Stocks had a mixed close yesterday with energy higher and tech lower as traders decided to take some profit on their recent high-flyers. Durable Goods Orders shot up higher than expected last month which is a sign that the economy will continue to thrive.

What economics book is in your bag. Have you ever heard someone say that the stock market IS the economy? Well, I don’t want to get deep into the semantics of that statement, but I do want to have a brief look at it. First of all, understanding the economy, how it works, and possibly, even more importantly, how it is doing, is extremely important. Why? Well, because it affects your wellbeing… er, your very existence. Can you remember the last time the US economy was on the rocks? That was at the beginning of the pandemic when the US was in lockdown. Many people lost their jobs and business owners suffered immensely. If you were not financially impacted in some way during that time, count yourself lucky and in the minority. Now to be clear, most of the time when we are talking about economy, we are referring to GDP growth.

GDP, or Gross Domestic Product can be looked at in many different ways, but the most common is through the level of expenditures made by consumers, businesses, and the Government. Let’s not get into too much theory but when those three groups are spending a lot of money, the economy, or GDP is healthy. At least 2 of those groups rely on income to spend money. The more they make, the more they spend. Let’s leave the prickly stuff of Government spending for another time. It is reasonable to assume, therefore, that if your income is safe that you will continue to spend money, and if your income is going up, you are likely to spend more money. The same can be applied to companies, right? If income is stable and growing, companies are likely to invest more in buildings and machinery, etc. Are you following me?

If you are, you may be wondering which comes first? Does a strong economy mean that consumers and businesses are making lots of money or are consumers and businesses making lots of money and spending it causing the economy to grow. Chicken then egg… or egg then chicken. Don’t worry, you don’t have to have the precise answer to that, economists don’t either. For this conversation, let’s assume, practically, that rational companies base their spending on their income. If companies’ incomes are growing and they expect the growth to continue, they will continue to spend more thus spurring economic growth… um, GDP growth. To add to this already messy analysis, let’s also assume that healthy companies continue to employ workers. Workers rely on their earnings to CONSUME. When workers’ wages are stagnant or they lose their jobs, they purchase less, and vice versa when wages are growing and employment is high, workers spend more money, thus causing GDP to grow.

So, it should be clear that companies have a lot to do with a successful economy. They spend money and they employ consumers who also spend money. That spending accounts for nearly 85% of GDP, but consumers, who make up the bulk of it, are still reliant on companies for jobs, so, again, it is companies that are at the front of this cycle of economic success… or potential failure. That should be clear by now. How do we know how well companies are doing? That was a rhetorical question, you don’t have to answer it. Obviously, we can observe company performance through their revenues. Check out this following chart of S&P500 revenues going back 20 years. You can see how there were periods of steep growth, some plateaus, and some declines. The notable declines are associated with recessions, not surprisingly. Check it out then follow me to the finish.

You see those tan colored bars on the right-hand side of the chart? Those represent expected revenues for the next three quarters, and they appear to be going higher after several quarters of minimal growth. Those forecasts are based on analysts estimates, which are based on actual performance as well as guidance from the companies themselves. Q2 earnings announcements are almost complete. I say “almost”, because the third largest company on the S&P500, NVIDIA, has yet to announce its results. Now, I have oversimplified lots of things in this lead up, but it should be clear to you by now that a lot is weighing on what NVIDIA will say tomorrow when it announces its earnings results. Will it meet or exceed analysts’ estimates? Will the company provide guidance beyond current expectations? Those will certainly affect how the stock market behaves in the days and weeks ahead. That possibly may even tell us how well the economy is doing. In response to the statement that the stock market is the economy. Current stock market performance reflects, yes, how well companies are doing today, but also, how well investors expect those companies to perform in the future. So, in fairness, if those expectations are correct, the market is really not the economy but rather, a great indicator of where investors expect the economy to be in the future. That is also why almost everyone, including economists, are likely more interested in NVIDIA’s upcoming earnings announcement than almost everything else this week, though they may not admit it 😉.

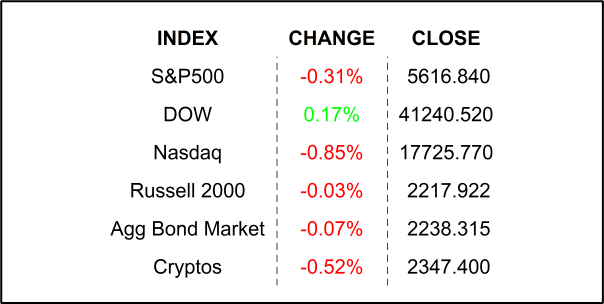

YESTERDAY’S MARKETS

NEXT UP

- FHFA House Price Index (June) is expected to have risen by +0.1% after remaining flat in the prior month.

- Conference Board Consumer Confidence (August) probably inched higher to 100.8 from 100.3.

- Nordstrom and PVH will announce earnings after the closing bell.

.png)