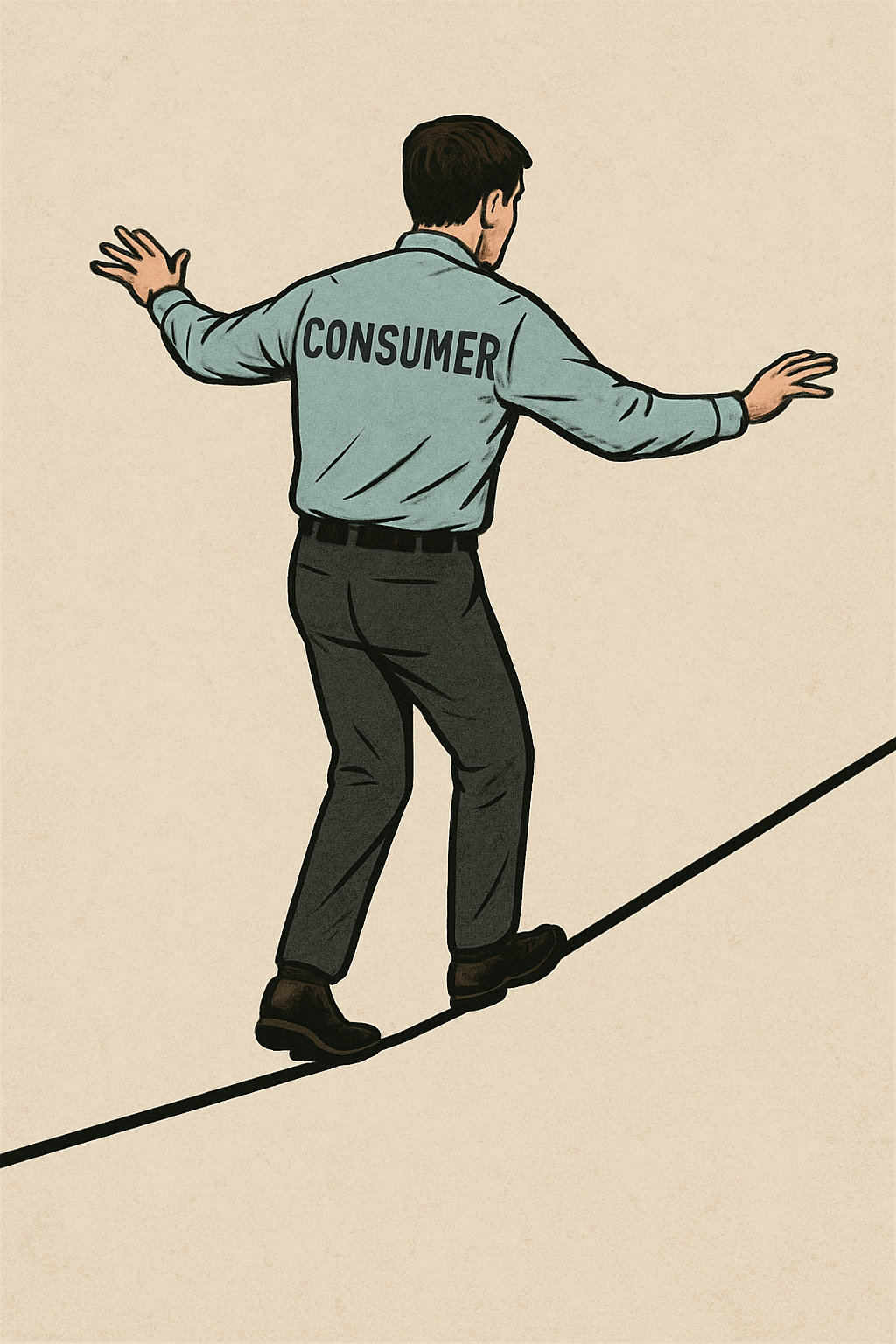

Confidence is plunging, expectations are crashing—what’s next for the economy?

