The wealth effect, confidence, and how the markets just sent a screaming message to D.C.

KEY TAKEAWAYS

- The market experienced an 8.5% intraday swing—one of the largest in history.

- Triggered by new tariffs and a false rumor of a 90-day delay.

- Traders panicked early, then rallied hard before settling into modest losses.

- The volatility reflected deep concern over economic damage from trade policy.

- The market’s reaction may have influenced subtle shifts in White House posture.

MY HOT TAKES

- The Administration has underestimated how much damage tariffs can cause.

- Market reactions can serve as a warning shot to policymakers.

- Stock market volatility isn’t just noise—it affects real economic behavior.

- The President may not care about Wall Street, but Wall Street cares about him.

- We should be more aware of the feedback loop between markets and the economy.

- You can quote me: “...markets can become a self-fulfilling economic prophecy.”

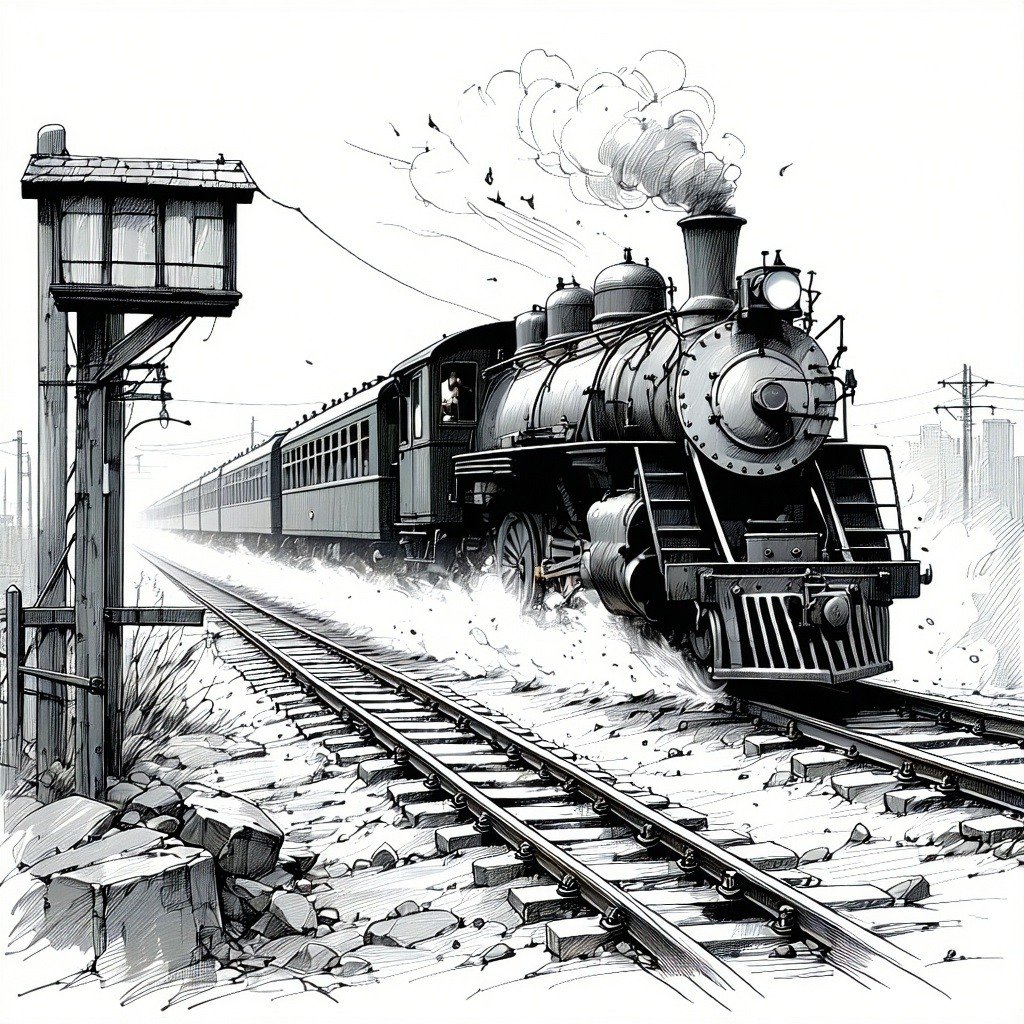

Runaway train. You have probably seen an old black and white movie where a train is steaming down the tracks and the conductor yanks on a lever (probably the brakes) and it detaches, leaving the conductor in a bit of a nasty situation, running headlong into disaster. That is how many of us felt yesterday in the early hours of the morning seeing the massive declines that would be teed up for the morning’s open. Despite much weekend discussion and research, it was clear that the Liberation Day tariffs were very real and that they would be very costly to consumers, companies, and the economy.

