If you think tariffs caused June CPI to rise, you’ve been misled.

KEY TAKEAWAYS

-

CPI rose +0.3% in June, but the primary driver was Core Services, not tariffs

-

Shelter (housing costs) remains the largest inflation contributor

-

Tariff-sensitive categories like Core Goods and Food showed only slight increases

-

Items like household furnishings and coffee may hint at early tariff effects

-

Tariff-driven inflation is still a looming threat—but hasn’t arrived yet

MY HOT TAKES

-

Mainstream media continues to oversimplify inflation headlines, leading to public misinformation

-

Shelter-driven inflation is still the Fed’s biggest problem, not tomatoes

-

Tariffs haven’t meaningfully hit CPI—yet

-

Coffee may be the first real signal of tariff inflation sneaking in

-

The truth takes longer to brew than a cable news soundbite

-

You can quote me: “Blaming tariffs for June’s CPI increase is like blaming your dog for the stock market—technically possible, but wildly inaccurate.” 🐶

POV. I woke up this morning within minutes of the same time that I always wake up–no alarm needed. I glanced at the clock and smiled to myself as my perfect record still held, though it is nothing to be proud of. Glasses, phone, undrunk cup of water: check. Glanced at the dog: sprawled out at the end of the bed, giving me side-eye. I headed downstairs to the kitchen and went straight to the espresso machine. It IS about the process ☕ and, of course the caffeine. Checked markets and email while beans ground. Futures: down. Treasury yields: unchanged. Aerated / fluffed grinds, smelled the fresh grounds, two taps on the mat, distributed, tamped down with 22 pounds of pressure, cleaned the rim of the portafilter basket, checked pressure, and pressed go. While the magical jet-black elixir streams into my cup, theorized on why markets were down. Espresso was done and the aroma was otherworldly. Eloise the dog (Cavapoo) sauntered down the steps, stretched, and headed to the garden door. Let Ella do her thing while espresso number 1 was consumed. Ella back, treat distributed, prepared espresso number 2. Headed over to TV to take in 5 minutes of local news. It is not even local news but rather some sort of filler news show where they test out future anchors–I like to compare my teleprompter skills. 😉

This morning the headline story was something like “tariffs caused inflation to tick up.” B-roll footage of containers being offloaded from a cargo ship with an unflattering picture of President Trump angrily pointing at something. I afforded myself 10 minutes tops before I head to my office and start my morning research. I had to hear this story–likely the reason for the lower futures. As expected the report didn’t say much other than that the Consumer Price Index / CPI rose by +0.3% last month caused by tariffs. Now, I don’t know how many people are awake at that ungodly hour, nor do I know how many people were watching, but whoever was would most likely have walked away… well, misinformed.

The Bureau of Labor Statistics released June’s CPI report yesterday morning at 8:30 AM Wall Street Time. It did, indeed, indicate that prices rose by 0.3% last month, but the headline number only tells us the symptom and not the cause. Was it really caused by tariffs? To be clear, we know that tariffs are inflationary, and because there are currently tariffs in force, inflation is bound to show up at some point. How much and how long it may last is the real question that needs to be answered. The fact is, that tariff-based inflation has not really shown up yet. Would June be the first? Let’s dig in. To start, have a glance at my favorite Bloomberg ECAN chart. Just look, it will save me 1000 words.

This chart shows CPI and its major components. The white line is headline CPI while the light-blue line is Core CPI. You can see how it spiked in 2020 and slowly–but surely–decended to where we are today, still in a shallow decline. You can see how the lines tickled up in June along with the stacked bar. The gold bar, which represents the majority of the inflation number, is Core Services. You will notice that it has, in fact, been the major driver of inflation since mid-2021. You also know this BECAUSE YOU READ MY NOTE. This is the “sticky” inflation that we all talk about, every month. The largest contributor to services inflation is Shelter aka housing cost. It makes up almost 60% of service inflation. The next two are Medical Care and Education, each contributing about 10%. Housing costs have been the nemesis of the inflation-fighting Fed, and you don’t need to be a regular reader to know that. The good news–if you can even call it that–is that it has been receding, BUT REALLY, REALLY SLOWLY. Overall Core Services have been slowly receding but ticked higher last month for the first time in many months. This was a big factor in yesterday’s so-called inflation increase. But what could have caused it? Well, certainly NOT TARIFFS.

No. Tariff-based inflation is likely to be found in Food and Core Goods. On the chart above, those are represented by the blue and purple bars. What’s that? You can barely make those out? Exactly. But let’s dig further. They both did, in fact, increase last month, and together they make up nearly ⅓ of inflation. Digging further yet, most categories declined last month with notable exceptions in Used Cars, Tires, and Household Furnishings. Could it be tires? No, because about 75% of US tire consumption is domestically produced. Used cars, it can be argued, may have increased due to stronger demand as new car prices may be on the rise…BUT ALAS, New Vehicle prices disinflated last month, despite an existing, but highly complex tariff. Now Household Furnishings, I will give you. A lot of those are, indeed, imported, and that category does account for 3.4% of core goods inflation.

Moving on to food. A surprising amount of what we eat on a daily basis is not domestically produced. Many fruits and vegetables are imported from Mexico, Canada, and South America, however, currently the only tariffed produce is Mexican-grown tomatoes. Stepping back, one would note that food inflation has been on the rise SINCE LAST AUGUST, and it has risen only moderately since Trump took office.

