Competition is the ultimate proof that AI is real. NVIDIA, Alphabet, Meta, AMD, and others are accelerating innovation—not killing it.

KEY TAKEAWAYS

-

Competition is proof that AI is real and demand is exploding

-

Alphabet providing TPUs to Meta shows AI chip demand is broadening, not shrinking

-

NVIDIA’s dominance is strong but competition strengthens innovation

-

Historical examples show competition expands markets rather than kills incumbents

-

AI’s innovation cycle accelerates when multiple firms push the envelope

MY HOT TAKES

-

AI competition is the strongest bullish signal in the entire sector

-

NVIDIA’s dip on TPU news is emotional, not fundamental

-

Meta buying Alphabet chips shows hyperscalers want multi-vendor strategies, good job Meta

-

AI silicon becomes a multi-winner market, not winner-take-all

-

Innovation speed is about to increase dramatically as rivals clash

-

You can quote me: “AI isn’t a one-winner race—this is the rare moment where every giant can win.”

Let them eat cake. Imagine that you are walking the streets of a large crowded city (I have one in mind 😉) and you come upon a set table–nice white linen and fine china–with a big piece of chocolate cake on it. Assuming you like chocolate, what would be your first thought? Mine would be, “why has no one taken the cake?” Millions of hungry chocoholics running around the city and no one takes the free chocolate cake. You wonder if there is something wrong with the cake, because you know that it’s not out of politeness that the confection remains untouched.

Lately, there has been a lot of talk about the value proposition of AI. Is it real? Is anyone going to use it or pay for it at the end of the day? Good questions considering that hyperscalers are spending billions and billions on capex to build data centers that give AI its life. Okay, maybe we have learned to accept that AI is real and that it can be a tool for expansion. But is it just a flash in the pan–another dotcom bubble? A pets.com?

Much of the world rewards innovation. Even communist countries have mechanisms for rewarding innovation. That said, capital has a way of flowing into opportunities, the more viable the more capital tends to find it. But sometimes mistakes are made. Think of Thanos, Nikola, or Lordstown Motors. Ok, maybe there was a bit of fraud in those examples, but how about ideas before their time or markets once thought to be huge turned out to be… well smallish. Think 3D home printers, Google Glass, the Metaverse! Lots of capital flowed into those opportunities that didn’t exactly play out. The result? Well, funds dried up, and maybe even a few bankruptcies. Do you know how we could have avoided making those mistakes? By watching the competition! You see, if there is NO competition, it is likely that the BIG opportunity may not be a viable opportunity at all. If there is lots of competition, that is usually a good heuristic sign that a market is real. 💥

What is the first company that pops into your mind when you think of hardware? That’s right, AI poster child NVIDIA. Its chips and software are at the core of the entire AI ecosystem. It is in the leadership position with a pretty big moat protecting it. It has a first mover advantage–it was already making parallel processors for graphics cards and crypto miners when someone figured out that its technology would be useful in AI training. A legend was born.

So, that’s it? If you want to build a data center you have to line up at NVIDIA? Well, kind of, but not really. They are ahead of the competition, but there are competitors, and some of the competition is starting to get bigger in Jenson Huang’s rearview mirror. In fact, overnight, WHILE YOU SLEPT, we learned that Meta is in talks with Alphabet to supply it with billions of dollars worth of its Trillium Tensor Processing Units (TPUs) to be used in its data centers.

The news sent Alphabet’s stock higher in the pre market and incumbent chip provider NVIDIA lower. What is the first thought that comes to your mind when you realize that NVIDIA has competition? Is this doom for NVIDIA? QUITE THE OPPOSITE.

Foremost, the fact that there is competition provides us with a sign of life for AI. If you followed me above, you should recognize that if there is no competition, the opportunity is probably not real. Yes, Alphabet has its own AI chips that are working, though they are not exactly apples to apples comparisons to NVIDIAs Blackwell or H100 chipsets. In fact if you look closely, you will notice that there are plenty of companies making silicon for AI. To name just a few, AMD (Instinct), Google (Trillium TPU), Amazon (Trainium/Inferentia), Microsoft (Maia / Cobalt), Meta, Intel (Gaudi), and Cerebras (WSE)! And there are other folks with alternative solutions going after the same space. Namely Apple, Qualcomm, Broadcom, and Tesla. Folks, there is certainly competition, so if you are concerned that AI might not be a real opportunity… don’t be. We have a saying on Wall Street: “if it looks too good to be true, it probably isn’t!” AI is clearly not a piece of chocolate in the middle of a bustling city. SO, my message to you is that competition is good!

