Stocks had a mixed close in a bumpy session controlled by institutional traders and their computers. It was a dog-days-of-summer session as everyone awaited today’s and tomorrow’s inflation figures.

Take a moment and think. I am going to veer away from the inflation discussion today, because there will be lots to unpack later this week, once we get the numbers. It’s still an issue, and important, but there is something else needling at the markets. I have a TV in my office which stays on always. Don’t hate me tree huggers, I use it for work. I am a conscious recycler and a compulsive light-switcher-offer. Let me let you in on another little secret. That ever-glowing TV in my office is almost always on mute. Why? Because most of the information you will hear from so-called “experts” will confuse you and lead you astray. You don’t believe me? Pick your favorite financial news station and listen for a whole session. Create a tally chart for how many guests project the markets will go in one direction and how many the complete opposite. You will probably find that there is a 50 / 50 split. In other words, you have gained no important information.

Further, and especially of late, you will find many guests robotically pointing to the outrageous valuations in tech and AI. If pressed further, many will simply throw in the “declining earnings growth” thesis. They throw it lightly, but it has a heavy effect on the market. You see, tech and AI-involved companies are all considered growth stocks. It used to be that a good growth stock opportunity was one that had great growth prospects for the future with actual, current earnings taking a second seat in importance. While that is still the case for smaller, emergent companies, there is a new class of stock that has become of paramount importance and particular interest, and that is mega-cap growth. Think magnificent 7 stocks. These are companies which have earnings that have grown fast and are expected to continue growing… um, fast. As such, the market’s fascination with them has led their share prices higher and higher… and higher yet. But for how long can we expect those earnings to continue to grow so fast? Well, isn’t that the $2 trillion question?

Let me start with a disclaimer. I am not recommending NVIDIA, but it seems to be the poster child of mega-cap growth and AI, which means all those TV experts are talking about it. And you are wondering about it… go on, admit it. Have you heard that NVIDIA’s stock rose by +220% for the 12 months prior to its recent decline of -20%? Ask most “experts” and they will quickly retort that the company’s earnings growth is declining. Does that scare you and make you want to sell the stock? It may, and it probably did send some investors running for the hills in last week’s summer squall. Wait, I know, why don’t we have a look for ourselves. In 2019 (the company closes books in January of the following year), the company had revenues of $10.9 billion, respectable. In the following year, the company sold $16.7 billion, a +53% increase. Wow, that seems like an interesting opportunity. 2021 revenues jumped to $26.9 billion for a yearly increase of some +62%. Interested yet? Calm down, revenue growth was flat in 2022, but guess what happened in 2023? If you guessed AI, you get a prize! That propelled 2023 revenues to $60.9 billion! That is a +126% growth! Holy SH…ut the door, right? Now, that explains why the stock had such fantastic gains through July. Analysts are expecting revenues to be $120.5 this year. If realized, that would be a +98% annual increase. Pretty good, but of course not as good as the prior year’s +126% growth. Should we be worried? Next year, analysts are expecting the company to hit revenues of $167.4 billion, which would be a +39% increase. ONLY a +39% increase! What? Were you bamboozled? What kind of stinky growth is that for a mega-cap growth stock. Does that scare you? Is NVIDIA no longer a good stock to own?

Enter the “base effect.” The base effect is when changes in growth rates appear more or less significant due to the comparison with an unusually high or low level in a previous period. Go ahead, read that again. If I only told you that NVIDIA’s revenues are expected to increase by +39% next year when it is expected to end this year with a +98% increase, you might be disappointed. But what if I told you that 2025’s expected revenues were +175% higher than 2023’s already high revenues? I won’t even do the calculations for pre-AI years… the growth is big. The company is expected to earn $167 billion next year, and the orders keep coming in. Is that a company that looks like it has good prospects for growth in the future? Of course, you would love to see the revenues grow by another +98% to $238 billion, but that would be very unrealistic. Remember, calculating the year over year growth is basic math. Anyone can do the calculation, but not anyone can understand what is means to grow revenues from $16 billion to $167 billion in 5 years. I hope you can. Please keep those TVs on mute… unless, of course, you see me 😉.

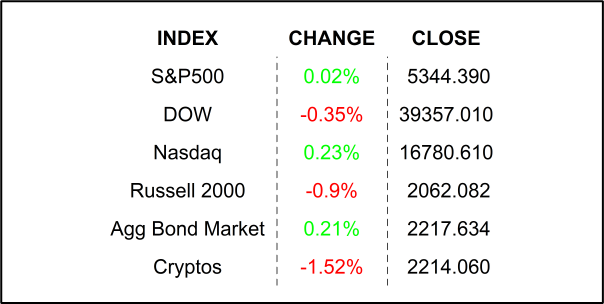

YESTERDAY’S MARKETS

NEXT UP

- Producer Price Index / PPI (July) is expected to come in at +23% after printing +2.6% in July. Pay Attention, this is considered a leading indicator of Consumer Price Index / PPI aka inflation.

- Atlanta Fed President Raphael Bostic will speak today.

- This morning, Home Depot missed earnings forecasts and lowered its full-year EPS guidance. Shares are down by -1.7% in the premarket.

.png)