New highs in the market, and yes, we’re asking: How did we get here?

KEY TAKEAWAYS

-

The S&P 500 just hit only its third all-time high in 2025, despite volatile conditions

-

Markets tanked nearly 19% after February’s highs due to tariff shock and geopolitical risk

-

Momentum began to rebuild as trade negotiations advanced and risks faded

-

Tariff deadline was delayed, and conflict in the Middle East de-escalated

-

Positive tailwinds now include potential fiscal stimulus and Fed rate cuts

MY HOT TAKES

-

Momentum is real and it still works—even in 2025

-

145% tariff was never meant to stick—it was a negotiation tactic, and positive sign to those paying attention

-

The market doesn't need new catalysts, it just needs old risks to fade

-

We’ve already seen the worst-case scenarios play out, and we survived

-

Markets drift higher in the absence of headwinds, just like a boat without brakes

-

You can quote me: “The market already priced in the worst-case scenarios back in April—what’s left now is the slow removal of obstacles and the quiet return of optimism.”

You may ask yourself. Remember this famous lyric bit? It’s from the Talking Heads’ 1981 hit Once In A Lifetime. You didn’t have to be a fan of new wave rock music to know this one if you had MTV on in the background. It was part of the early 80s rotation. In it, co-writer and frontman David Byrne says: “And you may ask yourself: ‘Well, how did I get here?’”

If you have been following the markets, you may be asking yourself the same thing. How did I get here? In case you missed it, the S&P 500 closed at an all-time high on Friday. There was a time, not too long ago, where news of an all-time high for the index may not have warranted its own newsletter topic, let alone a mere mention in the MARKETS section of my post. But this time, it was a bit different. Last year alone the S&P 500 made 57 all-time high closes. Talk about a house without a roof.

Hitting new highs had become a norm–expected, in fact. We are just at the halfway mark for 2025 and guess how many record closes we have had this year so far? Well, as of last Thursday, the answer is 2. That’s it. Friday’s record close brought the tally to 3. It’s not necessarily the rarity of record closes this year that is remarkable insomuch as what we had to go through to get there.

Our last record close was on February 19th. It took just 34 days for the market to erase nearly -19% to hit the year's low, which was, incidentally, below 5,000. That’s a big deal for traders as round numbers tend to be strong natural support and resistance lines. And the market ignored it on that day. So, yeah, it crossed the line. That close was an uncomfortable one for everyone except for those few bears that are constantly on the hunt for black swans. Surely that afternoon, financial news TV producers were searching through their notes for that guest that appeared 100 times in the prior 2 years calling for epic market disasters and were wrong on 99 of them.

At that point, I was not proclaiming an epic market disaster, though I did publicly announce my disappointment. Last year’s 57 record closes were justified! The economy was healthy, the Fed was cutting interest rates, AI was exploding, and corporate earnings were strong. We earned it, we deserved it. All that great stuff would go to waste.

Looking back, the few years prior were tough ones, marred by aggressive Fed rate hiking, bank failures, and finally Fed easing false-starts. Not 2024, that was the year where all that pain would be rewarded. The Fed would finally cut interest rates. On the political front, ‘24 was expected to be crazy. It was a Presidential election year in which then-candidate Trump was not only fighting for the Oval Office but his freedom. Biden’s unceremonious removal from the Democrat’s ticket left a gloves-off race to the finish line between Harris and Trump. Both candidates came to the race with bagfuls of candy to hand out. Tax cuts, investments… you name it.

In the end, Trump would earn a decisive win. There was concern in the market that a win may not be decisive leading to a repeat of the last election’s aftermath. But not this time, and that was bullish in and of itself. Trump won, and it was his turn to make good on all the election promises he made. It was clear that his agenda was pro market. This drove markets higher, adding even more power to the already positive momentum that existed, thanks, in large part, to the AI rally.

