Markets slipped yesterday because it was the last week in August and boredom ahead of NVIDIA’s earnings allowed their minds… and fingers to wander. NVIDIA beat almost every estimate handily, as usual, but investors were expecting it to be fireworks like a first kiss – it wasn’t, but it was still pretty spectacular.

The “sinister” corporate machine. My regular readers know that I like to apply an equally sharp eye to all sides, whether it is toward Republican vs Democrat policy or whether toward Consumer vs Corporations. We will have plenty more time to focus on the former in coming months, and the latter is one that has existed since the idea of firm first appeared. For the record, the idea of a modern corporate-like entity first popped up around the 16th and 17th century. Notable bad-boy East India Company was founded in 1600. Since then, consumers have something to readily point the finger at when things looked grim for them while the image of their fat, rosy-cheeked “bosses” gorged on food and basked in pleasure. Now, I am not saying that some of that ire was deserved, but for the most part, firms – ones that are rational, are designed to make profit.

Let’s not get caught up in history, but rather let’s bring our lens to today. Here we lie, in the wake of a pitch battle with inflation that came on the heels of a pandemic which took the lives of many humans and companies. The clouds are just beginning to clear, and our ears are still ringing from the struggles. Now would be a perfect time to point fingers, right?

It didn’t start out of nowhere, but recently, the trope “corporate greed” came back in vogue. I called it out to you in a note just as election season began to push out its first blooms. I am not exactly sure what I said, but I am sure that I came down on the side of corporations saying something like, “as stockholders, we would hope that the companies we invest in would act rationally and attempt to be as profitable as possible.” Of course, I didn’t mean “using all means necessary,” as in, break the law, but rather to raise and lower prices to the point at which markets would bear them. If you look back at my earlier musings, you would probably have found a few notes in which I reminded you, my faithful friends, that it is companies who set prices. I talk a lot about supply and demand and on Wall Street, you will not find a bigger proponent of free markets than me. Companies do set prices and free markets govern that activity. By the way, I want to remind you that I keep all of my notes posted going back to 2018 so you can check me on any of my pronouncements, be they right or wrong.

So, getting back to the topic. The last post I made on so-called corporate greed is probably a few months old by now. However, the topic will still not go away. In fact, I am hearing it more and more and from everyday acquaintances. So, I decided that I would show you a simple chart and let you, my friends, make your own decision. Check it out, then follow me to the close, but really, look at the chart 😉.

This chart shows the gross margin on the whole S&P500 (top panel) and the consumer staples sector (bottom panel). What, not a student of accounting? No worries, gross margin is simply total sales less cost of goods/services sold. For example, if you sold a dozen eggs for $5 and your cost of goods sold $4.25, your gross profit would be $0.75, leaving you with a gross margin of 15%. On the chart we can see gross margins going back 10 years, and we can probably eyeball that on average, S&P 500 margins were around 35% and consumer staples around 29%. Consumer staples are things we consume that are largely necessities, like groceries and toiletries… you know, “gotta’ haves.” Ok, back to eyeballing the chart, you will notice that those gross margins did, indeed pop up in 2021, indicating that companies were more profitable, likely due to price increases. However, you will notice that those margins rapidly declined to well below their 10-year averages last year. In other words, companies were becoming less profitable, most likely because their costs were going up, or lower demand caused downward price adjustments. You will note that, currently, those margins are slightly below their 10-year averages.

Would you say, now that you know the ACTUAL numbers, that corporate greed is at play here? Of course, not. Folks, what you are witnessing is the FREE market at work bringing margins into equilibrium. What you are also witnessing is politics, in which the old “corporate greed” trope is being resurrected to curry favor from voters. You can see that regulation is not needed to bring corporations to heel, but rather the free markets, and the consumer’s dollar. Finally, I do not doubt that there are plenty of bad actors who would take advantage of consumers. In those cases, regulations are needed to make sure laws are abided by, but for most cases, overregulation will simply muck up the free-market system and all its natural checks and balances.

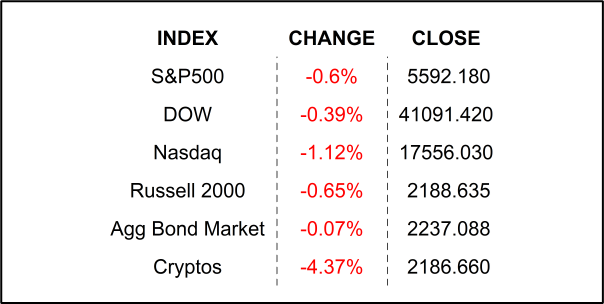

YESTERDAY’S MARKETS

NEXT UP

- Annualized Quarterly GDP (Q2) is expected to be unrevised at +2.8%.

- Initial Jobless Claims (August 24) is expected to come in at 232k, same as last week.

- Pending Home Sales (July) may have grown at +0.2% after climbing by +4.8% in June.

- Atlanta Fed President Raphael Bostic will speak today.

- After the closing bell earnings: The Gap, Dell, Marvell, Autodesk, Ulta Beauty, HashiCorp, and MongoDB.

.png)