The economy is at a tipping point. Tariffs, spending cuts, and uncertainty are shaking investor confidence.

KEY TAKEAWAYS

- Markets and Washington are in a high-stakes standoff over tariffs and economic policy.

- Investor confidence is shaking as tariffs increase, regulations shift, and spending cuts loom.

- The President is sticking to his economic agenda, despite mounting market pushback.

- Uncertainty is the market’s worst enemy, and that’s exactly what we have right now.

- If consumer confidence takes a hit, things could go from bad to worse quickly.

MY HOT TAKES

- Tariffs were always the biggest risk, and now we’re seeing why.

- Wall Street was too excited about tax cuts and deregulation, ignoring the inflationary impact of trade wars.

- The market always pushes back against bad policy—this time, Washington might not listen.

- If my mother-in-law is worried about the economy, we’ve officially reached “oh 💩” territory.

- The next few weeks could decide whether this is just a correction—or something much worse.

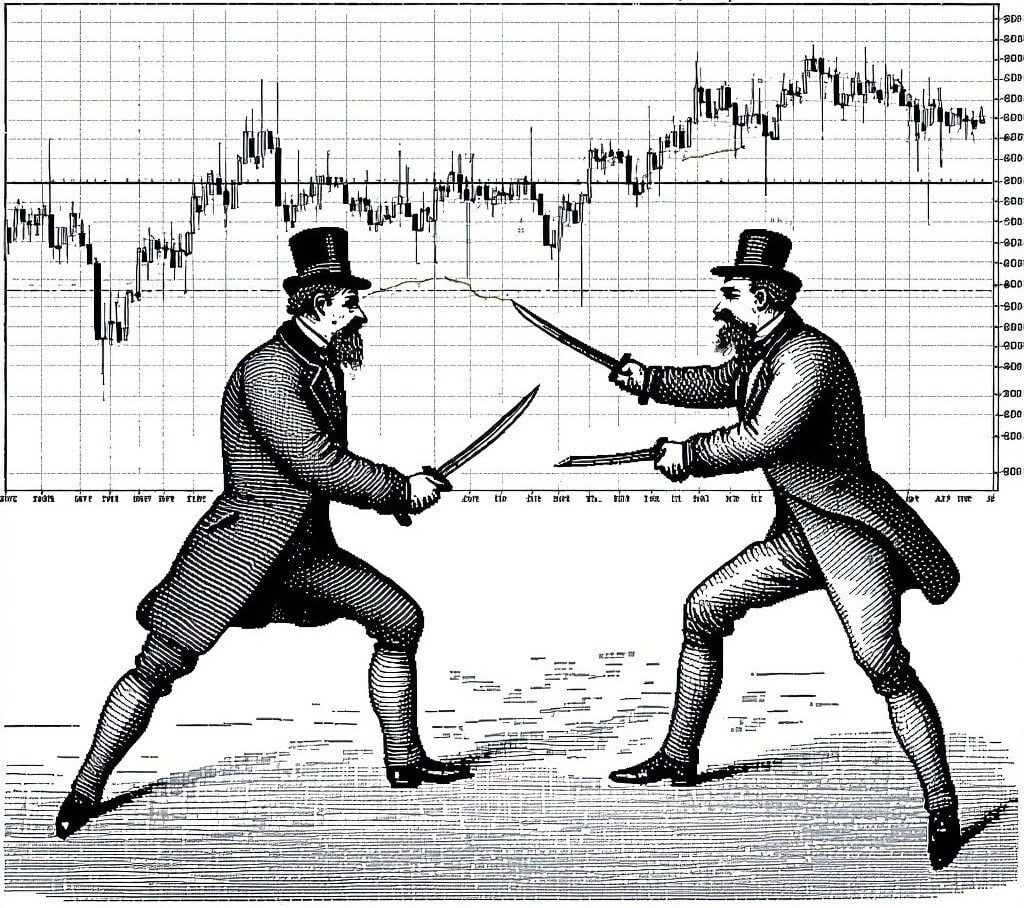

- You can quote me: “Is this a big game of chicken between Mr. Market and Mr. President? You bet it is.