You have heard me say this many times: there are over 400 documented anomalies to the Efficient Market Hypothesis, and momentum is the most powerful one. To clarify, the Efficient Market Hypothesis pretty much says that you can’t beat the market (over-simplified). But in fact, there are 400 challenges to the hypothesis and momentum is the most replicable. An object in motion stays in motion, and that applies to stocks more times than not. It probably has a lot to do with crowd psychology and FOMO (fear of missing out), though it doesn’t really matter as long as it works. And it does, trust me. 😉

Leading up to the inauguration in January markets had lots of positive momentum, and it was all justified by fundamentals. In other words, you didn’t need to be a quant with expensive computers to like the market. And then it happened. Tariffs! Trump’s making good on that “other” campaign promise, surprisingly… surprised the markets. Good went to bad, went to worse, and worse yet. At one point I declared to the press that the bull market was dead (you can probably find my quote if you google it). That momentum that I referred to not only went away, but it was starting to look like it could turn negative. Oh, by the way, you need to understand that momentum works in both directions. 😟

The President had just ratcheted Chinese tariffs to 145% and even the biggest bulls had to unbutton their top buttons. This was about to get ugly. For me, it was a sign that the President was ready to negotiate. The number: 145% was so unrealistic, that it was sure to be a signal of some change. And it was. Within days, the administration shifted in negotiation mode.

In the midst of it all, we had an earnings season which had AI ecosystem companies looking quite healthy. Still, there were some serious risk hurdles for the markets. Tariffs didn’t go away, they were just delayed, and only some of them. Many were still in place. The President had proclaimed earlier that there would be a minimum tariff for all countries, even if negotiations were successful. That seemed to almost guarantee some sort of inflationary impact. What would that mean for the economy? What would that mean for the Fed? Would the economy tank while inflation re-ignited? It could be a nightmare. A big risk cloud hovered over the markets. I would argue to you that a majority of analysts were and are still waiting for bad numbers to start showing up. They began to expect them. However, for the most part, those bad numbers have NOT shown up yet. That fact combined with slow but sure progress on trade negotiations allowed markets to start to grind higher. The AI trade which powered last year’s gains slowly came back to life.

Then all of a sudden, Middle East tensions flared up with Israel's attack on Iran’s nuclear facilities. Now the markets had new hurdles to overcome. Geopolitical risk and inflation risk driven by crude oil gains. The knot that was now in the way of market gains was at its worst. Thankfully, the Israel-Iran conflict was quickly dispatched with the US’s attack last weekend. Calm ensued, removing another major market hurdle.

July 9th is soon approaching, and that will mark the end of the President's “liberation day” tariff delay period. That was a major risk facing markets until last week when the administration made it clear that the actual date is not a “hard” date for countries engaged in the negotiations. We have now learned that the administration is targeting Labor Day to finalize trade deals with larger trade partners. This follows on positive announcements between the US, UK, and China. The President is working his trade craft and markets view that as positive. That is to say that risks are diminishing.

That leaves us with hurdle after hurdle shrinking or being removed, each clearing the path for markets to grind higher. Without those headwinds, in a vacuum, markets simply drift higher at this point, following the momentum. Think of it as a boat that is moving forward, and the skipper cuts the engines abruptly. The boat will continue to move forward due to momentum, unless there is a headwind or an oncoming current.

I haven’t yet mentioned tail winds. Currently, as I pen this letter, lawmakers are haggling over the so-called “Beautiful Bill,” which Republicans hope to send to the President by this upcoming weekend. Whether you are a fan of the bill or not, you must recognize that it is stimulative to the economy. Tailwinds like that will only add to the positive momentum that prevails at the moment. Left alone, markets will drift higher yet.

However, being left alone is not likely in the cards. The economy has been showing some signs of exhaust. Unemployment appears to be ticking higher, and growth is slowing. Post-pandemic inflation is still receding, albeit slowly, but surely. Some tariff-based inflation may be creeping in, but more and more economists expect it to be smaller and transitory, and to be clear, many expect the big jumps in prices to come in late-summer-early-autumn.

So here is the bottom line. We are at new highs. Momentum is positive, though not quite as positive as last year. However, it has the potential to increase as more headwinds diminish and tailwinds increase. Are risks still out there? Of course they are, but we have to remember that the market already tested worst case scenarios in April, and we are clearly better off now than we were back then. The Fed? Well, it just reiterated its expectation for 2 cuts before New Years. While inflation remains a risk, unemployment seems to be strengthening, which should prompt the Fed to act faster, which could help the markets rally higher. Earnings season is set to begin next week, and it is expected to show a marked decline in earnings growth. That is already factored in the market, so assuming no major surprises, momentum, once again will win out.

So, my friends. You may ask yourself how we got here? We are heading “into the blue again, into the silent water.” Now is the time to stay focused and maintain your long-term view. Momentum is back on our side. It is “same as it ever was, same as it ever was.”