As for the equity markets, traders appeared to be out of options once it became clear that the Administration was doubling down when Treasury Secretary Bessent showed up to his Sunday morning Meet the Press interview having clearly forgotten his economics textbook at home. The brake lever was not attached when the morning bell rang at the iconic New York Stock Exchange yesterday morning. No trader would dare to try and fill the trade gap between Friday’s close and Monday’s open. It was a wait and pray event.

Stocks initially fell at the open prompting more than one exhausted trader to issue “sell all at market” orders, which would turn out to be… well, kind of… er, badly timed, because by 10 AM, the market shot up like a rocket straight into positive territory. This was clearly not just the market buying the dip. I can tell you that just about every trader, large and small, scrambled to figure out how the Big Index managed a 8.4% swing between 9:42 and 10:17. It turns out that a rumor surfaced, which suggested that the President was considering a 90-day delay on the tariffs. The White House was quick to label the news as “false,” and stocks quickly dropped back into losses, albeit not quite as deep as they were prior to the rumor emerging. In bonds, 10-year Treasury Note yields jumped by some 15 basis points as the affair played out. Stocks ultimately closed well off their session lows with lots of volatility, and bond yields closed markedly higher.

Once the closing bell did its duty and traders spilled out of the exchange, most to local bars 😉, discussions were focused on how the session felt reminiscent of trading in March of 2020, October of 2008, or even worse, October of 1987. For the record, those daily declines looked like -9.51%, -9.03, and -20.46%. To be clear, it wasn’t about the close, as the S&P only gave up some -0.23% yesterday. No. It was about the large 8.5% intraday swing, which incidentally would make the top 5 biggest for the S&P 500.

What this shows is that the market does not approve of the Administration trifling with international trade, especially when American companies and consumers are left to pay the tab. Now, as we have all been reporting these goings-on over the past week, we have slipped back and forth between the economy and markets. Given yesterday’s wild market ride, the question begs are the markets and the economy one in the same? That is just one of the topics addressed in my radio interview on BBC World Service last night with host Rahul Tandon. Tandon queried “the markets aren’t the economy, are they?” Unfortunately, it was another guest's turn to respond to which he said that the markets, in some way, predict where the economy is going. I agree, but I would like to clarify my thoughts on the matter. Markets attempt to predict where the economy is going. Markets can be wrong! If I were asked the same question, I would say that markets can become a self-fulfilling prophecy.

What do I mean by that? Well, there is lots of great academic research on how market performance impacts consumer behavior. Many today refer to the wealth effect of rising stock markets. Very basically, as markets rise, they create wealth, and that creation of wealth raises investor sentiment, ultimately leading to consumption, and economic growth. Seems logical, right? The seminal research on the topic dates back to 1954 (Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. Franco Modigliani, 1(1), 388-436.). For a more expansive take on the impact of confidence, Akerloff and Shiller (Akerlof, G. A., & Shiller, R. J. (2009). Animal spirits: How human psychology drives the economy, and why it matters for global capitalism. Princeton University Press) explore how human psychology—emotions like fear, confidence, and fairness—shapes economic decision-making and drives market outcomes. By the way, all three authors are Nobel Laureates, so, I would say, they are probably onto something. We also know through other literature (Fisher, K. L., & Statman, M. (2003). Consumer Confidence and Stock Returns. The Journal of Portfolio Management, 30(1), 115–127.), that even the 39% of Americans who don’t own stocks adjust their purchasing habits when markets are in turmoil.

Well, it appears that the President is aware of this fact as well. Though his recent behavior of waving off stock market reactions to his tariffs suggest that he is less concerned than many had hoped (including me), it appears that perhaps, he has taken note. Through very subtle body language, the President has sent a message to the markets, and you are likely to see the results of that today. Now, does that mean that the economy is out of hot water? Absolutely not. These tariffs, if they stick, will cause economic decline and inflated prices. In fact, I would argue that there has already been damage done, but not irreversible. We must, for now, be satisfied with the fact that the markets have sent a message to the President, and he has received the message. How and if he acts on it will determine whether that steaming train will crash into the station.

YESTERDAY’S MARKETS

Stocks went on a wild ride yesterday, initially poised to be a “Black Monday,” shares briefly turned around on a social media rumor that tariffs would be delayed but ultimately dipped back in the red when the White House labeled it as “fake news.” Shares recovered some losses and ultimately closed mixed to slightly lower–all still driven by the shock and awe of Liberation Day tariffs. Bond yields spiked aggressively on the rumor but did not recede once equities resumed their decline leaving traders scratching their heads.

NEXT UP

- NFIB Small Business Optimist (March) declined to 97.4 from 100.7, missing estimates.

- San Francisco Fed President Mary Daly will speak today.

.png)