Just when markets were calming, Israel strikes Iran. A threat matrix analysis breaks down sector risks.

KEY TAKEAWAYS

-

Markets were set for a quiet Friday before Israel struck Iranian targets overnight

-

Oil, gold, and defense stocks surged while equities and travel stocks dropped

-

The Strait of Hormuz is a critical geopolitical choke point for global oil supply

-

A conflict escalation could drive inflation higher and reignite volatility

MY HOT TAKES

-

Markets don’t price war well—they price emotion

-

Crude disruptions hit inflation faster than the Fed can react

-

Iran’s power lies more in its geography than its production

-

Travel stocks are the first to get hit in global unrest—again

-

You can quote me: “Overshoot, undershoot, react, repeat.”

Lack of energy. It’s a Friday before Father’s day. Summer is officially about one week away. Beaches are open in the Northeast, though the sand remains unmarked due to uncooperative weather. The US labor market is about limping along with no major issues, inflation continues to recede. This is according to last Friday’s labor numbers, this week’s CPI, and even this week’s CPI. Treasury yields have also receded and recent auction successes have quelled fears of “sell America.” The Fed is in no hurry to cut rates soon, and the market has factored in that reality. Today we will get University of Michigan’s first estimate of consumer sentiment later this morning, and it will likely show that consumer sentiment edged higher and inflation expectations edged lower in response to the Administration’s recent overtures to the US’s trade partners. Should be a quiet day, right?

Well, I am sure that you know where this is going. Last night WHILE YOU WERE ALMOST ASLEEP, Israel struck strategic Iranian nuclear and military installations. Israel has long warned of such a move and markets have had a long time to contemplate what a military strike might look like. However, now that it happened, the market, in typical fashion, has reacted. Overshoot, undershoot, react, repeat.

The initial reaction looks like this. Crude oil prices have shot up. Initially after the attack, the Dollar and Treasuries gained along with Gold as assets piled into safe-haven investments. By the time I am finalizing this post, Crude and Gold remain elevated, and Treasuries have pulled back. US stock indexes are all down in the premarket, but off their wee-small-hours lows. As traders flick on their screens the haze is clearing but the conflict in the middle east is far from over. Iran has already begun its counter-attack and Israel has all but promised that its assault is far from over.

Not shockingly, equity indexes are pointing to a lower open. I am sure that you are wondering what impact this emerging conflict will have on your portfolio. The most obvious one is on energy prices. Iran represents around 15% of OPEC oil production. Despite international sanctions, Iran, through backchannels, manages to contribute to global oil supply and most of its output is consumed by China and India. Crude prices have dropped as the conflict threatens global crude supply. Crude oil is fungible (at a very high level), so disruptions in one part of the world affect prices everywhere.

Iranian output disruption is only the tip of the iceberg. A desperate Iran can disrupt global oil shipments far beyond its 3.4 million barrels per day. Looking at a map, you can see that Iran flanks the Strait of Hormuz. Saudi Arabia, Iraq, UAE, and Kuwait all ship some 18 million barrels per day through the strait which is only 20 miles wide at its narrowest point. Choking that point can deprive the world of around 20% of global crude supply. It is also important to recognize that Iranian proxy Yemen is strategically located on Southwestern edge of the Arabian peninsula, where it overlooks the strait between the Red Sea and the Arabian Sea. Roughly 8-9% of seaborne crude travels past Yemen.

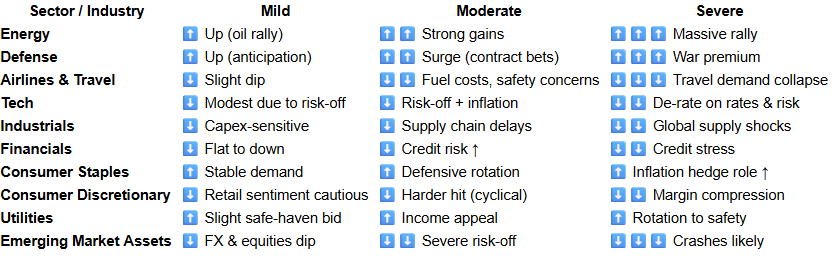

So how does this all affect broader markets? Well, I have put together a threat matrix which lists all the major sectors. I looked at three scenarios from mild to severe. A “mild” conflict includes short duration Israeli strimites with limited Iranian response. The “moderate” conflict scenario would mean prolonged attacks from both sides and threats to Strait of Hormuz shipping. Finally, a severe conflict would have the Port of Hormuz completely disrupted with shipping attacks as well as active proxy attacks in the Red Sea. Check out the threat matrix and keep reading.

As of this morning, I would classify the conflict as “mild”, but it certainly has the potential to get to moderate in the days if not hours ahead. Crude is indeed up in the premarket and the pre-market leaderboard is filled with energy companies and defence companies, including Occidental Petroleum, Northrop Grumman, RTX, Schlumberger, General Dynamics, and Lockheed. Meanwhile, the loser board is littered with travel stocks. It is important to note that information continues to flow in and the conflict is still unfolding. In other words, all of what we know is already factored into the market. That is a kind way of suggesting that you remain patient.

However, if we expect the conflict to escalate in Moderate territory. You will note that many of my single arrows go to double. Energy and defense will possibly run higher while Airlines/Travel and Emerging Markets may get further pressure. That theme continues if the conflict escalates to severe where double arrows go to triple and some singles go to doubles.

Really, at the end of the day, navigating through this period of what is sure to be increased volatility will be challenging and require additional levels of diligence. It is important to recognize that this conflict adds challenges to the already sizable collection of worries being maintained by the markets–those aren’t going away. At the bare minimum the spike in crude, if it persists, will have an almost immediate impact on inflation numbers. You know, the very numbers that everyone is obsessed with these days, rightly so.

More and more in the academic circles through which I moonlight, folks are sharing “TL;DR” sections, though they will never admit it in public, so don’t ask. 😉 In case you didn’t know, TL;DR stands for “too long didn’t read.” Because this is a fluid and complicated scenario, I will give you a bonus chart today, which is really a TL;DR. I will leave you with one bit of advice. Be thoughtful in your investing, always do your diligence, and try–TRY to be proactive and not reactive. Here is your chart; have at it.

YESTERDAY’S MARKETS

Stocks gained on an inflation-friendly Producer Price Index release. Boeing weighed on the Dow after a crash in India exposed unhealed wounds and small caps continue to struggle. Yesterday’s long bond auction went off with strong demand allaying fears the the Sell America trade is maybe not a thing anymore.

.png)