Trade talks resume as Trump resets the tariff deadline. Markets react—but should investors?

KEY TAKEAWAYS:

-

Momentum was positive until tariff letters hit 14 countries

-

President Trump extended the tariff deadline to August 1

-

Markets sold off despite no new information—just old risks resurfacing

-

Negotiations with countries like Japan and South Korea are still possible

-

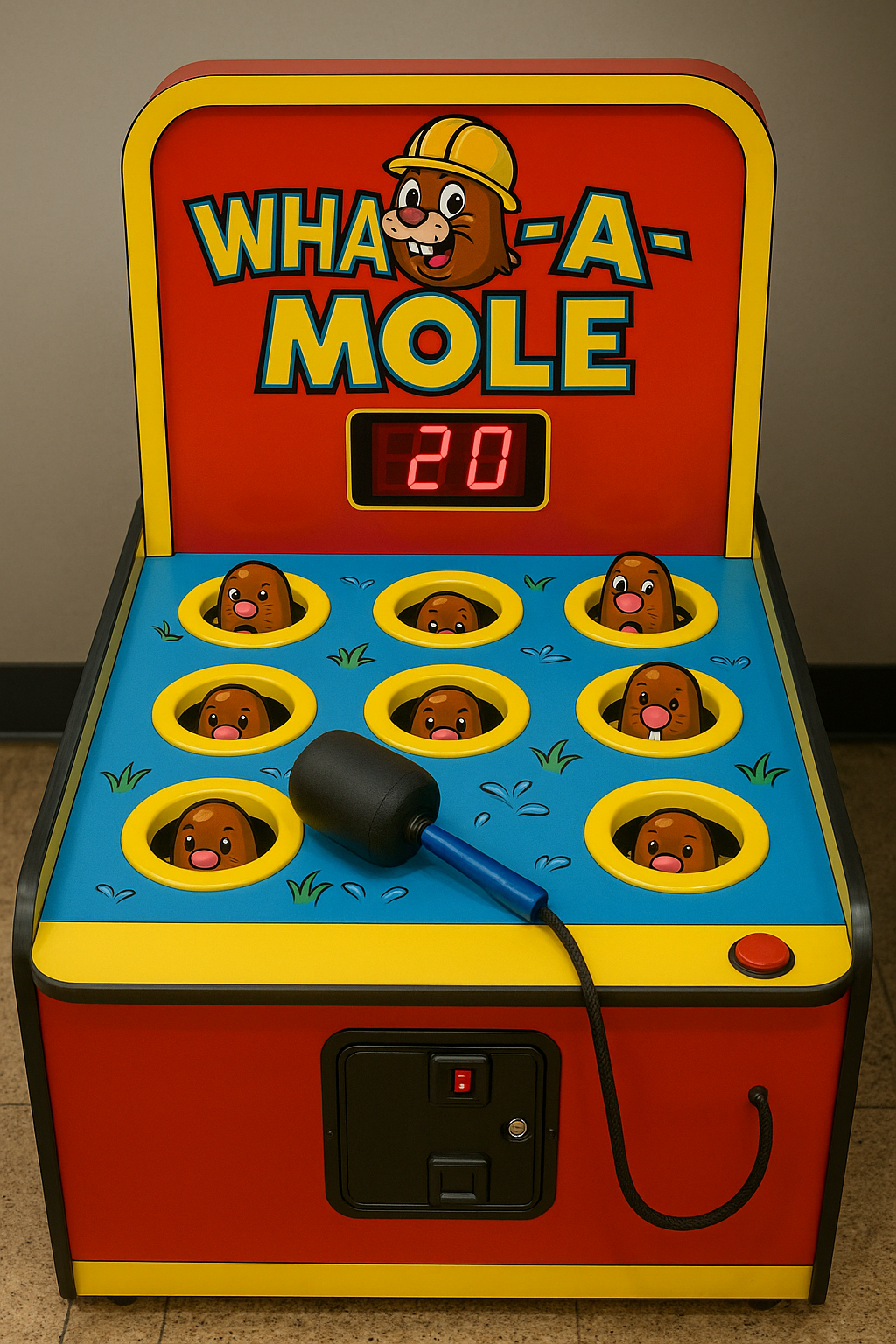

The game analogy reinforces market unpredictability and investor strategy

MY HOT TAKES:

-

Market panic is often about reminders—not surprises

-

Trump's strategy is more calculated than chaotic

-

Countries ignoring the clock may now regret wasting time

-

This is classic brinkmanship—but with a mallet

-

Investors need to stay sharp in July—it’s far from sleepy season

-

You can quote me: “It might all seem crazy if we didn’t already know it was coming—that’s what makes it market psychology, not news.”

