MY HOT TAKES

-

No matter how you do the math–whatever you call it–consumers and investors pay for the tariffs

-

Japan played the long game—secured its market while appearing to make concessions

-

Inflation numbers are easily misunderstood thanks to base effects

-

The Fed shouldn’t react to short-term price jumps that don’t persist

-

Politicians will scream about inflation that’s already priced in

-

You can quote me: “Tariffs don’t hurt exporters if no one can make it cheaper—consumers just get the bill, and inflation appears as the net result.”

Silly math, again. It’s been a day or two since I have felt the need to talk about tariffs. However, overnight, WHILE YOU SLEPT, the administration announced that it had struck a trade deal with Japan, which is no small feat. Japan, if you recall, was playing hardball leading up to the recently extended July deadline, and for good reason. The Japanese economy is highly reliant on the US. The US is Japan’s second largest export market only slightly behind China. Japan is pretty important to the US as well. The US imported roughly $148.2 billion worth of goods in 2024 making it the 5th largest importer behind Mexico, China, Canada, and Germany (in descending order of US import partners), but to be clear, the US imports nearly 4 ½ times that from Mexico.

Last night’s announcement included a 15% “reciprocal” tariff on imports, including autos. Japan also agreed to invest up to $550 billion in the US, purchase 100 Boeing aircraft, $8 billion in US agricultural products, increase rice purchase by 75%, and raise US defense purchases by $3 billion. Wow, seems like a good deal for the US. Let’s break it down.

Did Japan cave? We can’t look at it from that angle. As mentioned above, it was in Japan’s best interest to cut a deal with the US, its second largest trade partner, or risk losing manufacturing to surrounding countries. Vietnam and South Korea export nearly as much to the US, and Japan sought to secure the lowest tariff possible, which it turns out, was 15%, but it would come at a cost. To be clear, Japan’s financial commitments would only require it to buy products it would already buy, but more exclusively from the US. And that $550 billion would represent an investment in which Japan would get the bulk of the proceeds.

So, what is the cost to Japan? Well, let’s be brutally clear. Tariffs are designed to make imports more expensive, ultimately causing manufacturers and consumers to purchase cheaper goods locally or elsewhere. That is an important distinction–I hope you got it. Goods purchased elsewhere would diminish exports from Japan. Remember, exports increase GDP, so Japan can suffer a GDP decline.

However, Japan can still come out a winner. If competing countries negotiate the same tariff rate or higher than its competitors, the declines may be minimal, if any. Let’s take that a step further. If US-based competitors can’t produce the same import for less than 15% more than the current import price, the US loses.

Let’s look at a real example. Japanese watch company Seiko manufactures, amongst many things, its iconic “Arnie” divers watch (named after Arnold Schwarzenegger, who wore it in his 1980’s blockbuster films) in Japan. This new tariff may add an additional 15% to the price of the watch. Importer-retailers will either make 15% less margin or they will charge the consumers 15% more, and because of low margins, consumers are likely to get the price bump. This provides an opportunity for a competitor to make a similar watch that is lower-priced than the newly-hiked price. But the question is, can a local business compete and deliver a substitute and still make a healthy margin? Not likely, so consumers are likely to just bear the increase, making the importer whole, and Japanese exports… unchanged. I’ll be back… with a final thought on this, keep reading.

Now that we broached the topic, isn’t a 15% increase in the price of goods inflation? And isn’t it true that inflation now tops the list of the most dangerous perpetrators to the American economy? Well, the answers to those questions are “yes,” and “yes.” But, it is not that simple. Inflation–the word–literally refers to a change in price from a year earlier. If the watch is 15% more, watch inflation is said to be 15%. That’s bad, but not what economists are really worried about. They are worried that prices will continue to go up.

Here is an example. If the watch was $435 last summer and it now costs $500 because of tariffs, that is base inflation of 15%. If the watch remains $500 for the next 12 months, it will always be 15% more than a year prior. But guess what, here is a little secret. On month 13, if the watch is still $500, its base inflation will fall to 0%. That is called the base effect. The price of the watch may not change at all for the next 12 months after the initial increase and inflation will still register 15% in the interim; politicians will be screaming! No change in price. It’s just math, silly.

Let me complicate it, to make it even more realistic. Let’s say that in month 6, the watch’s retail price goes up to $510. In that very same month, the watch will be 17% more than a year earlier–17% inflation! Politicians will certainly be enraged for the next 6 months. Assuming that the watch stays at $510 for the next 6 months, that inflation number will persist and likely be called “sticky.” But guess what happens in month 7 after the $10 increase? It will only be $10 more than a year prior and its inflation calculation will be… … wait for it… 2%. Right on target! Still, 6 months beyond, it will drop to 0%, if the price remains unchanged. It’s just more math, silly.

Why did I just go through all that? To show you the difference between persistent inflation and transitory inflation. Remember transitory inflation is just a one-time increase, while persistent inflation is a continuous increase. Both cost consumers more money and are not good things, but transitory inflation is not considered insidious, because it goes away on its own, over time, and the Fed would not likely modify its rate policy for transitory inflation.

