Stocks had a risk off day in the cold vacuum ahead of today’s Fed Chair comments at Jackson Hole. Peloton moves to the front of the peloton with big gains, proving that you can only move up from last place if you can stay alive long enough.

Put down the calculator. If I have said it once, I have said it….um, dozens of times. Now, I am an academic fellow, and I have many good friends who are also academic 😉. We all know, perhaps better than most, how the net present value equation works. We also know how important it is to build a framework for understanding the value of an asset. It is simple, elegant, broadly utilized… and, unfortunately, easily manipulated. Many people use the very same equation for stock valuation. While it can, theoretically, give us an understanding of what a stock’s intrinsic value is, its lack of factoring in market psychology renders it useless as a singular tool in stock valuation. Let’s leave the lecture there and go to the video tape.

Growth stocks and superlative tech stocks (I use tech broadly) were in rally mode as inflation began to pick up in 2021. As soon as it became clear that the Fed was going to raise interest rates, growth stocks literally fell into an epic tailspin causing much pain in 2022. The reason? High interest rates. HIGH INTEREST RATES? What does that got to do with innovation? Did you buy less iPhones during that time? Did you stop watching YouTube? How about your Amazon prime membership, did you cancel that because of high interest rates? Of course you didn’t. All these companies were completely healthy from a sales growth perspective. Oh, are you going to tell me that those companies’ borrowing costs went up so they would be less profitable? Sorry, most of them had HUGE cash reserves from profits and large bond offerings when rates were at historical lows. So, what was it?

Well, some Wall Street wizards decided to blame it on the net present value equation. I have written extensively about it, but it all boils down to math in which interest rates are in the denominator of the valuation equation, which means that when they go up the value goes down. It’s just math, stupid… and it’s stupid math if you used it to justify selling a perfectly healthy company’s stock.

So, here we are today. The Fed Chair who served as the market’s evil foe for the past few years is expected to ride a white horse into Jackson Hole today, clad in all white, and declare himself as the market’s hero. He was the guy who orchestrated the painful rate hikes, and now he will be the maestro for a period of rate cuts which may start as soon as next month. So, with these lower rates, will growth stocks rally once again, now that analysts are firing up their spreadsheets and lowering their WACCs, their hurdle rates, their r’s? I know, why don’t we have a look at a chart and see if we can learn something about what to expect next. Check this out then follow me to the close.

Ok, this chart shows Fed Funds (black line) and the S&P500 Tech Index (green line) going back to 2007. It covers 2 hiking cycles, 2 cutting cycles, and 2 recessions. In the 2 cutting cycles, the index gained +262.5% and +119.6%. So, low interest rates are good for growth. Not so fast. The same index grew by +70.9% and +55.9% during the hiking cycles. They did not decline, as you might have suspected. In fairness, the index grew more in cutting cycles than hiking, but was it really because of the mathematics of finance? I think not-so-much.

When the Fed is cutting interest rates, people feel good. Consumers gain confidence. Confident consumers… consume, which is good for the economy. Confident investors… BUY, which is good for stocks… especially the ones that are healthy and have good growth prospects. That brings me to my final point. Those “growth prospects” that I just mentioned are the real reason for why growth stocks (as the name implies) go higher. Would you be surprised to learn that “growth” is also an integral part of that venerated math equation? It sure is! It is mostly in the numerator, which means the bigger it gets, the bigger the result. It can also appear in the denominator where it is subtracted from interest rates (growing perpetuity), meaning, as it gets bigger so does the resulting value. OH BOY, so maybe we were obsessing over the wrong variable in the equation all along. No matter, we are still happy to get whatever boosts we can get from lower interest rates… even if they are just psychological. Oh, and in the chart above, the index grew by some +1990% from that first rate cutting cycle through current. Powell rides into town this morning at 10:00 AM Wall Street time.

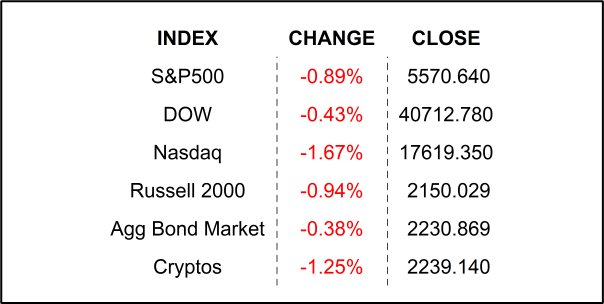

YESTERDAY’S MARKETS

NEXT UP

- New Home Sales (July) may have climbed by +1.0% after declining by -0.6% in June.

- Fed Chair Jerome Powell will speak at Jackson Hole Economic Policy Symposium at 10:00 Wall Street Time. DO NOT miss it.

- Also, FOMC members Bostic, Harker, and Goolsbee will surely weigh in their appearances today.

- Next week, we will get Durable Goods Orders, more housing numbers, Consumer Confidence, GDP, Personal Income, Personal Spending, and PCE Deflator. Check back in on Monday to get the calendars, so you can be ahead of the game. See you then.

.png)