Stocks had a mixed close yesterday after a private US jobs figure missed estimates igniting further fears that an economic downturn is looming on the horizon. Weekly jobless claims came in more or less on expectation further clouding the market’s perception of labor market strength.

What’s in a number. Let’s call 73 “blue chip” economists and ask them what they think this morning’s highly anticipated Nonfarm Payrolls number is going to be. This is not a normal month. The NFP, its street name, is always a closely watched number, but at this key inflection point for the Fed, the number has been teed up as THE data point that could determine whether the Fed cuts interest rates by -25 or -50 basis points later this month. In fact, traders have even begun to consider the path of rates beyond, through the end of the year – there are only 2 meetings after this one.

I am sure that you would not be surprised if I told you that the market has been quite volatile over the past… month. WAIT, wasn’t it the July payrolls report that came out on the first Friday of August that first ignited this nagging, panicky feeling? Indeed, it was, my friends. The VIX Volatility Index, also known as The Fear Gauge, spiked big time in early August. To be clear, the Yen unwinding trade played a role in that initial spike, but it was the weak employment situation that really set the groundwork for the move, and despite the VIX settling down by mid-month, that fear of an economic downturn has not left the minds of traders. Since earlier this week, the VIX has been over 20, after a weaker-than-expected manufacturing PMI spooked traders.

Let’s run through the lead up to this volatility. Inflation was high. Not just too high, but really, really high. The Fed sprang into action, according to many, at least 6 months late. Hindsight is 20/20, especially on Wall Street, but many were calling for the Fed to act at the time, INCLUDING ME. Regardless, the Fed ratchetted rates up, threw more cold water on the market with Quantitative Tightening, and then waited and watched. The US economy, the largest in the world, doesn’t exactly turn on a dime. Inflation remained sticky, but it eventually came to heal, all except services. Specifically, housing and healthcare. Housing, in my estimation, and I have been quite vocal about this, needs LOWER rates, not higher in order to allow rent inflation to cool. And healthcare costs… well, it’s not clear that decreased demand is even an option, which means higher interest rates are not likely to affect those. Still, those sticky corners of inflation have been trending downward, albeit slowly. With inflation getting back to normal, the Fed could shift its focus to the health of the economy. You see, those restrictive rates are designed to slow the economy. The trick is not to let it slow too much to the point where it stalls and crashes into a recession. The Fed has a long track record of doing just that. Hopefully this time, it will be different.

The economy has shown signs of losing altitude but only in a shallow glidepath, which gives the Fed some room to maneuver and attempt to get it just right. Sounds good, but the reality of hitting +2.00% inflation, 3.5% unemployment, and +3% GDP all at once is not really a reality at all. There is no “just right,” but close enough. At this point the Fed has been backed into a corner with an increasing amount of handwriting on the wall; almost the complete opposite of the early stages of inflation where policymakers failed to act decisively. The Fed has drawn a line in the sand… not on inflation, but employment. This makes sense as it is part of its mandate. That said, the employment situation in the US is beginning to show signs of decay with the last monthly employment number crystallizing that challenge. The Fed responded in words reflecting its shared concern. All that will come to a head when the FOMC meets on September 17th and 18th to discuss policy, and that is not an if proposition, but rather a how much according to most. Between now and then, the Fed will have one more inflation report (next week) to ponder, and more importantly (IN CASE YOU HAVEN’T ALREADY CONCLUDED), this morning’s monthly labor report. Yesterday’s ADP Employment Change big miss only intensifies the scrutiny that will be given to this morning’s official release.

So, what will be an acceptable number for the now, clearly nervous equity market? What will satisfy traders for almost 2 weeks as we await the next FOMC meeting? Remember those 73 economists? Why not ask them, it is after all, their jobs to come up with forecasts. So here is a chart (thank you Bloomberg) of what those 73 spreadsheet jockeys are expecting. Grab a quick look then follow me to the finish.

There you go, that is how we come up with the consensus estimate. You will see that the median expectation is for +165k new nonfarm payroll adds for August. The median is simply the middle value of the full range of estimates. If you just eyeball the chart, you will notice that the distribution of observations is pretty widespread, spanning over 100,000 jobs from low to high. You will also notice, if you are a statistics geek (like me) that the standard deviation is pretty big. All that means… REALLY, is that there is clear collective vision on where the number will come in. You can see, on the histogram, that the 2 largest consensus groups (bins) are the same. One group thinks the number will be 160k and the other 176k. Based on the market’s behavior yesterday and in this morning's premarket, it is pretty clear that traders are hoping for a number of 165k or higher. Any lower is sure to further increase the risk-off trade. That is a fancy way of saying “selling.” In the wake of that, it will be in the hands of Fed policy makers John Williams and Cristopher Waller, who are scheduled to speak in the wake of the release, to quell the markets. Williams is scheduled to speak right after the release before the market opens and Waller will speak at 11:00 PM Wall Street Time, which is likely where the market will focus for some color. Christopher Waller, by the way, is known to be slightly hawkish, and he is a voting member. Buckle up, my friends.