KEY TAKEAWAYS:

- Consumer confidence is now at 86.0—its lowest level since May 2020.

- The Expectations Index dropped to 54.4, the lowest since 2011, with rising fears around jobs and inflation.

- Survey data shows rising concern over prices and geopolitical uncertainty.

- Job openings declined to 7.192 million in March from 7.568 million in February.

- Confidence is slipping across political affiliations, though unevenly.

MY HOT TAKES:

- Consumer confidence is necessary but not sufficient for economic strength.

- Expectations are more telling than headline confidence numbers.

- Surveys have limitations—but they still reveal useful sentiment shifts.

- Hard data like job openings should be monitored in tandem.

- The market might look fine, but consumer psychology is quietly shifting.

- You can quote me: “It’s not time to bury canned foods in your backyard, but it should put us on notice that things can get worse.”

Down and troubled? What were you doing in May of 2020? Were you stocking up on toilet paper and desperate to get hand sanitizer? Were you trying to find a quiet corner in your home to work after your company shut down its offices? Like many Americans, were you asked to take a cut in your income? Let me remind you that COVID, by the start of May, had claimed 6.264 million lives already. There were meat shortages. Grocery shelves were empty, and we were disinfecting packages in our yards. We were cut off from friends and extended family. Misinformation about COVID was rampant, adding to the stress. Most were worried for their lives. The unemployment rate spiked to 14.8%! The Bureau of Labor Statistics reported in the month before that 20,471,000 nonfarm payrolls were erased. Jobs were lost. Two months earlier the S&P 500 lost some 34% in a matter of weeks. Stocks would begin to recover in April but were still off their February levels by around 14% at the start of May. Now do you remember? That was a pretty grim time, wasn’t it.

Were you confident? Were you concerned about your finances and your job? Were you planning lavish vacations or buying new cars? It turns out that you were NOT confident, at least according to the Conference Board’s Consumer Confidence Survey in May of 2020. The index was at 85.9, down from 130.4, where it started off 2020. April marked the low of the pandemic at 85.7, and the index began a choppy recovery thereafter reaching a height of 128.9 in 2021 as prospects looked up–the world was reopening, but not without some cost, literally. Inflation was on the climb, and it was starting to hurt. By the end of that year, the Fed pivoted from friend to foe, promising rate hikes. We had no idea just how intense those hikes would be in the following year. Confidence crumbled once again as the stock markets took a drubbing and inflation continued to spike. By summer, the index fell back to 95.3. That would be a low in a jerky sideways movement that spanned 2023 and 2024… until 2025. This year would feature four successive declines to yesterday’s reported level of 86.0, the lowest level since… well, May of 2020.

The index is broken down into confidence on the present situation and expectations. Confidence in the present situation slipped to 133.5 from 134.5, but the starkest declines came in expectations which fell to 54.4 from 66.9, the lowest level since October 2011. Breaking that down further, only 15.7% of respondents expect business conditions to improve beyond six months, while 32.1% expect fewer jobs to be available, representing a 16-year high. Median inflation expectations for the next year topped 6%, up from the prior month’s 4.9%. Open-ended survey questions showed that rising prices (especially on food and groceries) and geopolitical tensions weighed on confidence.

So what does this all mean? My regular readers know well my oft-quoted “confident consumers consume” mantra. Anecdotally, this is true, however many argue that consumer confidence is a “soft” number, and that it is not a statistically strong predictor of recessions. There is research from NBER (the guys responsible for labeling recessions) and the Fed (the guys who often cause recessions) that suggest that the expectations index is a strong indicator of economic activity over the next 6 months. The Conference Board, who publishes the number, sees Expectations Index readings below 80, and especially below 60 as being aligned with elevated recession risks. So, I guess that 54.4 14-year low Expectations reading would be considered… um, not great.