Bottoms up! Have you heard? Markets are...um, not exactly acting the way we would like them to. I am sure you have. But guess what? So has my pushing-90 mother-in-law, and she doesn’t own stocks. Remember, this is the same mother-in-law that can quote you the price of any grocery at any chain TO THE PENNY. She doesn’t like paying more for bananas–refuses, in fact. AND she is now on alert about the economy because she heard that the stock market is going down. That is a data point for you. Hold on to it for a moment–we will come back to it.

Now, I am almost sure that I brought up this old story before, perhaps even in a different context–sorry, I can’t resist–it’s one of my favorites. Growing up, my best friend lived two doors down from me. On any given day in the early 1970s, he and I could be seen climbing over fences, climbing trees, digging holes… you know old-school boy stuff. On one of those days, one of us hit our only shared baseball into the yard between ours where a big German Shepherd named Teddy lived (yes, he lived outside). Teddy had a vast collection of our balls, and there was little we could do about it–he had huge teeth. Anyway, in search of a new activity to keep ourselves occupied before we were whistled in for dinner, we decided to play a game of chicken.

Trigger alert: if you were not born in the 1940s through the 1970s, you may be surprised at the good, clean fun kids had back then. Chicken for me and my friend David meant that he pulled out his Cub Scout knife and me my European shepherd knife (which I still own today). CALM DOWN, it’s going to be ok. We faced each other, stared each other down, then one at a time we would throw our knives at the ground in front of the opponent's foot. The one who flinched first lost.

My friend David was kind of a budding Olympian (literally), which meant he usually beat me in running races (we did that often), hit the baseball a little further than I, and certainly climbed chain link fences more quickly than most of us. But I had nerves of steel. This was a matchup that I could win. This morning, my determination was as steely as steel could be. David threw his knife, and I refused to flinch. We both looked down slowly only to notice that his knife went straight through my sneaker. My first thought was “did I win?”

Last year ended with a bang on Wall Street. The bulls were running. Investor sentiment was running high. The artificial intelligence / AI trade was as strong as it ever was, offering great hopes of a real, information-based boom for stocks. The economy was running strong. The Fed was no longer hawkish. The US had just voted in a President who promised tax cuts and many other economic stimuli. This President was against regulation which is the bane of corporations. Shackles would be removed. M&A would flourish, and big banks stood to make big gains. America first policies would benefit US-based companies. There could not be a better setup for stocks entering 2026. It was going to be a banner year. Some Wall Street folks were secretly worried, though. As we prepped for press interviews, we read through our notes over and over… and over. We knew that the first or last question (usually the most important ones) would be something like “what would a Trump win mean for stocks.”

The first thing that always came to mind was tariffs. The President promised big tariffs to level the playing field and advantage the US, punish trade partners who have taken advantage of us, protect strategic intellectual property, make US-made goods more attractive, and force production back to the US. All noble objectives and ones that should ultimately be positive for companies and stocks. However, we knew the reality that tariffs, at a bare minimum, were inflationary, which was worrisome given that we were still above the Fed’s inflation target. At that point, we could only put a question mark next to that note–it was an unknown. Not the effects, but rather whether and how severe the President would tariff.

Moving on, we would note that regulation stifles corporate growth, and less regulation would enable companies to be more profitable. Additionally, a more pro-business DOJ, FTC, etc. would enable more M&A activity. That is not just good for Wall Street, it’s great.