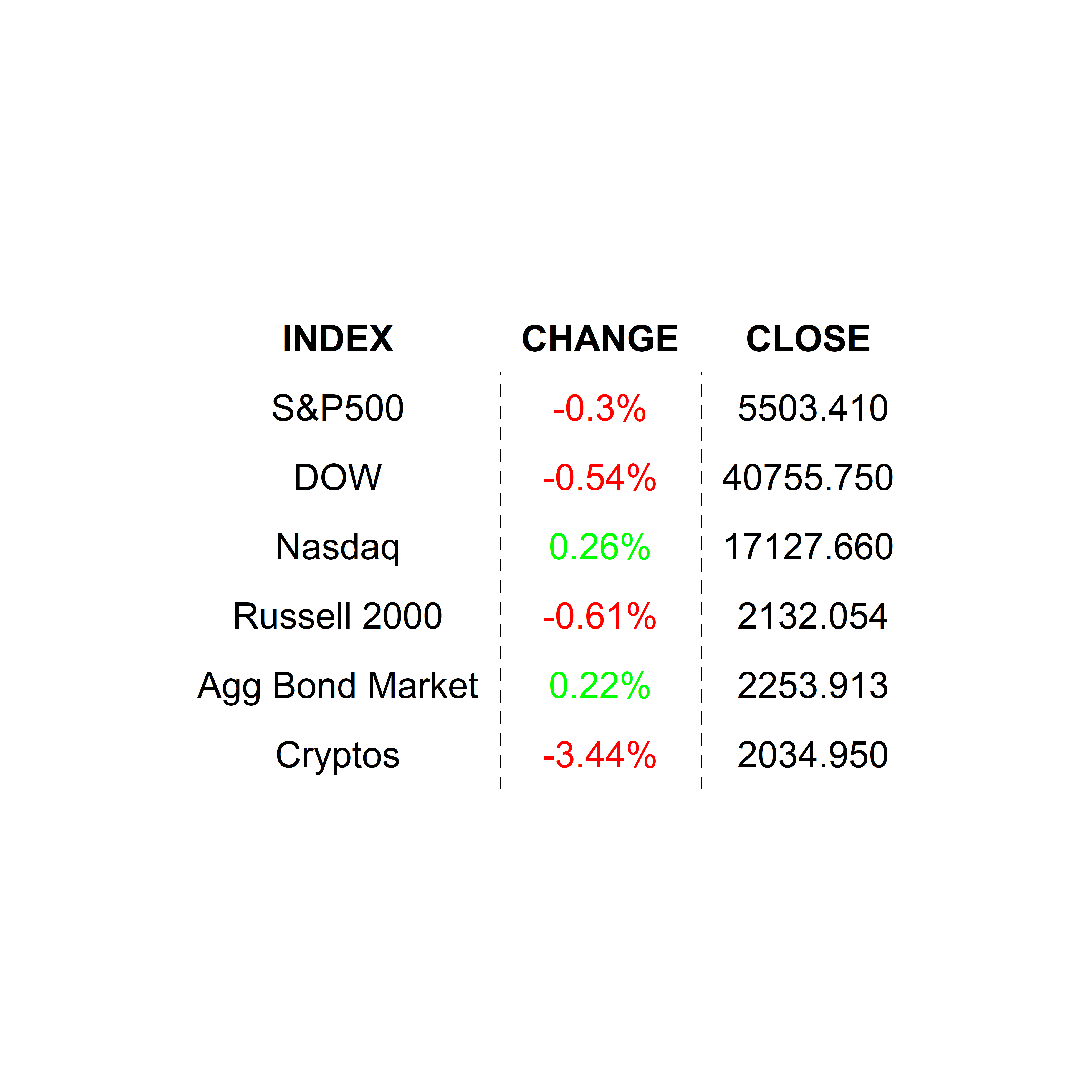

YESTERDAY’S MARKETS

NEXT UP

- Change in Nonfarm Payrolls (August) is expected to come in at +165k, higher than last month’s +144k new additions. This and the unemployment rate are critical determinants of today’s trade… and beyond. Don’t miss this.

- Unemployment Rate (August) may have ticked down to 4.2% from 4.3%.

- Pay attention to Fed Governor Chris Waller’s 11:00 AM speech for clarity. Traders WILL be watching.

- Next week: Consumer Price Index / CPI, Producer Price Index / PPI, and University of Michigan Sentiment are on the docket. Check back in Monday for calendars and details.

.png)