Stocks closed out an eighth straight session deep in the green as investors raised their bets on a soft landing. Pressure mounts on Chair Powell as even the slightest hint of hawkishness in his Friday’s speech can have painful reverberations – that’s pain with a capital P.

Good guys are bad guys? Why does the US have the largest economy in the world? Well, answering that question exhaustively is more likely the stuff of a doctoral thesis versus a morning market note. This morning, I simply want to skim the surface. What is it that keeps the US economy growing and growing… and growing despite fixed resources? How is it that the US enjoys a 4.3% unemployment rate, and we consider it to be bad? I suspect that US corporations and their workers have a lot to do with it. Let’s be really clear here, it is not easy to be successful in the US, though it may look like it from afar. Competition is INTENSE! For every successful company there are truckloads that have failed. Oh, and one more thing, once a company is successful, it is not guaranteed to remain successful. I think that it’s clear that the ones that have, indeed made it, are very admirable. Without those successful companies, who would employ the workforce? Without work and wages, how would consumers be able to… um, consume? Without those companies, who would invest in innovation? Innovation that could heal the sick and make an average person more productive than ever before?

I know it seems like I am asking lots of questions, but in contemplating them, I am sure that you have recognized that successful businesses are paramount for a successful economy. If you are reading this market note, you are likely to own an investment portfolio. The success of that investment portfolio is very closely tied to the success of the corporations behind those stocks and bonds. Wouldn’t you agree? I hope so. Let’s get basic for a second, and then I will stop beating around the bush and get to the point. Let’s say you are coaching your kid’s soccer team, and you are having a really good season. You have 3 very strong players who have significantly contributed to the success and happiness of all the kids… and parents. Would you intentionally bench all three of those strong players?

Yesterday was a busy day for me and it culminated in a live, on-air interview on Yahoo! Finance. I had to hustle to get over to the studios and the interview took place just as the market was closing. I tried really hard to keep up with what was going on in the midst of all the pre-show preparations, but finally I took my seat on the set, and while we were waiting to get cued in, Julie Hyman, one of the hosts leaned over to me and said, “did you see what Kamala Harris said about corporate taxes?” I was instantly nervous as I had not yet seen the news. And then we got the “3…2…1…”

First, let’s start with the disclaimer. You know the rules, policy not politics. Here is what Julie was referring to. A campaign spokesperson told the press that Ms. Harris was proposing to RAISE the corporate tax rate to 28% from 21%. That spokesperson further said something to the effect that it is a “fiscally responsible way to put money back in the pockets of working people.” I am not quite sure I understand the statement, as employing those working people and paying them wages seems like a very direct method, and highly motivating to boot.

I have been talking a lot about fiscal responsibility lately. It is clear that there are costs for every concession and both parties have their own view of what those concessions and costs should look like. But there is one thing which I think that both parties should agree upon, and that is healthy corporations are the key to a healthy economy, and doing anything to squelch their success, rendering them less competitive, would only serve to weaken the economy causing grief for all income classes and political parties.

I have been critical of both parties’ proposed policies only with respect to how they would impact the economy, the markets, and ultimately, your portfolio. One of the key policy proposals from Trump is to lower corporate taxes. Understanding that there is a cost to lowering taxes and the Republicans have not been very clear on how they would make up for the deficit in a tangible way. However, I can tell you this, if you scour the Treasury Department’s websites you are likely to find that corporate income tax only makes up between 7 and 10 percent of the government’s revenue. Therefore, cutting the corporate tax rate will have significantly less impact on the deficit than say, cutting the personal income tax rate. So, if you are going to give a concession, cutting the corporate tax rate seems like a lower cost way to help US corporations remain competitive and successful. Now the Democrats are proposing to raise those taxes. That may not have a large impact on the government’s income, but it will certainly have a large impact on the success of the companies… successful companies, that power the most successful economy in the world. And it won’t help your portfolio either. In case you were wondering, you can check out the video from my interview here: A strategist’s view on earnings season, Fed, Harris policies (yahoo.com) .

A quick data byte: The largest 10 companies on the S&P500 Apple, Microsoft, NVIDIA, Amazon, Meta, Alphabet, Bershire Hathaway, Eli Lilly, Broadcom, and JPMorgan Chase jointly employ some 2.73 million workers. Trust me, I did the math.

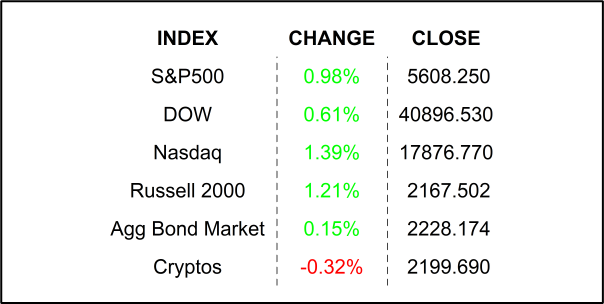

YESTERDAY’S MARKETS

NEXT UP

- No major economic releases today, but don’t worry, things will pick up in a big way tomorrow.

- This morning Lowe’s Cos Inc missed revenue forecasts and lowered full year guidance. After the closing bell, we will hear from homebuilder Toll Brothers.

.png)