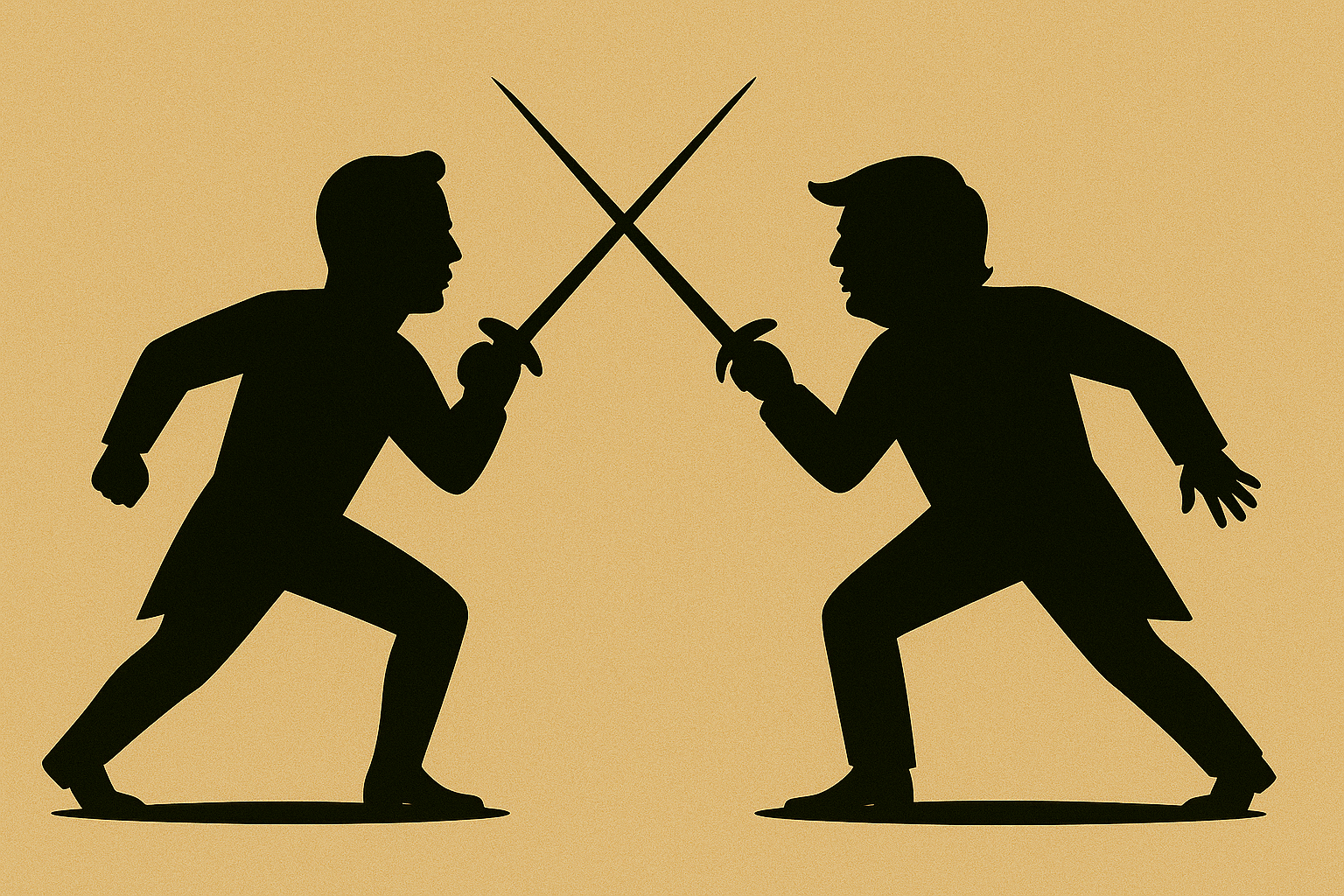

Rocketman 2.0. Yeah, this is kind of about yesterday’s drama between the President and Elon Musk. There are just so many tongue-in-cheek taglines I could have used: “breaking up is hard to do,” “bromance over,” “jilted,” “starlink crossed lovers”... honestly, I can go on and on. There is nothing like a good diversion for the markets whilst in the midst of heightened global trade tensions, at least two wars, a market on the verge of recovery, employment getting a bit cool, a stuck-in-the-mud Fed, low inflation with high prices (go on you can read that truth bomb again), and a mixed domestic economic picture.

On the one side we have a maverick President who is intent on leaving his unique mark on the country–you can call him a political eccentric, and on the other hand, we have a maverick industrialist, a social eccentric, who like most overly successful businessmen was drawn to Washington DC like a moth to flame. Another conquest. I have witnessed this time and again in my career. A person who enjoyed great success in business is convinced that they can literally fix anything, even Washington DC.

