Stocks took a beating yesterday after a key manufacturing gauge disappointed… again. Chips were hit hard because they are an easy target – taking profits is not as hard as taking losses when the market is in turmoil.

The gears of the economic machine. Have you ever seen this emoji 🏭? Too small for you to recognize? It’s a factory. We used to see pictures similar to this one quite often. Smokestacks were a sign of economic growth. Industry! Since the 1980s we have seen less and less of those pictures, haven’t we, and it’s not because everyone is “going green” and smokestacks give the impression of pollution. No, it is because the services economy in the US has rapidly overtaken the goods producing one. Remember, services are not just manicures and auto repair. It is healthcare, banking, accounting, consulting, and so forth. We know, as a rule of thumb, that those things are all around us while manufacturing has largely gone offshore, and at an increasing pace since the 1980s. Never mind heuristics, I can tell you that manufacturing only makes up about 11% of US GDP.

So, does that mean that we should ignore the health of the manufacturing industry when examining overall economic health? I know the answer to this question, but I spent a lot of time searching for real numbers this morning, so I am going to keep it brief. Let’s step back for a minute. In the initial pandemic surge, there was lots of focus on manufacturing as manufacturing facilities struggled to keep their shutters open largely due to the fact that factory laborers generally need to be onsite. That means, work from home was not a viable option. Therefore, manufacturers were the first to really take it on the chin during the lockdown days.

As soon as workers started to return to factories, improving their prospects, focus rapidly shifted to services employees, specifically those that couldn’t work from home. At that point, there was no looking back at manufacturing. All eyes were turned on inflation… specifically, services. And they still are. So then, why in the world would anyone care about some arcane manufacturing PMI? I will show you one busy chart that will not only answer that question, but it will also tell you why the markets got trounced yesterday. Take a look and follow me to the close. Please look at the chart 🥺.

I know, there is a lot there, but here is the gist of it. When interest rates have gone up (green dashed line), manufacturing PMI has gone down (blue solid line), and ultimately recession (red shaded areas) has ensued. That should make sense considering how sensitive manufacturing is to interest rates. To clarify, a manufacturing PMI, or Purchasing Managers Index, is the result of polling real purchasing managers working in factories on New Orders, Production, Employment, Inventories, and Supplier Deliveries. They are asked if conditions in those areas have improved, stayed the same, or worsened. Throw some magic math at it and you get what is called a diffusion index. All you need to know about it is that if the number is above 50.0, manufacturing is expanding, and numbers below mean that it is contracting. You may have noticed that I pointed that out in yesterday's note in the NEXT UP section 😉.

Well, as you can see quite clearly by the chart above, the blue line, which is ISM Manufacturing PMI, has rapidly declined since 2021 and fell below 50 in October of 2021 where it remained, except for once (50.3), earlier this year. Since then, we have had 5 readings in a row below 50. In case you haven’t noticed, recently, the market has been a bit jumpy when it comes to economic performance. There are still some very fresh wounds from the selloff in early August where you may recall a weak employment number combined with weak PMI numbers got investors worried that the Fed had missed its mark to lower interest rates and prevent a recession. Now you remember. Well, then you shouldn’t be surprised that yesterday’s ISM Manufacturing PMI miss caused a painful selloff. Further, and finally, the series’ New Orders metric declined from 47.4 to 44.6. New Orders, as you might guess, is considered a leading indicator of manufacturing health. Manufacturing may only represent some 11% of GDP, but its health is a critical indicator of the overall health of the economy. If you don’t believe, look at the chart again.