Whack a mole! Come on, you must have played it at least once in your life. Seen it on TV? You get a mallet-type thingy and the music starts. “Let’s play whack-a-mole!” And off they go, the mechanical moles, randomly emerging from their holes, in need of a whack. All you need to do is whack those moles–all of them. You know where the moles hide, you know that they will come out, and you know what to expect, because you presumably watch someone else play it before dropping your quarter in the slot. It sounds easy, but, alas, it is not. Feeling bad for the little critters? Don’t, because you just lost all your money.

Hopefully, you enjoyed friends and family over this holiday weekend. In NYC, it was hot and sunny. Perfect weather for anything but a marathon. Markets closed early on Thursday with stocks at all-time highs. This was a perfect setup for a weekend of fireworks and gluttony. The S&P closed some 26% above April’s low close. The Big Beautiful Bill Act was passed and signed into law. Whether you like the act or not, you will probably find something in there that benefits you one way or another. That big regional Middle East War… didn’t happen and fighting has ceased for the most part–for now. On July 7th, the President’s reciprocal tariff leniency period officially ends. That could be a problem, but we already know that President Trump is looking for deals, so he was likely going to extend the deadline. And he did, this weekend.

Sure, stocks needed a rest after all that, but momentum has been positive and stocks were safely on the train. And then all of sudden the mole you were about to slug popped back in the hole while another appeared simultaneously on the complete opposite end of the board. We knew that the President was expected to send out letters to trade partners that had not yet agreed to a deal. This, for the record, was everyone but China, the UK, and Vietnam. Rumor on the street was that there were a few deals that were getting close. However, whispers were that Japan was not making things so easy. No playing ball, so to speak. So what about those letters?

As promised, those letters came, and they properly spooked the markets. On that invite list was none other than Japan, South Korea, Malaysia, Indonesia, Laos, Myanmar, South Africa, Thailand, Cambodia, Serbia, Bangladesh, Kazakhstan, Tunisia, and Bosnia-Herzegovina. The tariffs range from 25% and get as high as 40%, and if you think that’s trivial, think again. The US imported some $148 billion from Japan and $116 billion from South Korea in 2023, and the bronze medal went to Thailand with $56 billion.

That might all seem a bit crazy if we didn’t already know that it was coming. Reading through the letter sent to Japan, it was clear that the rumors were true, Japan was likely not cooperating. However it was also clear that the President was looking to negotiate. It was clear. The question is, was Japan looking to negotiate? I think the answer was yes, based on their response. It is likely that Japan and South Korea were betting that the President was bluffing and that he would… well, chicken out (I didn’t invent TACO). But the President just came off some big wins in the Middle East and the almost-as-hostile Congress.

The President reset the clock to August 1st, but now the list of invitees, with more adds promised, have been put on notice. The President means business and they are now in a slightly weaker bargaining position, having dawdled away precious time. Bigger trade partners have a lot to lose if their smaller, almost-as-capable neighbors strike deals first, running the risk of losing manufacturing to them. An example is how a great deal of Chinese manufacturing imports have shifted to Vietnam following the 2018 trade war.

All that still, however, does not guarantee that they will bend to Trump’s whims, but similar to China, a successful negotiation would be beneficial for both sides, so it is likely that common ground will be found. The same goes for South Korea or any of the others that are on or may be added to the list.

Today’s news also put the markets on notice, sending stocks tumbling. Is this the end of the line for the recent rally in stocks? Of course, not. Today’s news contained nothing new! The only thing we learned today is that the President is now refocusing on trade. The biggest risk at this stage is that the administration is unable to conclude and sign deals with all those 14 letter holders over the next three weeks.

As the game played on, the moles would jump out and back in at a faster and faster pace until finally, multiple moles seemed to pop up at the same time. With only one mallet-type thingy, you couldn’t possibly hit them all. Loss was inevitable–it is, in fact, part of the game. However, if you could avoid loss long enough, you may have gained enough points to get a round of applause from the people watching–even if those viewers were your parents.

Yesterday’s move in stocks was not as terrible as it felt. Nobody likes to lose on the first day back from the beach and fresh highs. I am going to remind you again that the tariff rates that appeared in yesterday’s letters were virtually the same as the ones revealed on Liberation Day. Nothing new here, folks. The President merely sent an official-looking letter while simultaneously and unilaterally extending the deadline. Hmm. Pay attention and don’t panic. This game is playing out exactly how it was programmed to.

YESTERDAY’S MARKETS

Stocks fell yesterday after the President refocused on tariff negotiations by sending out 14 nastygrams reminding the recipients of their tariffs. The President also officially extended the deadline to August 1st but markets didn’t care. 10-year Treasury Note yields climbed by 3 basis points and the Dollar strengthened.

.png)