Stocks climbed for another session after a few positive economic releases eased fears of a hard landing. Consumers are becoming more price sensitive but that doesn’t mean they are spending less, according to yesterday’s retail data blitz.

Retail therapy. Yesterday’s stronger-than-expected Retail Sales figure was another cooling salve on the rapidly healing equity markets. Therapy, much appreciated, indeed. Here we go… again. Sorry to be so consistent my precious, regular readers. IT’S ALL ABOUT CONSUMPTION! In my Monday’s appearance on Bloomberg TV, I talked about the importance of healthy consumption in determining what type of landing the economy will have (you can watch me here: https://youtu.be/8d6dQfZ0R-M?si=kaNxdxnoUxBh7Ej9). Early indicators of consumption (as in the 2/3 of GDP) are consumer confidence and folks’ willingness to spend money.

We will get a look at consumer confidence this morning when we get the University of Michigan Sentiment indicator. It is comprehensive and very timely. Later this month, we will get the closely-followed Conference Board Consumer Confidence number. On the latter, that is an index with a base year of 1985. I discussed this in a prior note earlier this week. That is the year that the index is set to 100. Wanna’ have a giggle? The index in July was 100.3, indicating that consumers are more or less at the same confidence level as 1985. For the record, I was MUCH MORE CONFIDENT IN 1985! I just graduated high school and was headed off to university. Unknown to me was… um, pretty much everything, so I was sure that the world was my oyster. Well, I have learned a few things since 😉. Back to the index, it was in the high 120’s prior to the pandemic. After falling in 2020, FOR OBVIOUS REASONS, it roared back in the summer of ’21 for less obvious reasons, only to trend downward and sideways since. The University of Michigan Sentiment index, due out this morning, had its base year in 1966. Economists are expecting it to come in at 66.9. If you have been paying attention, you would conclude that we are only 66% as confident as we were in 1966! I suppose that I was confident then, as I was in vitro with not a care in the world. The US entered the Vietnam war 2 years earlier. Sentiment held up briefly, but by the late 1960s had waned considerably. In December of 1969, the US entered a recession which was attributed to extremely tight Fed monetary policy 😉, increased taxes, and war spending. Sentiment dipped, as would be expected, bottoming out at 72.4. We will leave it at that.

Right now, monetary conditions are tighter than they have been since 2001, there are at least 2 wars raging, both of which are being subsidized by the US, taxes… well, they are heck of a lot lower than they were in the 1970s. Consumers are not super confident, as we just learned. So, with interest rates so high, one would think that consumer spending would be somewhat squelched. Oh, I forgot to mention that the unemployment rate is on the rise, another confidence killer. Enter Retail Sales, tallied up by the Census Bureau. Yesterday’s release marked a +1% gain, which is not only the biggest monthly increase since January of 2023, but it beat estimates. The good news is that the number itself does not give a sign of an overheated economy, but rather that consumers remain resilient. So, maybe the economy will not turn out as bad as traders thought last Monday when they sold, sold, sold. What did consumers buy more of last month? Autos and big-ticket electronics. That, despite high interest rates, and those high-ticket items are known to be more interest rate sensitive. Also, yesterday, we heard from super-retailer Walmart, which relayed to us that they are confident in the consumer. So much so that the company raised its full-year net sales guidance. While the company witnessed its first increase in general merchandise in 12 quarters, the company is witnessing faster growth in what it referred to as “essential” items. You know, gotta’ haves versus wanna’ haves. This continued shift shows that consumers, while still spending, may sense some clouds brewing on the horizon. Let’s keep watching the consumer carefully; they are the ultimate telltale.

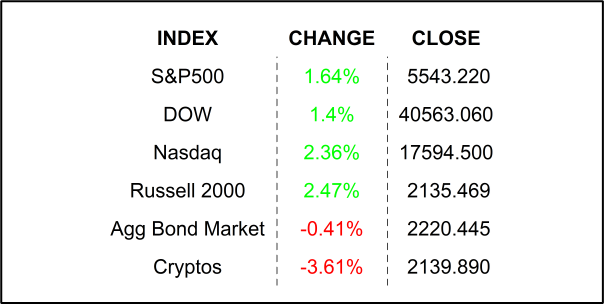

YESTERDAY’S MARKETS

NEXT UP

- Housing Starts (July) are expected to have slipped by -1.5% after climbing by +3.0%.

- Building Permits (July) may have declined by -2.0% after rising by +3.9% in June. You need permits to build, so this is like a leading indicator to Housing Starts.

- University of Michigan Sentiment (August) probably rose to 66.9 from 66.4.

- Next week: we will get Leading Economic Index, flash PMIs, more housing numbers, and FOMC Meeting Minutes from last month. All of these are market movers, so don’t miss them. Check back on Monday to download economic and earnings calendars.

.png)