Markets are cheering–but consumers aren’t. Here’s why that matters for the Fed and for investors.

KEY TAKEAWAYS

-

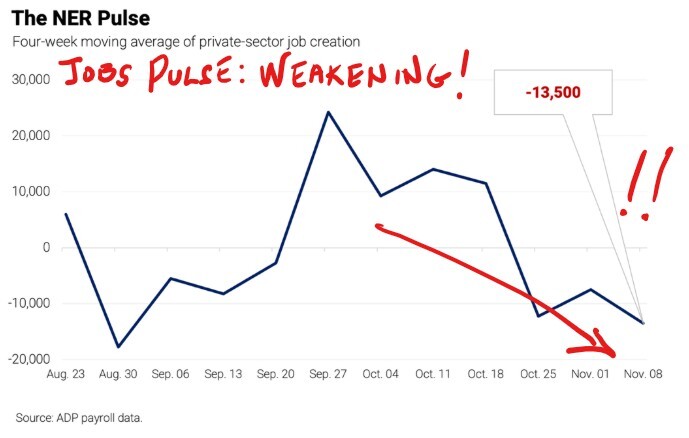

ADP NER Pulse printed a third consecutive negative reading at -13,500 jobs per week

-

Consumer Confidence dropped sharply to 88.7, lowest since April

-

Expectations Index below recession threshold for 10 consecutive months

-

Planned spending fell across cars, appliances, electronics, and travel

-

Real-world anecdote: my Lyft driver reports sharply lower November income due to fearful consumers

MY HOT TAKES

-

“Soft” data isn’t soft when it moves in one direction for ten months

-

Markets are too complacent relative to real-time labor and consumer stress

-

The Fed may end up with rate-cut justification for all the wrong reasons

-

Layoffs at major firms are becoming a trend, not isolated events

-

Main Street’s story is diverging sharply from Wall Street optimism

-

You can quote me: “You don’t lose 54,000 jobs in four weeks and call that noise.”

Sad Santa. Yesterday was a long day for me. 😮💨 I started my day on the CNBC set with Frank Holland–I was literally his first guest with a 5 AM hit time. That means my primping and prepping started at around 2:30 AM 🤣 It was a quick hit but there was lots to cover. Of course, there was the Meta -> Google chips news, which I wrote about in yesterday’s blog. He asked me about the barrage of economic data that was expected yesterday morning to which I replied, “it’s great but it’s old data from September,” but before he could move on, I asserted “however, the new ADP NER Pulse number and Consumer Confidence are very current and super, super important.” Two makeup wipes later, it was off to my lower Manhattan office.

Four videos recorded and in the can–all about how competition is good for the AI market. Then an unexpected phone interview with Bloomberg on a really neat topic–AI stocks’ impact on utility stocks–which I will share with you once it’s out. 😉 Then it was off to trading to invest some newly deposited funds. A quick phone call with our crazy-talented CMO–and my friend–on various topics. Time for some portfolio management–I had to approve a number of stock trades which I selected over the weekend. ✅ Somewhere in the middle of all that, those numbers I talked about with Frank hours earlier streamed in, and at first glance, they looked disappointing.

In fact, they looked pretty disappointing in my second glance as well. Markets were rallying, and I could see Fed Funds futures undulating in the corner of my screens. It was clear that since last Friday morning’s dovish comments by New York Fed President John Williams market sentiment took a turn for the positive, inviting bulls back to the party. Those less-than-economically-flattering numbers that came out likely add fuel to the rate-cut fire.

Let’s have a look at those numbers. We’ll start with the ADP NER Pulse. A quick reminder about what that is. The ADP NER Pulse number is essentially ADP’s high-frequency look at real-time hiring, showing how many workers are being added–or, um… not added–across thousands of firms using their payroll systems. It updates far more quickly than the traditional monthly ADP report (the National Employment Report / NEW), so it’s one of the earliest glimpses into shifting labor demand. It is simply a 4-week moving average of hires/fires. That helps us understand what is really happening on the ground. The moving average smooths the data but also gives a clue on the intra-month trend. Yesterday morning’s release showed that -13,500 jobs were cut per week over the past 4 weeks. That’s a meaningful decrease from last week’s -7,500 separations. This was the third loss print in a row. Positive for the economy? No way! Good for you if you are hoping to shake the Fed into cutting rates next month? Resounding yes–assuming someone is paying attention at Fed HQ.