Now, it is important to remember that these numbers are based on surveys, which we have learned in the past several years, have the ability to fool us. For example, just yesterday, I was on Mornings With Maria on Fox Business and one of the panel members mentioned that the University of Michigan Sentiment was politically biased against Republicans. It is true that there is a vast difference in confidence based on political party. The most recent reading on Michigan sentiment fell to 52.2 from 57.0. If we look below the surface, Republican respondents showed an increase in overall confidence to 90.2 from 87.4, however if you look at the Expectations component, even Republicans are losing confidence, though far less than Democrats and Independents.

While I think that confidence is a good leading indicator to follow, it cannot stand alone in predicting economic downturns. I can’t tell you how many times recently that I have been at a store or a swanky restaurant only to see what looked like absolute exuberance. My wife, who is a regular reader 😉 and is well-aware of my obsession with consumption indicators, has said to me time and again, “this does not look like consumers are losing confidence,” and she is correct. Consumer Confidence is a complex number to calculate and often demonstrates large discrepancies between income class, age, political affiliation, and so on. However, if we are careful, we dig further and combine it with other “hard” data points, we can get a good idea of what to expect.

An example of “hard” data is, of course, unemployment. When layoffs occur, or the labor market slackens, consumers tend to spend less money for obvious reasons. Yesterday we got the JOLTS Job Opening numbers which showed that there were 7.192 million job openings in March, down from 7.568 million vacancies in February. Now, I heard a guest on a show that I will be co-hosting later this week 😉📺 say that there were some 12 million job openings right after the pandemic, implying that 7.1 million was a low number. Well, first that is still relatively high based on the history of the number and also just around where it was prior to the pandemic. What the guest should have pointed out was that the number is from March and that there is a high likelihood that the number will start to reflect tariff-panicked company’s freezing hires in coming months. This is not a leading indicator, but it is a stable series, so if indeed it does start to show marked declines, we can more confidently predict a slackening of the labor market, and that is certainly a driver for economic decline. If you don’t believe me, just ask the Fed why labor market health is one of its two sole reasons for existence.

Consumer confidence is necessary for a strong economy, and that confidence in many ways is declining. Does it portend a recession? Well, not with enough statistical significance for me to recommend that you bury canned foods in your backyard, but it should put us on notice that things can get worse. How much and how soon, I suspect, is in the hands of the President and, of course, the Fed. It’s going to be a long… hot summer.

YESTERDAY’S MARKETS

Stocks managed to recover early setbacks on comments from Commerce Secretary Howard Lutnick that “he” was close to closing on a trade deal–few details beyond that, but it was enough to spur equities into a 6th straight gain. Confidence declined, job openings evaporated, and 10-year Note yields gave up yield.

NEXT UP

- ADP Employment Change (April) showed that 62k new jobs were added, missing estimates of 115k and down from March’s 147k additions.

- Annualized Quarterly GDP (Q1) showed that the economy contracted by -0.3% worse than estimates and last quarter’s robust 2.4% growth.

- PCE Price Index (March) is expected to have declined to 2.2% from 2.5%.

- Personal Spending (March) may have increased by 0.6% after climbing by 0.4% in February. Watch this one closely–it IS a leading indicator of GDP, but a rise may be a result of the pre-tariff buying surge.

- Personal Income (March) probably rose by 0.4% after increasing by 0.8% in the prior period.

- Pending Home Sales (March) may have declined by -5.75% after falling by -7.2% in the month before.

- Important earnings today: Humana, International Paper, Generac, Stanley Black & Decker, GE HealthCare, Norwegian Cruise Lines, Caterpillar, Martin Marietta Materials, Vulcan Materials, ADP, Super Micro, Yum! Brands, Etsy, Newell Brands, Hess Corp, Wingstop, Western Digital, American Water Works, KLA Corp, Equinix, Align Technologies, Meta, Bloom Energy, Microsoft, Annaly, VICI Properties, Albemarle, MetLife, eBay, Teladoc, and MGM Resorts.

.png)