Now you are armed with some facts. Has this latest increase in inflation been caused by tariffs? The simple answer is NO. If we want to get technical, we have witnessed some very subtle changes in household furnishings and possibly… tomatoes. Now, let’s be very clear. This doesn’t mean that inflation won’t pick up at some time in the future. To be clearer yet, we have no idea if food and furnishings will continue to display inflation or whether the subtle changes were transitory, OR CAUSED BY NATURE (like crop yields).

Right about now, I begin to ponder my third–YES THIRD–espresso of the morning. But wait, I did notice that Coffee prices inflated last month in the CPI report. Most coffee consumed in the US comes from Brazil and Vietnam. Those countries stand to be walloped with huge tariffs on August 1st, but at current, coffee is only subject to the 10% base tariff. It seems quite feasible that coffee prices have increased due to tariffs. That is disappointing, but it is not going to stop me from downing my third cup. I need to be sharp so I can focus on tariff-based inflation, which will come… at some point, but it’s not here yet. When? We still don’t know. How long it will last… also, still up for debate.

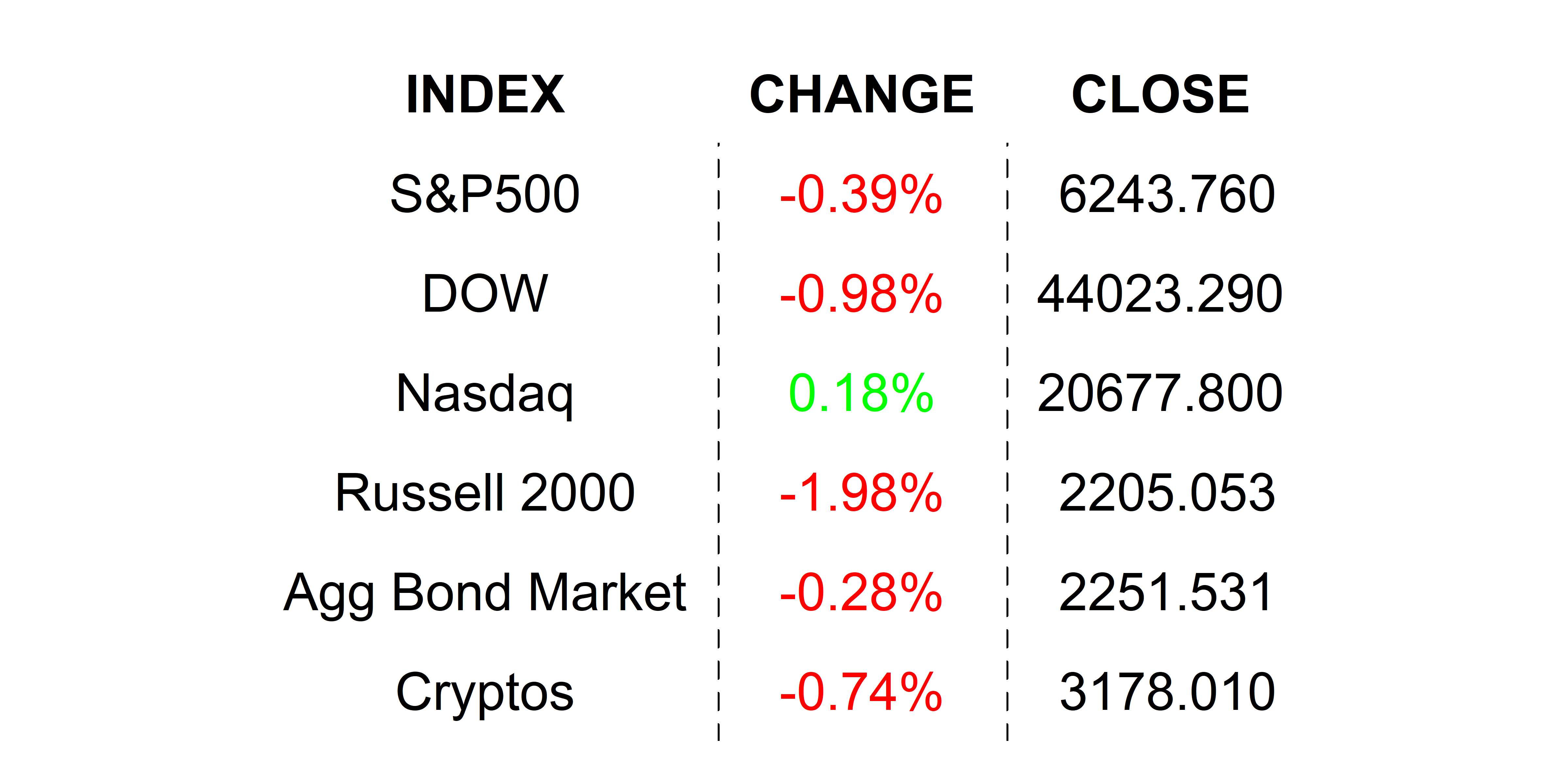

YESTERDAY’S MARKETS

Stocks declined yesterday on a hotter-than-expected headline inflation figure. Tech was a bright spot in yesterday’s markets rising on news that NVIDIA may be able to start selling its H20 chips to China again. Bond yields climbed on the inflation news.

NEXT UP

-

Producer Price Index / PPI (June) may have slowed to 2.5% from 2.6%. This is considered a leading indicator for yesterday’s number.

-

Fed Beige Book will be released this afternoon. It is likely to reflect little change from its prior release.

-

Fed speakers: Barkin, Hammack, Barr, Bostic, and Williams. That’s a lot of grey suits!

-

Important earnings today: Prologis, Progressive, J&J, PNC, BofA, Goldman Sachs, Morgan Stanley, Alcoa, UAL, and Kinder Morgan.

.png)