Both President Trump and Elon Musk came to Washington to “fix” it. The President has been at it for some time–a work in progress, while Musk kind-of showed up, last-minute, in the Presidential race supporting Trump. The romance ensued. Musk, a non-elected official, was, for a minute, the most feared man in Washington with seemingly unlimited power. Musk claimed to be able to cut $3 trillion in costs. That cost-cutting would not only cure the deficit problem, but it would pave the way for new fiscal stimulus.

It would be easy to cut $3 trillion in costs. Simply fire lots and lots of people, cancel all contracts, and stop giving away free stuff… to everyone. However, we know it is not so simple. Perhaps, with the aid of smart young folks and fancy computer algorithms we could find a new way, a path never explored before. Once DOGE hit the ground, $3 trillion was quickly rounded down to $2 trillion, still a respectable number. But soon after that, it probably became clear that there was little chance of accomplishing that ambitious goal, but that didn’t stop DOGE from trying. Shoot for the stars! To be clear, we must give them credit for attempting to get the nation’s finances in check. Musk appeared to have “special” access to the President, even showing up in all-black, clad with one of his army of children in the Oval Office. Now that is access. Alas, it probably became clear to Musk that his goal of $2 trillion in savings may not be achievable. Musk announced to Tesla shareholders that he would step back from his DOGE involvement in late April.