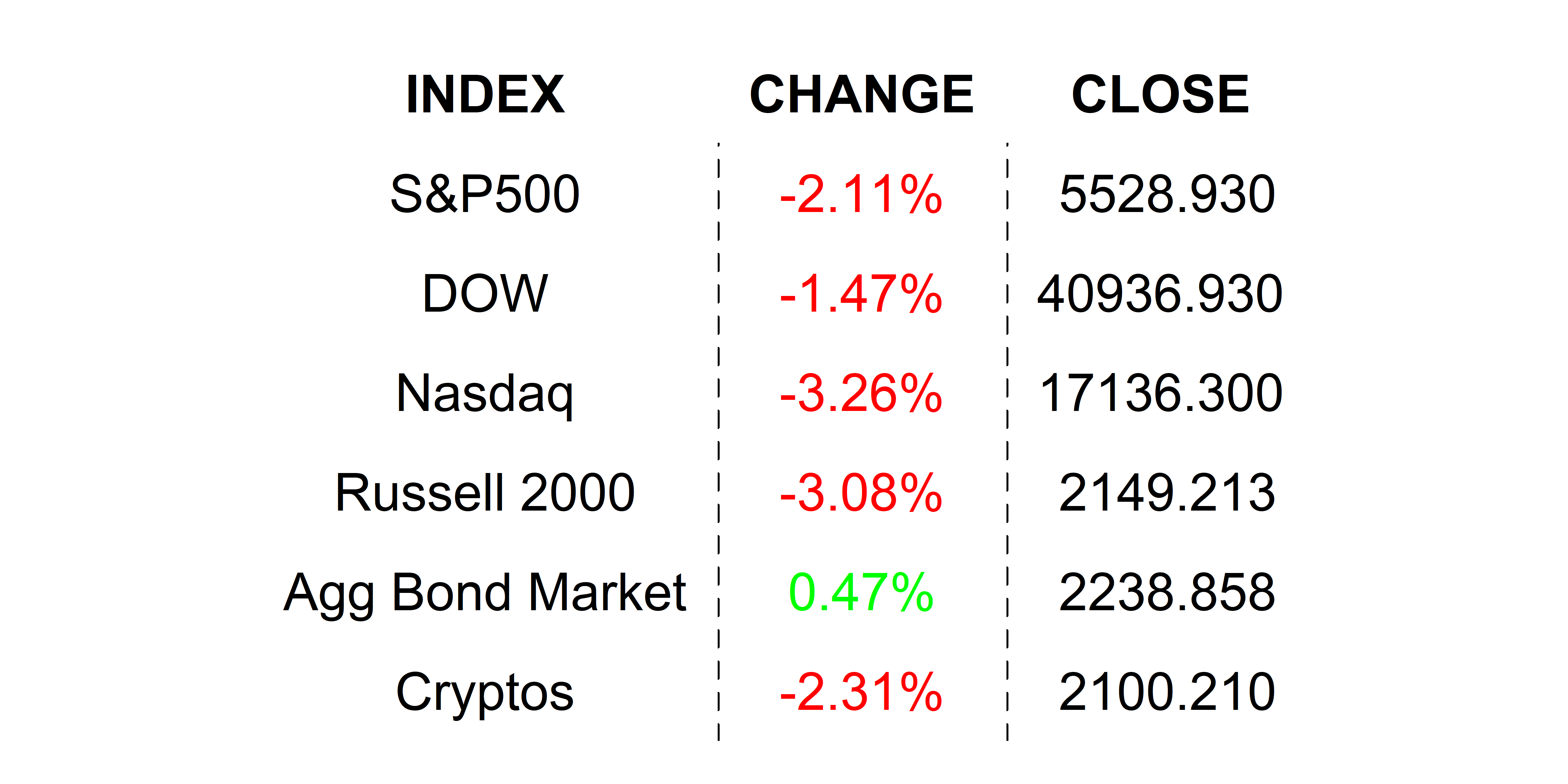

YESTERDAY’S MARKETS

NEXT UP

- JOLTS Job Openings (July) may have declined further to 8.1 million from 8.148 million vacancies.

- Factory Orders (July) is expected to have grown by +4.8% after declining by -3.3%. If you learned anything from above, don’t ignore this number… NBER, the folks who determine where we are in a recession or not look at this number 😉.

- Federal Reserve Beige Book will be released this afternoon reporting the health from around the various Fed districts.

- This morning, Dick’s Sporting Goods and Ciena beat on EPS and Sales, while Dollar Tree missed. After the closing bell, we will hear from Hewlett Packard Enterprise and C3.ai.

.png)