Finally, we could not ignore the potential for new tax legislation. Not tax relief on tips; that is great for folks in tipping industries, maybe even Wall Street if those folks spend those tax dollars on consumption. The taxes Wall Street was after were extensions of personal income tax cuts from 2017 Tax Cuts and Jobs Act (TCJA) that were set to sunset at the end of this year. Let’s be clear, all tax cuts are growth stimulants for the economy. Wall Street was also keen on tax cuts for corporations who pay higher taxes in the US than their rest-of-world competitors. This would make US companies more competitive AND more profitable.

The tally looked like this. Tariffs: ❓🤔, Less regulation: ✅, Tax cuts: ✅👍👍. The net net: BUY, BUY, BUY! It was an easy script to read, but there was still that gnawing unknown over tariffs… AND… “WAIT, how are we going to pay for the tax cuts, won’t they increase the size of the deficit?” 😟 A few began to speak out but, trust me, Wall Street was nervous.

Turn the clock forward. The President is now in the White House and he has been busy, real busy. He is doing just about everything he promised AND more. His solution for cutting the deficit is to shrink the Government’s budget. It’s a good thing… if done properly. The President wasted no time on tariffs, launching the largest duties since the 1940s. And then… delaying them. And then… doubling down on them. And then… increasing them. And then… limiting them by excluding autos. And then… adding more. And then… taking some off. All the while both China and Canada have enacted counter tariffs on the US–potentially painful ones at that.

Now, maybe under normal circumstance where the US is not just coming off of an unprecedented inflation spike and Fed hiking regime, where the S&P 500 had two back-to-back, banner return years, and many stocks with great growth potential are trading at high multiples, all this stress over hatchet-borne Government right sizing (adding to unemployment), and super-sized on again / off again tariffs, would be ok for the markets. BUT THESE ARE, ALAS, NOT normal circumstances.

In case you haven’t noticed, there is a give and take between markets and policy makers. Markets often wrestle with the Fed on rate cuts. It’s true. Markets send messages to the Fed about what is acceptable and what isn’t, and the Fed sends messages back to the market in “guidance.” That is why there are very few surprises. Similarly, the markets send messages to Congress and the President. Sometimes the markets allow lawmakers to haggle over budgets and debt ceilings, and other times they sell-off sending the message “work it out guys!” AND THEY DO.

In the case of the President with his recent trade and DOGE activities, markets have sent some signals. At first, they were small eruptions of discontent. Unknowns are not appreciated… EVER by markets. Markets sent the message “no tariffs Mr. President, please.” The President did not relent. Then the selloffs became more pronounced, sending the message “no tariffs Mr. President, pretty-please!” The President has since doubled down–no flinching from the White House. Finally, yesterday, the markets offered the harshest message to date.

Is this a big game of chicken between Mr. Market and Mr. President? You bet it is. Will markets ultimately accept this or will the President ultimately back down? Did the President even get the message? Probably, but what he does next is anyone’s guess.

My friend David was unsure how to respond. Did he just kill his best friend by being too aggressive? Should he hug me and read me my last rights? Should he call his mom? I looked him straight in the eye and burst out laughing. He nervously joined in. You see, I knew that the blade of his knife literally passed through my Converse sneaker between my toes missing me by a hair.

We learned our lesson and never did that again. We both came away winners. Me for my bravado and David for his almost-perfect aim. We were lucky, but it could have gone the other way where we both came away losers. We all lose if consumers lose confidence and stop spending money, and the blade is getting closer and closer to the flesh. Don’t believe me? Just ask my mother-in-law.

YESTERDAY’S MARKETS

Stocks took a drubbing yesterday after the President did very little to calm the nerves of traders with his unwillingness to rule out a recession in a Fox interview over the weekend. It’s not like traders weren’t already on edge as a pile of tariffs and counter-tariffs are about to hit in the week ahead. Tensions are high and uncertainty about trade and now economy health are in charge of markets at the moment.

NEXT UP

- JOLTS Job Openings (January) are expected to come in at 7.6 million, unchanged from December’s vacancies.

- Important earnings today: Ciena, Dick’s Sporting Goods, and Kohl’s.

.png)