So, to sum it all up. Japan cut a deal which may not ultimately impact its exports. US importers, and ultimately, the consumer will end up paying the 15% tariff. It will cause transitory inflation–that is, prices on Japanese imports will cost 15% more than a month earlier FOREVER, but will only register as 15% inflation for the next year (assuming no more price increases). Who wins and who loses? Boeing wins, rice farmers win, US defense contractors win, and commodities farmers win. Consumers lose, because they will pay 15% more for their Seiko “Arnie” watches. BUT WAIT A MOMENT! There is an American company, Luminox, that makes competing watches (substitutes, if you like). But there is a problem, it manufactures overseas, so it will likely have to pay import tariffs as well, and that can only mean one thing: inflation–but only for the next 12 months.

YESTERDAY’S MARKETS

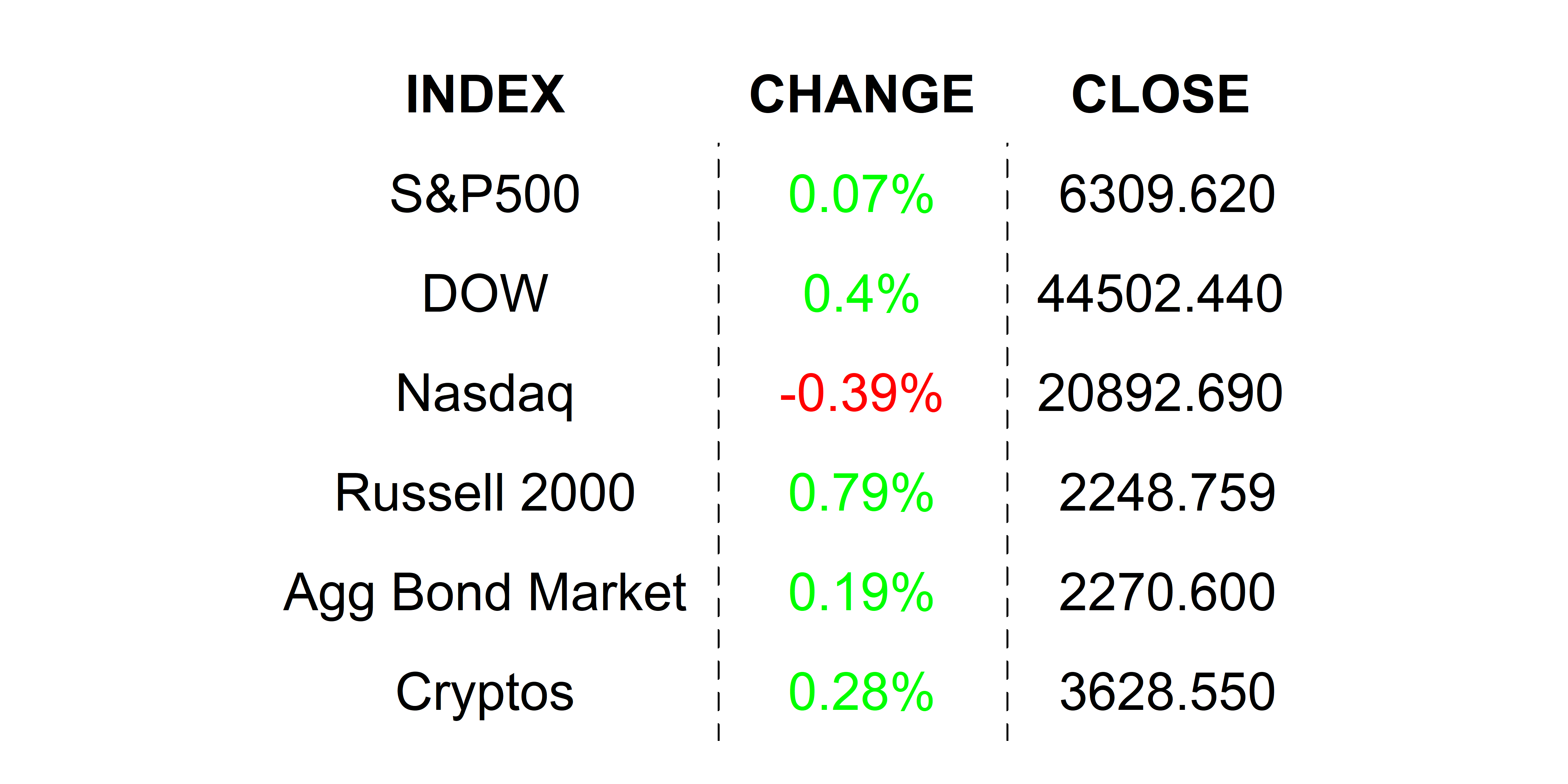

Stocks had another mixed, flattish close yesterday on mixed emotions on the first large-haul day of earnings–more of that today. In those earnings, investors got their first taste of tariff-based margin compression in the General Motors release. The first of the MAG-7 earnings come tonight after the close and investors are on the edges of their seats.

.png)