinking of buying a new home with a loan, then, maybe, you should pay close attention to 1) the state of the economy, and 2) proposed policies from the presidential candidates.

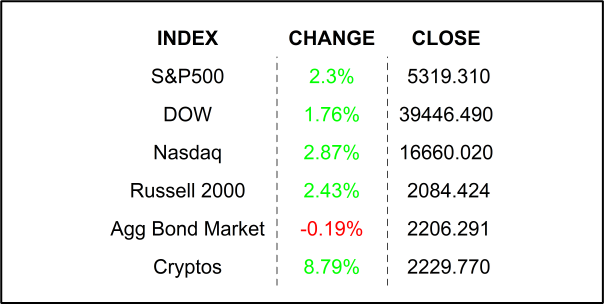

YESTERDAY’S MARKETS

NEXT UP

- No numbers today, but next week will have more earnings along with Producer Price Index / PPI, Consumer Price Index / CPI, Retail Sales, Industrial Production, housing numbers, and University of Michigan Sentiment. Check back in on Monday to download calendars and details.

- Don’t forget to follow us on Instagram (https://www.instagram.com/siebertfinancial), where you can watch my videos and get all the latest on what is happening at Siebert.

.png)