Do you think that those 54,000-ish folks that lost their jobs in the last 4 weeks are going to keep spending the same amount of money as before? How about the up to 6,000 employees who may lose their jobs at HP? How about anyone who works at HP after hearing the layoff announcement in last night’s earnings release? Would you say that confidence may be challenged a bit? Well, if you watched Monday’s video or read the blog post, you would know the answer. University of Michigan consumer sentiment warned of a severe loss in consumer sentiment. Yesterday, the Conference Board released its Consumer Confidence indicator, and that confirmed what U Mich relayed, and probably what you already suspect just by being present in the world today.

According to the release, consumer confidence weakened significantly in November, with the headline index slipping to 88.7, its lowest since April, as households grew more uneasy about jobs, incomes, and their overall financial footing. Both the Present Situation Index and the Expectations Index declined meaningfully, the latter now sitting below the recession-signaling threshold (according to the publisher that number is 80) for the 10th straight month. Households pointed to prices, tariffs, politics, and the ongoing government shutdown as key reasons for their worsening mood, and confidence fell across nearly every age and income group. Even though recession expectations remain mixed–fewer say one is “very likely,” but more believe we’re already in one–the tone across those telling write-in responses skewed noticeably more negative than in October, according to the report.

Planned spending reflected this shift as consumers pulled back on big-ticket items, travel, and most discretionary services. Intentions to buy cars, appliances, and electronics softened, and even the surge in October travel plans reversed. Households also reported deteriorating views of their current and future financial situations, with present-condition sentiment sinking back toward the lows of August 2024. The one notable outlier was healthcare, which jumped into the number 2 spot for planned spending–I don’t even want to try and interpret that. Overall, the report paints a picture of households retrenching toward essentials and “cheap thrills,” (that’s a direct quote from the report) a pattern consistent with slower consumption growth ahead.

Now, my regular followers are probably tired of my relentless focus on the labor market and consumer confidence. The former informs the latter which directly impacts… wait for it… consumption. My famous line: “confident consumer consume,” is oft repeated by me for a reason. It is real and consumption makes up the bulk of economic growth. Are consumers confident? Well, certainly not based on yesterday’s and last Friday’s numbers. Now, an important disclosure. Many scoff at these numbers as they can be biased and that their predictive success is statistically weak. They are often dismissed as soft numbers, which is a notion that I know–you all are well-aware–that I disagree with. The actual numbers are not as important as the trends and magnitudes. Ten months in a row cannot be dismissed as an outlier.

My day ended with me dragging my sorry, tired body to my Lyft, which would take nearly 3 hours to get to my house, because of the rain, rush hour traffic, and… well it is kind-of a holiday week with increased travel. I worked on my laptop until I felt motion sickness glance over at me. My Lyft driver was cheerful, and we struck up a conversation. Once he found out what I did, his cheerful mood changed–it turned markedly serious. He asked me about the economy. He was worried. He told me that November and December are typically boom months for him, but this month has been abysmal so far. He said that his income dropped significantly (his word) since last November. He shared some theories about why, and the one that resonated most was that “people are simply afraid to spend money these days because they are worried.” He didn’t know why–he was just stating facts. I would call that a data point. Fed, did you hear this? Are you seeing the same numbers we are seeing? Did you read that HP announced last night that it’s planning to lay off many thousands of workers? And a similar announcement by McKinsey? Fed, are you ready to satisfy that mandate about full employment?

