Stocks rose yesterday as investors called a September rate cut a done deal. The Bureau of Labor Statistics overestimated jobs growth by… a lot in the year ending in March.

Oops, I did it again. Repeat after me, “I pledge allegiance to the labor market!” That is how the Fed starts every meeting (not really, this is just for display). Why? Well, for one, when people are out of work and struggling to feed their families, they tend to want to behead their elected officials. Ok, do you want the less bloody answer? When people don’t have jobs, they don’t have money to spend. When people spend less money, the economy does not grow. We like to have the economy growing. That is probably why keeping full employment is ½ of the Fed’s dual mandate, the other half being keeping inflation in check.

As you have probably figured out by now, they are both connected. When unemployment is high and there are less dollars being spent, the reduced demand keeps inflation low. I don’t want to get too technical, but there are other factors that drive inflation beyond consumer demand, but elevated consumption is a big, if not the biggest, factor. All this means that the Fed has a very tough job in balancing the delicate relationship between inflation and the labor market. You may remember when it became clear that inflation peaked in the summer of 2022, Fed officials began complaining that the labor market was too strong. Those complaints became louder and louder until it became clear, more recently, that the labor market would be the final hurdle to overcome before the Fed could officially pivot.

In his July 31st press conference following the Fed’s last FOMC meeting, Powell struck a fairly dovish stance, though still not committing to rate cuts. Indeed, the FOMC’s policy statement gave little, if no, hint of a policy shift. Powell’s soft talk was appreciated by the markets which began upping bets that a cut would be in the offing soon. Stocks slipped on fears that the economy was in danger of recession and that the Fed missed its mark… AGAIN. On that Friday we received the Bureau of Labor Statistics monthly jobs report which showed a larger than expected Unemployment Rate, stoking further, fears of recession. Many wondered if Powell and company had received a special, double-top-secret, early look at the labor report prompting the Chair’s dovish demeanor. No, they didn’t, but they were aware of the trend that preceded it.

You see, sometimes, we get caught up in the numbers of the day. That is just how market psychology works – I didn’t invent it; I just report it. You see how I prompt you in the NEXT UP section below 👇. I tell you what the consensus estimates for upcoming economic releases are. As you might guess, a miss in either direction can move the markets. That is how most outlets report those releases. I try to take it a step further by reporting the last period’s release as well. This gives you an idea of which way things are going. But that is just one period, in most cases one month. However, astute students of these numbers would take it a step further and observe a longer-term trend. This month’s BLS release reported the Change in Nonfarm Payrolls at 114k, though economists were expecting 175k. That’s a miss… a bad for the economy miss. If we look at the prior month, we see that 179k jobs were added. All we know from the observation, is that the trend is… down. We could leave it at that, and we would have a valuable piece of information. But what if we look back further? Let’s do. Have a look then, follow me to the punchline, and finish.

This is a chart of Nonfarm Payrolls going back to 2022. The black line is the reported number and the green line is just a simple moving average to help us see the trend. If you can’t see the trend, I have taken the liberty of sloppily penciling in the orange trendline. Can you see it now? This shows us that less and less jobs are being created every month. That can be safely translated as the labor market weakening. The FOMC members know this because it is their job… at least half of it. This chart alone should be top of mind for the central bankers, and it is. What if I told you, it is wrong? Wait, what? Yep, the Bureau of Labor Statistics just revised its number for the year ending March 31st, and we learned that it overestimated it by 818,000 jobs! In other words, the labor market was not as strong as we might have thought based on the monthly numbers leading up to… er, last March. You see where this is going? Now, let’s be clear, this revision is the year that ended 6 months ago. You may be thinking “who cares, that is ancient history.” You are kind of right but consider this. Based on more recent, as yet unrevised, numbers that the labor market is weakening. This latest revelation simply serves to inform us that, overall, the labor market is weaker yet. Do you think this will be factored into the Fed’s next rate decision? You bet, it will.

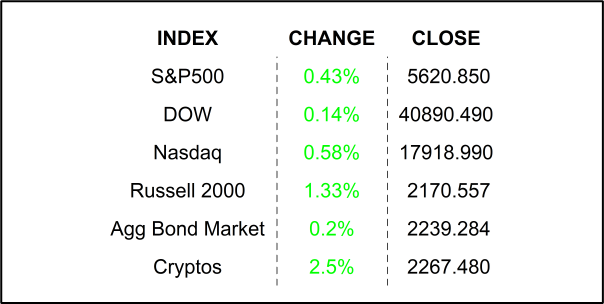

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (August 17th) is expected to come in at 232k, slightly higher than last week’s 227k. It is only a week, but if the number comes in at 232k we know that it is trending upward 🤔💡.

- S&P Global US Flash Manufacturing PMI (August) may have slipped to 49.5 from 49.6, while the Services PMI probably pulled back to 54.0 from 55.0.

- Existing Home Sales (July) is expected to have increased by +1.3% after declining by -4.4% in the month prior.

- This morning, BJ’s Wholesale Club and Peloton both beat EPS and Sales estimates while Advanced Auto Parts missed its EPS target. After the closing bell, we will hear from Ross Stores, Cava, and Intuit.

.png)