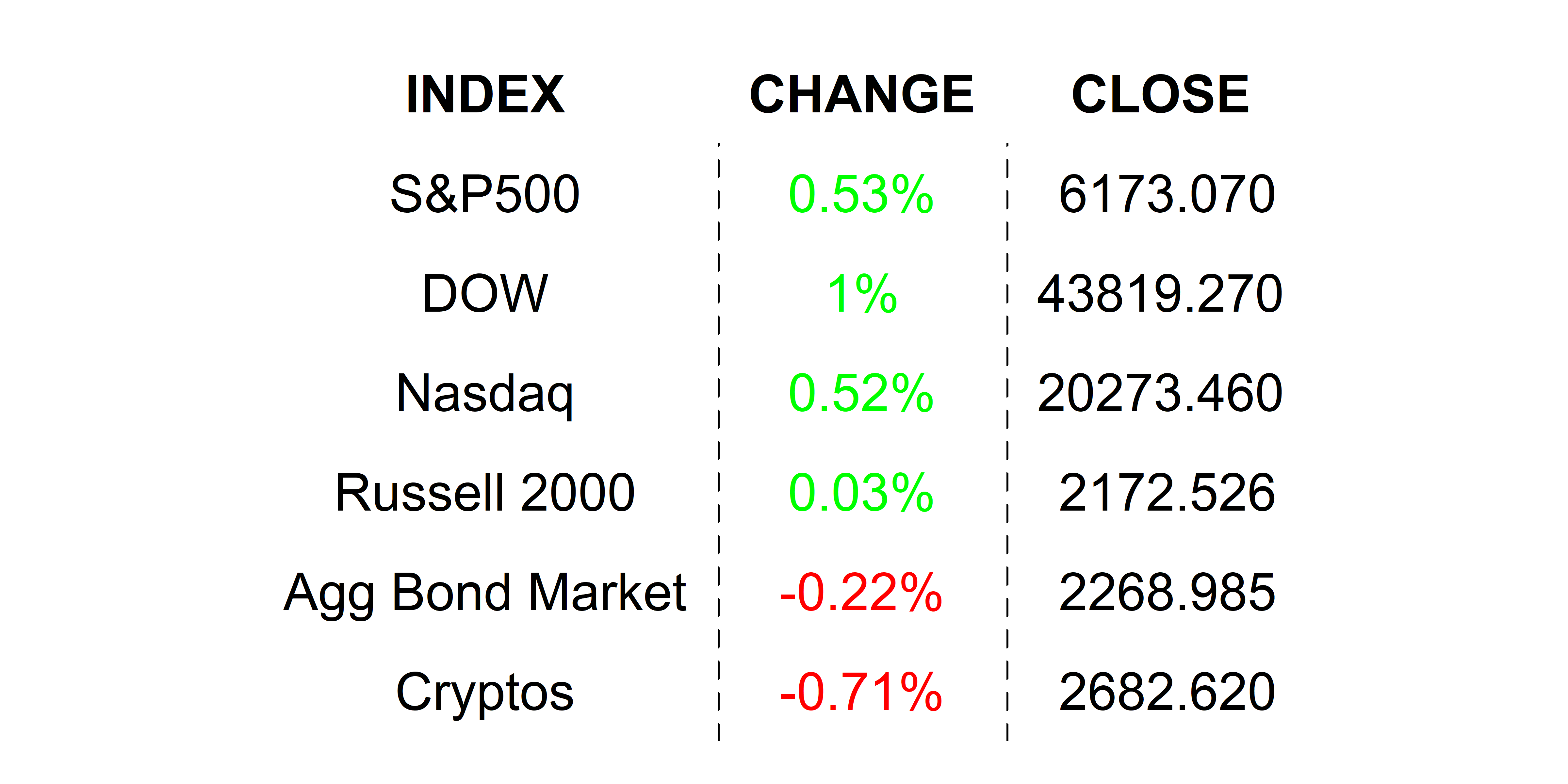

FRIDAY’S MARKETS

Markets rallied to new highs on Fridays carried by momentum which refused to relent, even if the President cut off negotiations with Canada. It’s back on as of this morning…shocker. 😉 Traders will have to focus this week, typically a slow one before a long weekend, as big employment numbers will be rolling in.

NEXT UP

-

No major releases today, but late this week we will get PMIs, JOLTS Job Openings, ADP Employment Change, and monthly employment numbers. Download the attached calendar for time and details.

-

Fed speakers today include Goolsbee and Bostic.

.png)