Let’s take it a step further. Competition is not only proof that the market is real, but it will benefit customers and consumers at the end of the day. It always has. When companies realize that someone is coming for their lunch, they move faster, think harder, and innovate more aggressively. They sharpen their pencils, tighten their engineering timelines, prioritize efficiency, and suddenly that leisurely product cycle gets boosted to a sprint. Think about what happened in the mobile phone industry. Apple drops the iPhone in 2007, and within a few short years, Samsung, Google, and others were pushing out devices that not only matched Apple feature for feature, but in some cases leapfrogged them. Cameras got better fast, processors doubled in speed, displays went from grainy to gorgeous, and battery life–well, it improved… eventually. The result wasn’t fewer great phones. The result was more: more options, more innovation, more power in every pocket, and, most importantly, better prices for consumers.

A classic example comes from something far more ordinary than microchips or shiny tech toys: coffee. Yes, coffee. ☕ For decades, Americans drank whatever came out of a tin can–Folgers, Maxwell House, the old-school percolator stuff your grandparents swore by. Then along came Starbucks. Suddenly coffee wasn’t just coffee anymore, it was an experience, a lifestyle, a menu which took training to understand (is tall small, is short medium 🙋). Did this crush the incumbents? Not even close. It revitalized the entire coffee market. Dunkin’ upgraded its stores, improved its beans, added espresso drinks, and exploded on the national scene. Local cafés popped up everywhere offering higher-end roasts and creative drink concoctions. Even the old brands pivoted into premium blends and single-origin offerings. Consumers got better coffee at every price point, from the $1 cup at a gas station to the $6 latte on the corner (pre-inflation prices). Starbucks didn’t kill coffee; it woke everyone up… literally and figuratively. 🤣 Competition didn’t destroy the incumbents. It made the whole industry stronger and far more profitable than it had ever been.

Consider electric vehicles. For years, Tesla was out there like that lone slice of chocolate cake. It was flashy, delicious-looking, and untouched by competitors who were convinced the “EV thing” was a fad or a niche. Fast-forward to today: every major automaker on Earth is in the EV race. Tesla didn’t die because of the competition. In fact, competition forced Tesla to push harder on range, reduce costs, build factories faster, improve its autopilot, and expand globally. And consumers now get EVs at price points that would’ve sounded like science fiction in 2014. Multiple companies “won,” and consumers definitely won.

Now apply that lens back to AI. NVIDIA’s dominance is real, but so is the pressure behind it. AMD is making enormous strides with Instinct. Google is leaning into TPUs like Trillium. Amazon, Microsoft, and Meta are each building their own custom silicon. Intel is still in the race–it can’t be counted out that easily. Even Apple and Qualcomm are chipping away at the edge-AI layer. And guess what? NVIDIA isn’t cowering away and rolling onto its back. It’s running faster. Blackwell didn’t appear out of thin air. Hopper wasn’t an accident. NVLink, CUDA, and their entire networking ecosystem exist because NVIDIA knows the competition is coming, and that means it can’t coast.

Competition forces every single one of these companies to work harder, and the ones who benefit most are the ones who rely on these technologies. AI models get trained faster. Cloud compute gets cheaper. Model inference gets more efficient. Enterprises get tools that would’ve taken another decade to arrive in a monopolistic world. Consumers get better search, better recommendations, better drug-discovery timelines, better fraud detection, and eventually better devices in their homes, their cars, and their pockets. Innovation compresses from decades into years, and years into months. That’s what competition does.

And remember, in almost every tech race, more than one company wins. NVIDIA will win. Alphabet will win. Meta will win. Amazon, Microsoft, AMD are winners all around. Maybe not in the same slice of the market, maybe not to the same degree, but in an expanding pie, multiple champions emerge. That’s the magic of real opportunity.

So if you find yourself worrying that competition means NVIDIA’s best days are behind it or that AI is suddenly at risk because Alphabet stepped onto the field, take a breath. Competition is the signal–not the noise. It tells us the opportunity is real. It tells us there is demand. It tells us that capital is flowing to the right places. And it tells us that innovation is about to accelerate in ways we haven’t even priced in yet.