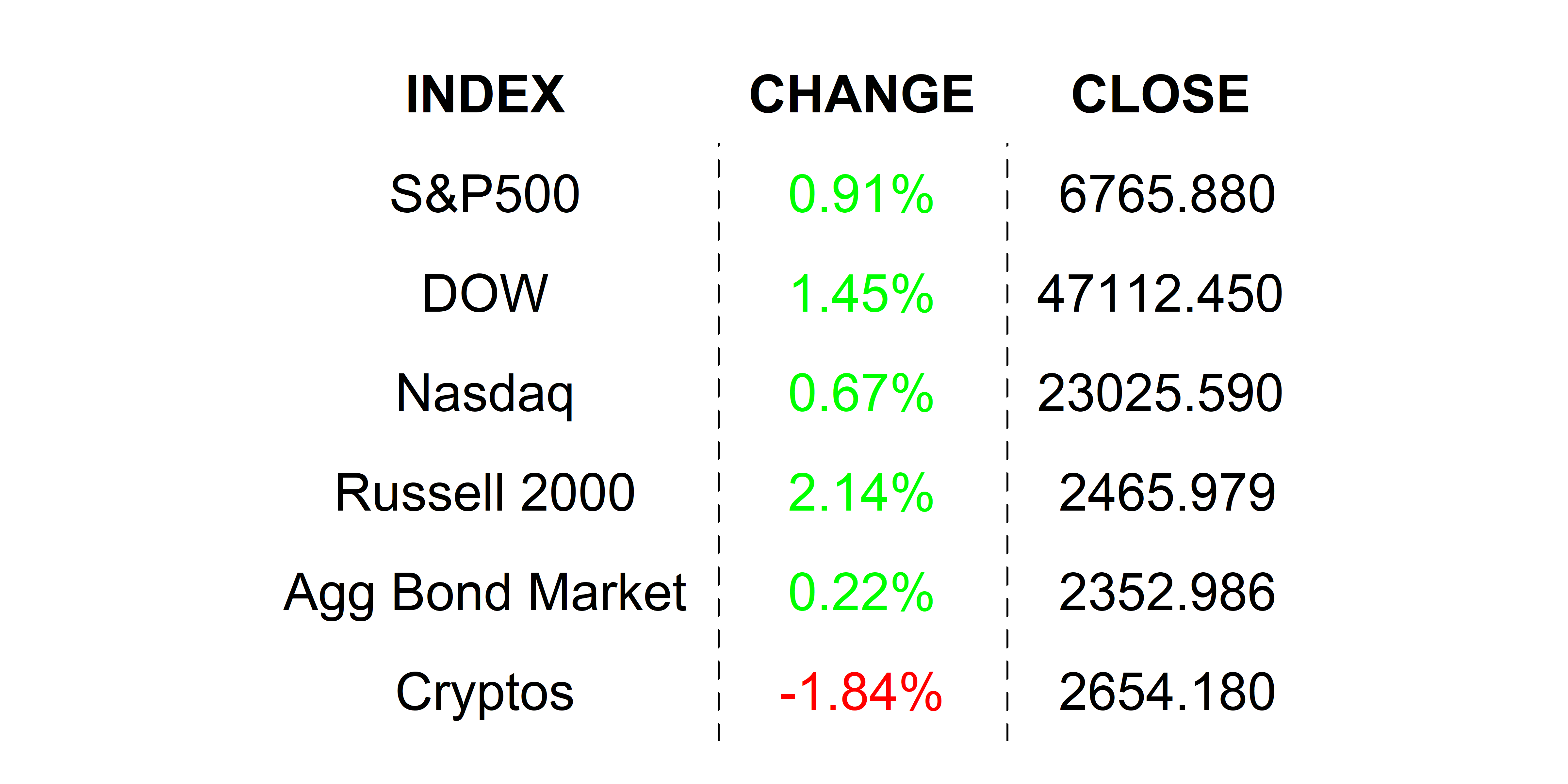

YESTERDAY’S MARKETS

Stocks rallied yesterday on continued optimism about December rate cuts. Weaker to mixed economic numbers–some delayed, some current–added fuel to the buying frenzy. Tech, for the most part, sat out in response to the news that Google chips are challenging NVIDIA’s dominance. Rate cut likelihood hit 80%, according to Fed Funds futures.

NEXT UP

-

Initial Jobless Claims (November 22nd) is expected to come in at 225k, up from the prior week’s 220k, and slightly above its 4-week moving average.

-

Durable Goods Orders (September) may have increased by 0.5% after climbing by 2.9% in August.

-

Fed Beige Book will be released at 2:00 Wall Street Time. It’s typically not a market mover, but it is packed with lots of useful anecdotal data points from the various Fed regions. In this charged environment, those anecdotes mean something. 👀

-

Markets are closed tomorrow for Thanksgiving, and they will close early on Friday.

DOWNLOAD MY DAILY CHARTBOOK HERE 📈

.png)