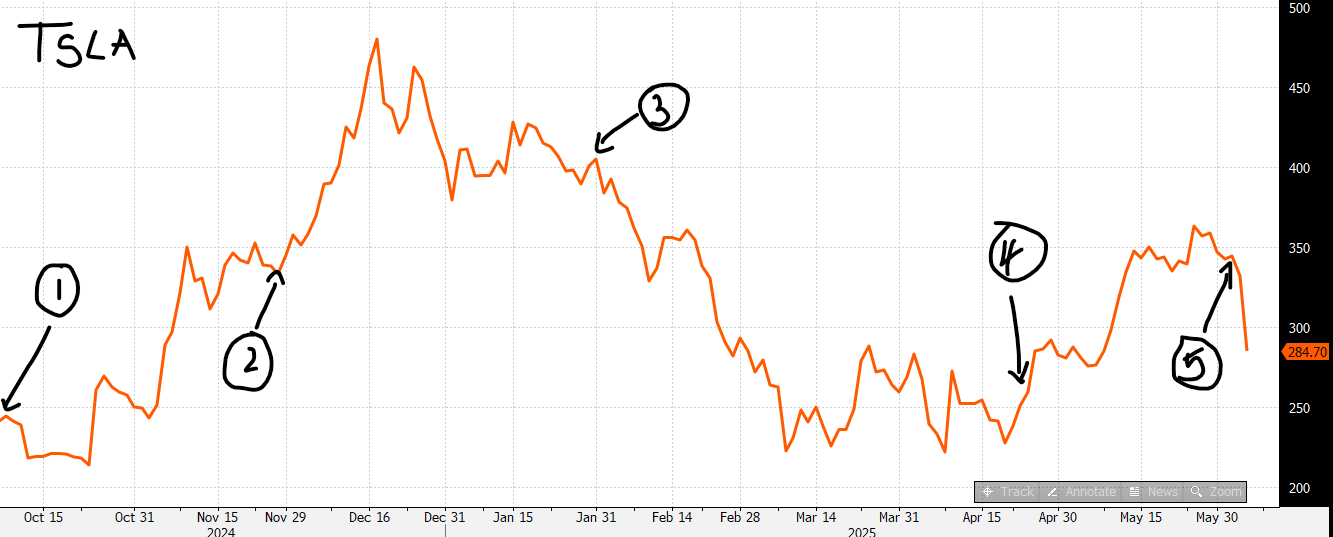

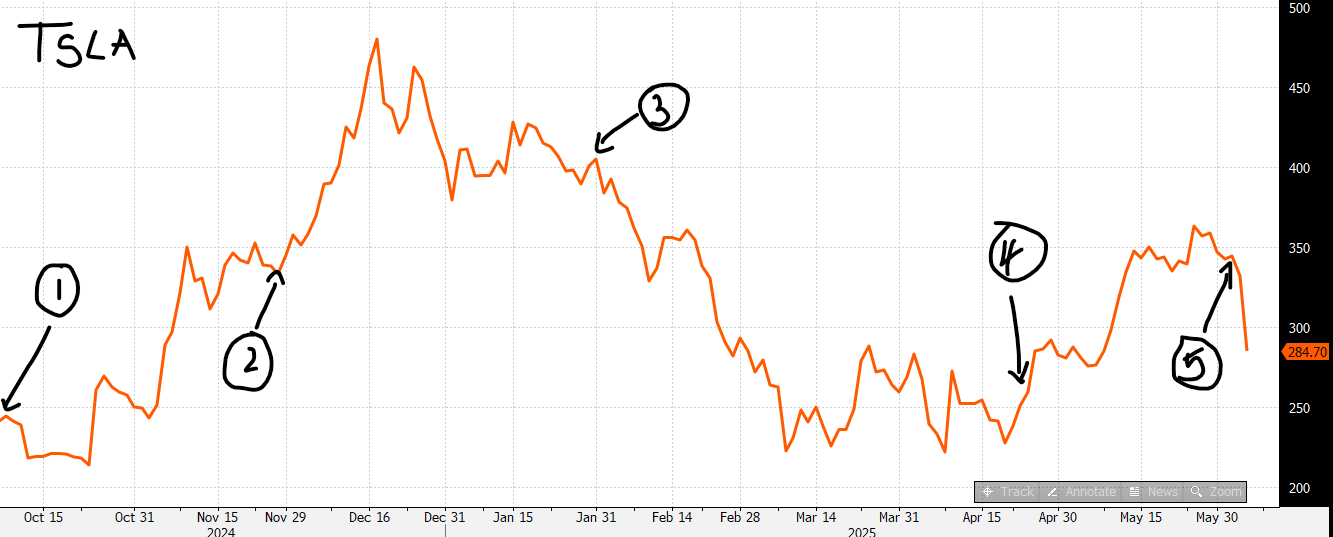

We should all be proud of Elon Musk’s industrial achievements. Paypal, Tesla, SpaceX, Boring Company, Neuralink, Starlink, X, X.ai–all successful in one way or another. Tesla, unfortunately, is the only one of his currently owned and operated businesses that is publicly traded. Tesla makes cars… and robots… and solar panels 🤔… and probably some other things I missed… oh yeah, robotaxis, which are… um, also cars. Tesla, you see, has become a proxy for the genius of Elon Musk. That is where the public can cast a vote on Elon Musk, every weekday between 9:30 AM and 4:00 PM, not including after hours and pre-market. Tesla’s stock has, since he first appeared at a Pennsylvania rally, awkwardly jumping around the stage behind the President, has become Musk’s political approval ratings proxy. Check out the following chart, then keep reading.

This chart shows Tesla's stock from Musk’s jump-dance (pointer No.1) through yesterday’s close. Pointer No. 2 is when Musk was appointed head of DOGE. The stock’s rise leading up to that point was part of a broader, post-election-win market rally. From Musk’s appearance through its December high, the stock rose by some 100%. In that 4th quarter rise, Tesla experienced a decrease in both revenue and earnings growth, and would see declines in both measures in Q1 of this year. Pointer No. 3 shows the inauguration, after which DOGE got to work rather quickly. The stock was at $424.07 on the day of the inauguration. It would see a -47% drop kkkkin the span of 33 trading days, hitting a low of $221.56 in April. The stock then traded in a choppy sideways pattern until Pointer No. 4, when Musk announced to Tesla shareholders that he would step back from his DOGE involvement and focus on the business of Tesla which was experiencing challenges. That refocus would help the stock rise by some 52% to its recent high. The break up between the once-besties happened at Pointer No. 5. It got ugly yesterday after the close where the tweets between the two could only be rivaled by the salacious details coming out of the Diddy trial (don’t look it up, trust me 🤮).

The best estimates for DOGE’s draconian cost-cutting efforts are $175 billion saved. STOP, I did the math for you–that’s 8.75% of the targeted $2 trillion. Now, that is still a respectable amount of savings 👏, but that also happens to be roughly around the same percentage of the Federal deficit. In other words, some savings is better than nothing, but it would barely put a dent in the mounting deficit.

Earlier in the week, CBO came out with an official estimate that the “One Beautiful Big Budget Act” would cost $2.4 trillion over 10 years. Was this the tipping point for Musk’s frontal attack? The Act would also come at a big cost to Tesla which relies on subsidies that would end if the Act were ratified. Or was it driven by Musk’s bruised ego after having to ride out of DC without having achieved the ambitious goals he publicly set for himself? He came to Washington with ambitious and noble goals and was not able to achieve all of them. That is a story that has been playing out since the founding of the country. Same story, different names. Running the largest economy in the world is no easy task. Is the Government efficient? Certainly not, but one could argue that it is probably as efficient as it–something so complex, with so many diverse stakeholders–can get.

All this theater aside, there is some serious business to contend with. Can lawmakers’ fear of upsetting Elon Musk impact their ability to get the reconciliation bill passed? Elon Musk? Markets have factored in the passage of a stimulative tax package, and if no package is forthcoming, things could get a bit spicy. WHILE YOU SLEPT, cool minds prevailed and it looks like the former pals are going to sit down and have a talk. In the interim, it would seem that both of them would have plenty of other things to get done. Elon, Tesla needs you now, more than ever. Mr. President, get your bill done–the market is counting on it. And if you are planning to go to Washington to fix it, first, please have a look at the chart above 🙃. On second thought, from Musk’s Pennsylvania appearance through yesterday’s ugly close, Tesla’s stock is up by 13.84% and the S&P 500 is up by only 3.27%.

YESTERDAY’S MARKETS

Stocks bounced around on a multitude of news items, ultimately closing in the red as indexes tracked the very public breakup of President Trump and Elon Musk. Weekly employment figures came in worse than expected. Bond vigilantes continue to watch from the sidelines as 10-year yields climbed a modest 3 basis points as political drama unfolds on Twitter/X.

.png)