Which brings me back to that lonely slice of chocolate cake. The real danger isn’t when everyone wants a piece. The real danger is when no one does. AI is not an untouched dessert on a table in the middle of a city. Everyone is grabbing a fork. Everyone wants in. And that is exactly why you shouldn’t fear competition. It’s proof that the cake is good, and that there is plenty more where that came from. 🍰

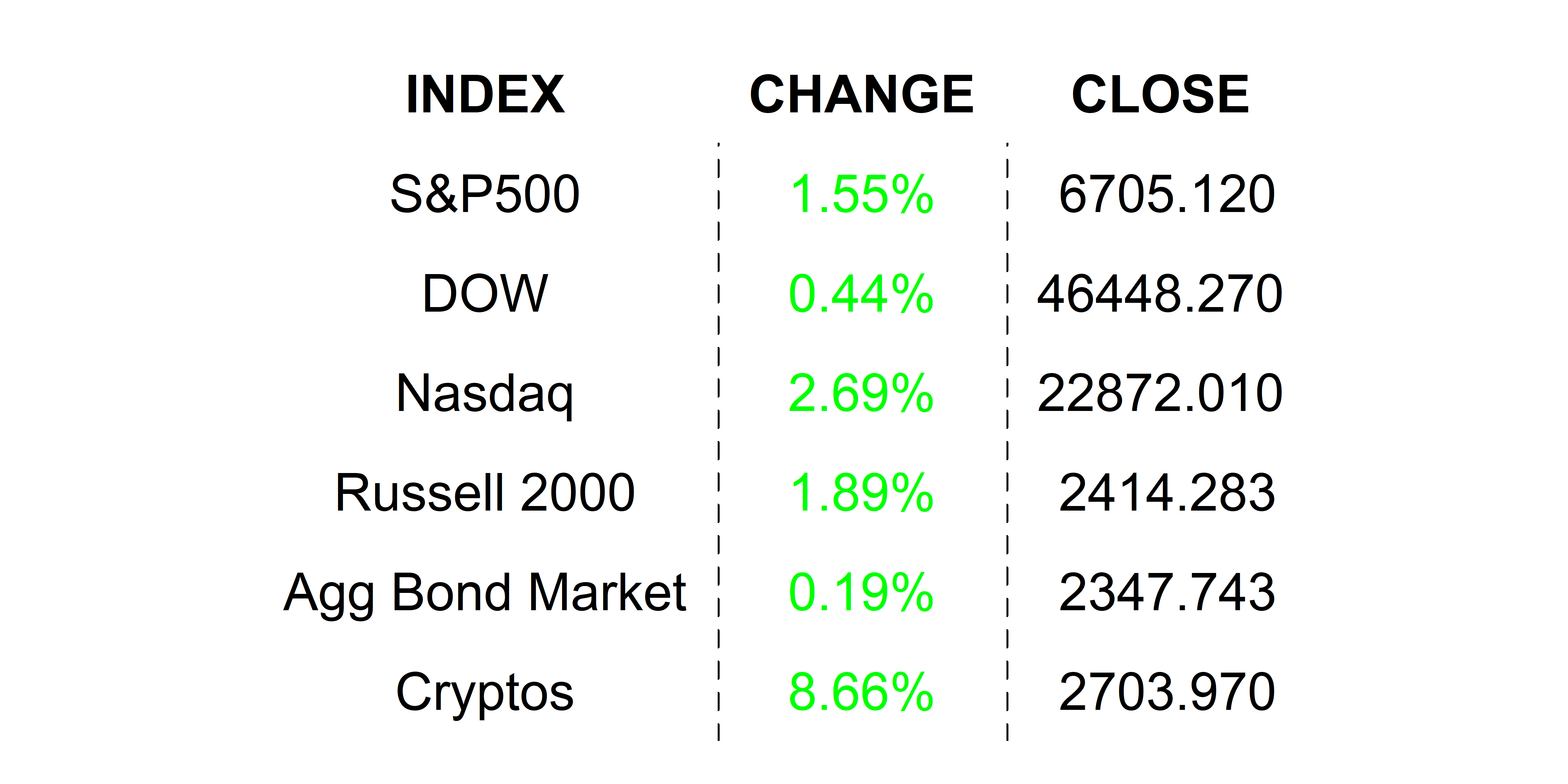

YESTERDAY’S MARKETS

Stocks rallied yesterday led by tech as investors rushed in to buy the dip as hopes for a December rate cut increase with soft talk from FOMC members. Bond yields declined as hopes of easing gain. Bitcoin got another day of rest from recent selling.

NEXT UP

-

Retail Sales (September) is expected to have gained by 0.4% after gaining by 0.6% in August.

-

Producer Price Index / PPI (September) is expected to have remained at 2.6% for a second straight month.

-

Conference Board Consumer Confidence (November) may have slipped to 93.3 from 94.6.

-

Pending Home Sales (October) probably increased by 0.2% after coming up flat in September.

-

Important earnings today: Best Buy, Dick’s Sporting Goods, Burlington, JM Smucker, Kohl’s, Analog Devices, Abercrombie & Fitch, Dell, HP Inc, Zscaler, Cleanspark, Urban Outfitters, and Deere.

.png)